Dozens of banks are gearing up for the Federal Reserve’s real-time payments system, which is expected to go live as early as 2023.

More than 110 have signed up to test FedNow, including Wells Fargo and First Internet Bancorp in Fishers, Ind. Executives at these two early-adopters agreed to interviews about what they're hoping to get out of it and how they're preparing for it. Those insights could be helpful to the many more banks that are still on the fence about which fast payments system to join, if any.

The $4.2 billion-asset First Internet said customers don't want to wait a long time for transactions to close, according to Anne Sharkey, senior vice president of operations of the online-only bank.

“It seemed just like anything else in our lives: People want things instantly, and I think payments are starting to catch on to that,” Sharkey said. “The infrastructures are starting to be built to be able to handle real-time payments, and that's the critical part. I think the Fed’s participation is driving both banks and consumers to think about it more.”

The biggest benefit for First Internet to using the FedNow system will be allowing customers to manage their money in real time, Sharkey said.

“Consumers will be able to make their mortgage payment on the due date and have it applied on that date as opposed to writing a check or going into online banking to have a check sent that may take five to seven days, especially with the slow mail these days, and incurring a late charge,” Sharkey said.

Small-business customers will be able to manage cash flow more easily through FedNow, she said.

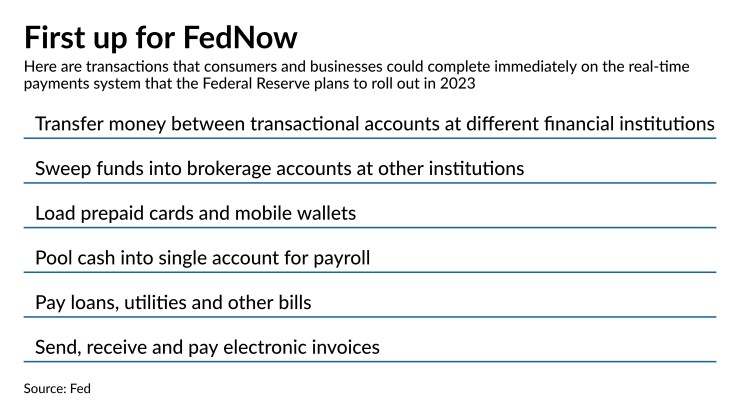

“They'll be able to invoice customers through the messaging system,” Sharkey said. “So if I have a lawn care company that can initiate an invoice to me saying I owe $54 for my lawn care treatment, I can answer that message with a payment and pay my bill that way, on the due date. Because of the messaging, they'll have all the information they need to apply that payment and get credit to their accounts.”

Small businesses will also be able to pay their suppliers or vendors on invoice due dates and know that the funds are there. They’ll be able to eventually stop paying for lockbox services for the payments they receive by check.

Using the FedNow payments system should also help First Internet reduce its check-processing costs as more customers take advantage of electronic billing and payments.

Wells Fargo, though a much larger company at $1.9 trillion of assets, says it's joining FedNow for similar reasons.

“We’ve seen the need for faster payments evolve and accelerate across all customer segments for a number of years,” said Chuck Silverman, head of treasury management product management and development at Wells. "FedNow will provide another option in the overall payments landscape to make fast and secure payments on demand.”

One use case Wells Fargo is exploring, he said, is using FedNow's liquidity management function to support interbank gross settlement of funds during nonbusiness hours, when Fedwire is unavailable. A FedNow FAQ describes the liquidity management tool as “support for FedNow Service participants in managing their liquidity needs in a 24/7/365 environment."

The Clearing House has had a competing real-time payments network called RTP running since November 2017. As of today, 115 banks are using it, including Wells Fargo.

Wells Fargo plans to use both real-time networks concurrently, Silverman said.

“Our customers are looking for choice in how and when they make payments, and our expectation is to provide them with a range of capabilities to meet their needs,” he said.

First Internet is also considering joining RTP.

“That is something we are looking at hard at right now alongside our participation in the FedNow initiative,” Sharkey said.

The difference between the two, as she sees it, is that with Clearing House transactions there's more settlement time between participants in the network. In the FedNow initiative, settlement will take place in real time or nearly real time in a bank’s Fed Reserve account.

“Behind the scenes, it is different for banks in how those funds settle and because of that, there's less risk with FedNow than with RTP,” Sharkey said.

The situation is similar with Zelle, the person-to-person payments system run by Early Warning, she said. “With Zelle today, if a transfer happens from me to you at 10:00 a.m., those funds are available to you at 10:00 a.m.,” Sharkey said. “However, settlement for those funds may not happen till 4:00 in the afternoon. It does create risks.”

A spokesman for The Clearing House said its RTP network is a real-time system, without settlement risk.

According to RTP

A common critique of the FedNow initiative is that it’s taking too long. FedNow representatives did not respond to a request for an interview.

“It took the Bank of England 18 months to build a real-time payment system in 2007, when the first iPhone came out,” said Aaron Klein, senior fellow in economic studies at the Brookings Institution. “I don't understand why more than a decade later, when technology has advanced, it is taking the Fed four-plus years to build a similar system. FedNow is a reminder of what would have happened if Blockbuster was in charge of developing streaming.”

While the Fed builds a new system, millions of American families are paying tens of billions of dollars in fees trying to access their own money and $66 million of Cares Act money went to check cashers, he said.

“Small banks piloting the system may make for great press releases,” Klein said. “But the reality is, the Fed was unprepared to handle emergency COVID payments. Millions of American children went hungry as their parents waited days and weeks for COVID payments to clear.”

In some cases, he said, the Treasury Department had the wrong bank account information and ended up sending a paper check.

“Real-time payment wouldn't have solved everything, but it was necessary to solve anything,” Klein said.

The industry has dragged its feet because banks don’t want to give up overdraft revenue, he said. “Nearly 30% of profit from the small banks comes from overdraft.”

Sharkey said the reason FedNow is taking so long is not that sinister.

“It's a huge initiative getting the technology up to where it needs to be,” she said. “There's a lot involved with a lot of the core providers to make that happen. There's also the ISO 20022 message system initiative that requires a lot of preparation and infrastructure work” on the part of the Federal Reserve.

For First Internet, the technology change required won’t be too heavy, Sharkey said, because the bank already uses a real-time core system, Fiserv’s DNA.

“This will not be a huge change for us here at the bank, but we will need to make some changes from a messaging perspective,” she said.

Wells Fargo’s Silverman said he couldn’t share much about the bank’s technology infrastructure, but “we are working through both the technical and operational impacts of FedNow, such as the implications of cutover timing for our reconciliation process.”

For both banks, it’s early days in the FedNow pilot.

“Right now the pilot is in its initial advisory phase,” Silverman said. “Our role is providing input to help to further define the road map, industry readiness and overall strategy. We look forward to engaging in testing.”