Forgiven

The Small Business Administration, as of March 11, had forgiven more than a third of the $521 billion of PPP loans originated last year. The PPP has provided emergency aid to small businesses harmed by the

Bankers should brace for questions during quarterly earnings calls about their growth strategies as the program tapers off. But bankers might be loath to serve up specifics until vaccines are more widely distributed and an end to the pandemic is in sight.

“The PPP was huge — but what comes next?” said Sam Pappas, CEO of Mystic Asset Management. “What’s the plan for growth?”

While Congress is considering a bill

“We look at the program as akin to a cowboy having arrived in the nick of time to save the day in an old Western town,” Scott Siefers, an analyst at Piper Sandler, wrote in a Thursday note to clients. “The job is largely over and the cowboy begins to ride into the sunset.”

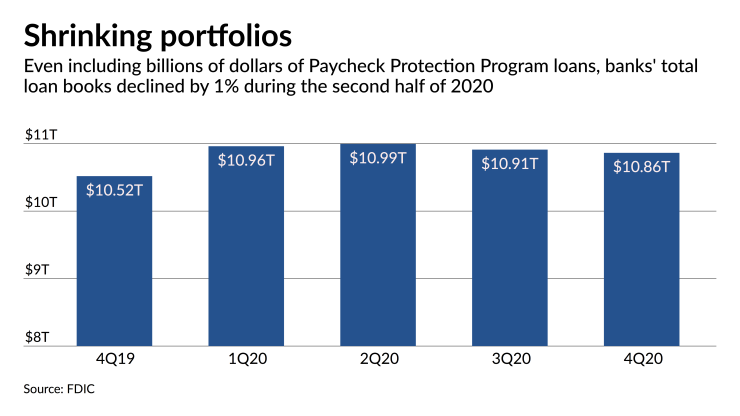

About 5% of the banking industry’s loan portfolio is “basically going into a runoff mode,” which is creating “a visible headwind for

Many community banks have been reluctant to overpromise, largely because of lingering uncertainty with

“We have a lot of businesses that have done really well, but others that are still hurting and struggling,” said Edward Barry, president and CEO of the $1.9 billion-asset Capital Bancorp in Rockville, Md. “There will be pockets of opportunity — and we’ll find them. But for a while, we’ll take a conservative bent.”

Bankers are likely to play their cards close to their vests for a couple more months — at least

“I think there will be two kinds of commercial borrowers coming out of this — those that adapted to the pandemic and figured new ways to generate revenue, and those that just really got hurt,” Deines said. “There will be some lasting pain … but there will also be some emerging growth stories and proven companies that need financing to expand, and we’ll be there for them.”

It is wise for bankers to exercise patience and caution, said Mike Matousek, a trader at U.S. Global Investors.

While investors will understandably press for loan growth projections, they also want assurances that banks hold to lessons learned from the 2008 financial crisis. Sound credit quality and reliable performance trumps boom-and-bust lending.

“I think you will see increases in business activity and stronger economic growth later this year, but you have to keep in mind that we’ll be growing off of a pretty beaten-down position,” Matousek said. “Better to have lower profit than no profit.”

Credit quality is another topic that is sure to frequent discussions during first-quarter calls. Expect bankers to field questions on loan-loss allowances and their ability to release reserves over coming quarters.

A recent study by the American Bankers Association, based on first-quarter input from bank economists, found that the industry is more upbeat about credit quality and lending opportunities now than at any point during the pandemic. The pace of vaccinations is a critical factor, the report said.

“Overall, the outlook for the credit markets is quite strong,” said Rob Strand, the association’s senior economist.