-

Wells Fargo has seven women on its 16-member board, a 44% ratio that is twice that of the average top 25 bank. It got there, in large part, by looking beyond C-suites for qualified directors.

September 22 -

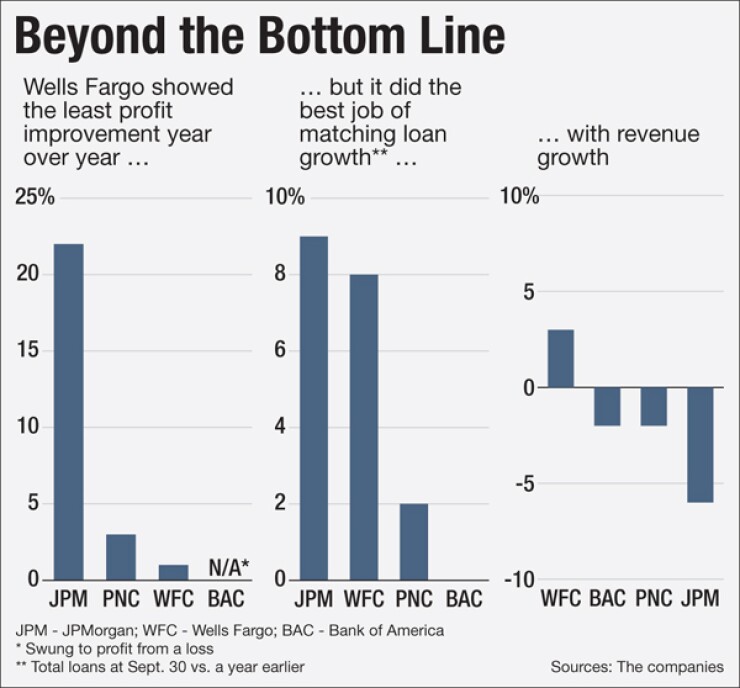

JPMorgan Chase said revenue fell 6.4%, driven by a slump in trading and mortgage banking.

October 13 - PH

JPM's 3Q Revenue Weakness; Reasons for Dismantling GE Capital

October 14

A modest cover sometimes hides a good book.

Wells Fargo's

Those figures included an 8% year-over-year increase in total loans to $903 billion and a 6% jump in deposits to $1.2 trillion, along with solid increases in the number of primary consumer and business checking accounts.

"We're experiencing some of the strongest growth we've seen in years in terms of our basic building blocks: relationships, loans, deposits and the depth of relationships," Chairman and Chief Executive John Stumpf said during a conference call Wednesday. "Not all that shows up next quarter, but over the long term it's the best way we know to successfully grow."

Wells' revenue jumped 3% to $21.9 billion. By contrast, some of Wells' money-center competitors struggled with revenue. J.P Morgan Chase and Bank of America both reported year-over-year declines.

Meanwhile, Wells' credit quality picture sharpened, too.

Nonperforming assets fell to $13.3 billion, down a whopping 17% from the third quarter of 2014. And chargeoffs are moving in the right direction, totaling $703 million for the quarter, or 0.31% of average loans.

"That's substantially lower than any time in recent memory," Chief Financial Officer John Shrewsberry said in an interview after the conference call. "Credit performance can't really improve meaningfully from where we are today. … We're not going to zero."

For now, Wells is making the most of the situation. It did not add anything to its loan loss reserve — the first time since 2010 that it made no quarterly provision.

Wells succeeded in trimming noninterest expenses by $70 million, to $12.4 billion. The cost savings dropped its efficiency ratio to 56.7% from the 58.5% it reported on June 30. For all of 2015, Shrewsberry predicted its efficiency ratio would finish at the high end of the company's 55% to 59% operating range.

Mortgage banking represented one weak spot in Wells' third-quarter results. Noninterest income related to home lending was off by $116 million, as quarterly origination volume fell to $55 billion, down $7 billion from the second quarter. Wells' application pipeline was also smaller, meaning origination volume would likely fall further in the fourth quarter, Shrewsberry said.

Overall, though Wells' retail segment reported net income of $3.7 billion, record levels of auto lending and strong fee income generated by credit and debit cards usage and deposits.

On Tuesday, Wells announced it would

"We're going to treat it like a merger," he said. "Right now, job one, job two and job three is to do it really well."

Stumpf and his team may have their work cut out for them. At least one and probably many more competitors are pondering how to take advantage of the market disruption from the deal.

"The question is what is Wells Fargo going to do," said David Goldin, CEO of commercial lender Capify. "Is there going to be restructuring that will affect parts of GE Capital? We'll watch and wait. We view it as an opportunity. The crumbs that fall off that table could make a full meal for another lender."

According to Shrewsberry, integration costs will likely minimize any bump to earnings the GE Capital deal might contribute in 2016. The deal would be neutral to modestly accretive in the near term but would pay off after that, he said.

"We're bound to incur expenses up front in order to get this thing done right," Stumpf added. "I've been around the acquisition game a long time. What I've said in the past is to look for accretion by year three. This will happen sooner. It's a long-term value-add for the company."

On Sept. 30, Wells announced it would acquire GE's railroad car finance, leasing and fleet management business. Expected to close in the first quarter, the deal would add 77,000 rail cars and more than 1,000 locomotives to Wells' already considerable First Union Rail unit.