Mortgage volumes

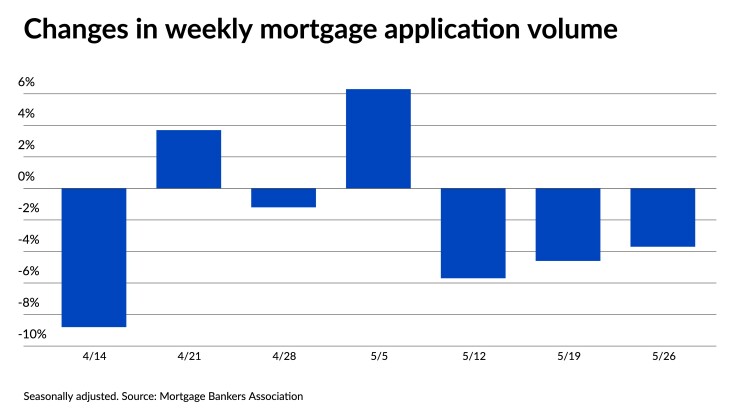

The MBA's Market Composite Index, a measure of weekly loan application activity based on surveys of the trade group's members, dropped a seasonally adjusted 3.7% for the seven-day period ending May 26. Compared to the same week last year, volumes were 36% lower, with economic pressure continuing to weigh on both consumers and lenders.

"Mortgage rates for conforming-balance 30-year loans were being quoted above 7% by some lenders last week, and the weekly average at 6.9% reached the highest level since last November," said Mike Fratantoni, MBA's senior vice president and chief economist, in a press release.

"Application volumes for both purchase and refinance loans decreased last week due to these higher rates," he said.

The 30-year rate for loans under the conforming balance of $726,200 finished 22 basis points higher than the prior week's average of 6.69%. Meanwhile, borrowers typically used 0.83 points, up from 0.66, for 80% loan-to-value ratio loans.

The 30-year fixed-contract jumbo rate made a similar large upward leap to an average of 6.78% compared to 6.57% a week earlier, Points also increased to 0.76 from 0.57.

Businesses and potential borrowers hoping for relief from high interest rates, which have remained above 6% for most of the last eight months, won't likely find it in the foreseeable future, according to Fratantoni. While

"Inflation is still running too high, and recent economic data is beginning to convince investors that the Federal Reserve will not be cutting rates anytime soon," Fratantoni said. After the May meeting of the Federal Open Market Committee,

The uncertainty surrounding rates has contributed to the slow pace of the housing market this year. The MBA's seasonally adjusted Purchase Index fell for a third straight week, down 2.5% from volumes reported seven days earlier. On a year-over-year basis, purchase applications finished 31.1% lower, as a

The Refinance Index took an even larger drop of 6.9% from the previous survey. With most eligible homeowners already sitting on interest rates below current levels, refinance volumes came in 45.1% below their level during the same week in 2022. The share of refinances in relation to total mortgage activity also shrank to 26.7% from 27.4% seven days earlier.

Meanwhile, average loan sizes decreased across the board, with the overall mean application amount landing at an average of $391,000, down 0.7% from the prior week's $393,600. Average purchase sizes inched down 0.6% to $439,400 from $442,000, while the typical refinance amount was $258,400, sliding down 2.5% from the previous week's $265,100.

The seasonally adjusted Government Index came in 4.4% lower from the prior week's survey,

As it did for conforming and jumbo loans, the average contract rate of the 30-year FHA-backed mortgage also shot up to its highest level in months, finishing 29 basis points higher last week at 6.85%, compared to 6.56% seven days earlier. The use of borrower points for 80% LTV loans inched up to 1.26 from 1.24.

Meanwhile, the contract average rate of the 15-year fixed mortgage came in at 6.41%, up from 6.15% the previous week. Points increased to 0.84 from 0.72.

As fixed interest rates headed higher across categories tracked by the MBA last week, ARMs went in the other direction. The contract average of the 5/1 adjustable-rate mortgage fell 34 basis points to 5.39% from 5.73%, while points decreased to 0.46 from 1.19.

The decrease helped lift the share of adjustable-rate mortgage applications up to 6.8% from 6.7% of loan activity a week earlier. The mortgages remain at a fixed rate for a five-year term before adjusting to market levels.