Royal Bank of Canada has the resources and the tech know-how to build a digital-only bank in the U.S., but can it differentiate itself in a market that’s becoming increasingly crowded?

The $1.1 trillion-asset company revealed on an earnings call last week that it intends to roll out a direct-to-consumer bank in the U.S later this year. With deposit growth lagging loan growth at its U.S. subsidiary, Los Angeles-based City National Bank, RBC is looking to build up its funding base by pitching high-yielding accounts to affluent households.

Executives offered few other details and would not even say if the digital bank would be branded under the RBC or City National names. The company did not respond Monday to calls for additional comment.

But observers say that while RBC certainly has the access to high-net-worth households — City National largely serves a wealthy clientele — it will also face stiff competition from well-established digital banks, including USAA Federal Savings Bank, Capital One and Ally Financial, as well as new digital offerings from the likes of Citizens Financial Group, PNC Financial Services Group, Goldman Sachs, MUFG Union Bank and a host of other smaller regional banks. Another deep-pocketed global bank, Santander, plans to launch a digital bank in the U.S. later this year.

“A healthy amount of skepticism is definitely valid,” said Meny Grauman, an analyst with Cormark Securities. “The execution is always where the rubber meets the road. Royal has all the tools and experience to make it work, but it’s definitely going to take time.”

Providence, R.I.-based Citizens has had a fair amount of success with its digital effort. Launched in mid-2018, its digital bank, Citizens Access, has already brought in nearly $6 billion of deposits and has customers in every state.

Goldman Sachs has been growing deposits at a 43% clip annually since it acquired GE Capital Bank's online deposit platform and launched its digital bank, Marcus, in April 2016.

RBC also isn’t alone among Canadian banks pushing to grow U.S. deposits using online channels. Canadian Imperial Bank of Commerce

On a conference call Friday to discuss first-quarter earnings, RBC Chief Financial Officer Rod Bolger said the bank would likely roll out its offer late this year or early in 2021. The bank will focus on ultra-high-net-worth clients and may eventually move down market into mass affluent clients, he said.

“The loan book has been growing faster than the deposit book, so growing our deposit strategy has become of paramount importance,” he said.

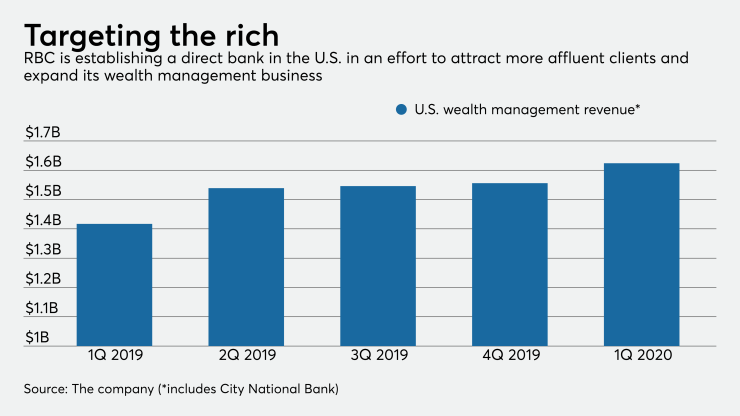

Revenue from RBC’s U.S. wealth management business, which includes City National, hit $1.6 billion in the company’s fiscal first quarter that ended Jan. 31, up 10% from a year earlier and 4.3% from the prior quarter. Still, the unit’s revenue growth had been flat for several quarters last year and RBC and analysts say RBC has been talking about the need to juice deposit growth for the past year or two as a way to lower funding costs. Cormark’s Grauman said that RBC had floated the idea of establishing a digital deposit-gathering arm in the U.S. as early as 2015, when it acquired City National.

Analysts say a digital-first strategy is certainly more cost-effective than adding new branches and point out that RBC has proven

“RBC’s Canadian operation is fairly strong and very tech focused, so that’s one of their advantages,” said John Mackerey, senior vice president of North American financial institutions at DBRS Morningstar. “They’ve built a lot of digital offerings north of the border.”

Mackerey said he is mostly withholding judgment on the plan until RBC shares more details, but warned that RBC will need to be careful not to cannibalize its existing U.S. customer base. Other analysts shared Mackerey’s concern about how rate-sensitive those new deposits would be and whether RBC would be able to sell other products to those depositors.

Other institutions offering direct-to-consumer products "have come up with high promotion rates to attract depositors, but does that lead to sticky relationships with customers?” said Ebrahim Poonawala, an analyst with Bank of America Merrill Lynch.

“That’s the challenge they’re going to face: How do you have relationships that go beyond deposits? Because I don’t think they just want to pay high rates and bring in hot money.”

Allissa Kline and Kevin Wack contributed to this story.