-

From interest rate risk to C-suite and boardroom diversity to succession planning, community bankers need to be acutely tuned in to a combination of global and domestic factors that are changing their world at an unprecedented pace.

October 20 -

An open-source analytical engine called Spark is becoming popular in banking circles to get real-time insights on consumer transactions and the customers themselves.

September 25 -

The acquisitive Bank of North Carolina is using a new iPad and desktop app to help its frontline employees make product recommendations to customers.

February 25

Technology is often referred to as "the great equalizer," and for community banks looking to get an edge with data, this adage has never been more true.

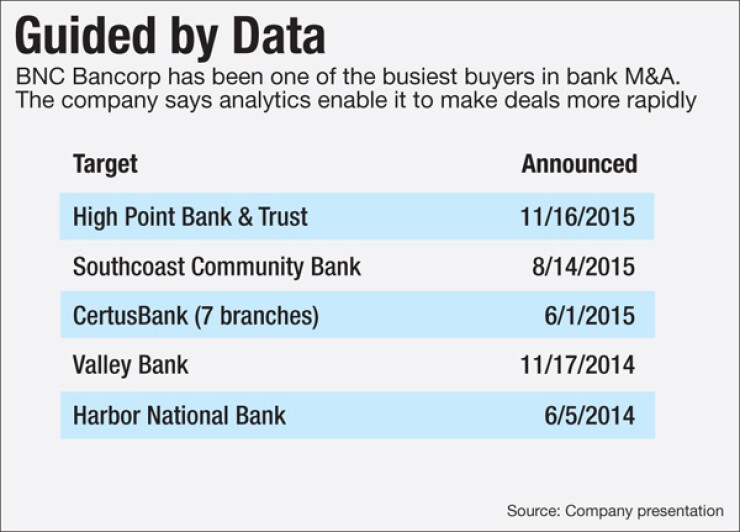

Take BNC Bancorp. The $5 billion-asset company is using analytics tools to shape its M&A strategy in North Carolina, one of the hottest markets for bank mergers in the country. BNC has been

Analytics tools "can help us do things like quickly learn how a target bank may perform using our models for reporting," said Michael Bryan, chief information officer of BNC. "It makes the whole process quicker and more efficient. For a community bank, it makes a big difference having these tools.

The company began using analytics tools last year. It was becoming difficult to load data and create models when looking at potential acquisitions, Bryan said. Using analytics software, the bank can now take pertinent data — such as risk metrics — from the target institutions and easily convert into a report that departments across the bank can use in due diligence.

For years, the use of analytics tools and solutions in financial institutions was reserved for quantitative staffs composed of analysts, statisticians and others, primarily in large banks that could afford them. A major reason was that specialized skills were required to access system data.

There is "a democratization of sorts when it comes to analytics" happening in the banking industry, said Ed O'Brien, director of the banking channels advisory service for the research firm Mercator. The latest generation of cloud and software-based analytics solutions allows smaller firms that don't have teams of quants or a massive investment in data operations to do faster and more robust modeling, data manipulation, testing and execution, O'Brien said. Further, these new options can be particularly attractive to small and midsize institutions since some providers offer subscription pricing and access to dedicated subject matter experts that can assist banks in analyzing data.

"What we're seeing now is that the smaller banks and credit unions can really start to compete with the big boys" with analytics capabilities, O'Brien said. "Compared to just two or three years ago, the technology available now enables them to do so much more without a huge investment. Obviously the big banks still have an edge, but the gap is closing."

Another community bank taking advantage of the proliferation of analytics tools is Fauquier Bankshares in Warrenton, Va. The $600 million-asset institution was able to improve its efficiency and implement sophisticated pricing strategies using analytics software that would have been impossible in years past given the bank's size, said Janet Grimsley, vice president of decision support at Fauquier.

"Absolutely, data preparation and analytics software is now integral to what we do," said Grimsley, adding that the bank has only one full-time staffer dedicated to data analytics. "It's become an integral part of our information governance investment."

Working mostly with solutions from Datawatch Corp., Fauquier now has the ability to access data from disparate systems and in different file formats to analyze critical data more efficiently in order to immediately make more profitable business decisions. Previously, Grimsley noted, employees had to resort to printing and reviewing hard-copy reports from different systems line by line.

For example, finance, accounting, retail support and other departments can now apply analysis to decision making for things like creating data files for third-party staffing models, ensuring that bank tellers are properly staffed throughout the day. Support and audit departments are also using the analytics capability to quickly validate banking processes and settlements without the use of paper or the need to have IT on site to create reports.

Further, Grimsley said, the bank doesn't need a team of data scientists or quants for what it wants to do, just "someone with a bit of analytical skills," thanks to visualization tools and the general user-friendliness of the software,

Indeed, that capability of nondata personnel being able to effectively use analytics is a key component of the solutions available in this so-called "democratization of analytics" era, said David Wallace, global financial services marketing manager for SAS (whose technology BNC uses).

"In the past you'd have analysts that would interrogate the data, create models, then refine those models and then hand it off to IT who would have to recode the data before finally putting it into production," Wallace said. "Meanwhile the business people are waiting around impatiently for the results."

Now, with the tools becoming available, a line-of-business head can start with a palette of data and, at the very least, turn it into a simple forecast. The data scientists and analysts can work on more complex issues, because the software automates work that previously was done manually.

Bigger banks, which can afford to employ teams of data scientists, will always maintain an advantage due to the resources available, but smaller banks are gaining ground, Wallace said.

"You're starting to see a lot more investment" by community banks in analytics, Wallace said. "It's a way they can punch above their weight."