Want unlimited access to top ideas and insights?

Many consumers — millennials in particular — have a love-hate relationship with credit.

They are comfortable borrowing for specific purposes, such as paying for school, buying a car or even financing a dream wedding. But research conducted by banks and fintechs has found that many younger Americans are uncomfortable carrying credit card balances, partly because they saw their parents struggle with debt during the financial crisis and prefer the more certain repayment terms of installment loans.

This affinity for more straightforward credit products helps explain why so many banks and fintechs are now offering personal loans that consumers can use to consolidate debt, finance big-ticket purchases and, increasingly, buy smaller items too. Personal loans issued by banks — these exclude credit cards and auto and home equity loans — hit a record $807 billion at Sept. 30, according to data from the Federal Deposit Insurance Corp., up 9% from two years earlier and nearly 30% since 2012. That’s not even including the many billions of dollars of loans made by upstart online lenders that don’t end up on banks’ balance sheets.

It is also giving rise to a fast-growing subset of personal loans known as point-of-sale loans.

Point-of-sale loans are hardly new — banks have been offering them indirectly at the likes of furniture stores and orthodontists’ offices for decades. The biggest players historically have been Wells Fargo, Citigroup and Synchrony Financial.

But this type of lending has become increasingly popular in recent years as technology has improved to the point where merchants and contractors that previously may have only accepted cash, check or credit cards are now offering the option of a loan at the moment of purchase, whether online, in stores, or in person. Think of the owner of a roofing company at the house to give an estimate on a project whipping out an iPad to offer an instant loan to pay for the work.

Besides giving consumers another payment option, these loans help merchants sell more goods and services, bankers and fintech executives say. They have also been a boon for online lenders — San Francisco-based Affirm originated more than $1 billion in point-of-sale loans last year — and, increasingly, for regional banks that are funding the loans, either directly or behind the scenes.

Citizens Financial Group has built a thriving business as the exclusive point-of-sale lender for iPhones at Apple stores and at Apple.com. It has a similar exclusive partnership with Vivint, a home security firm.

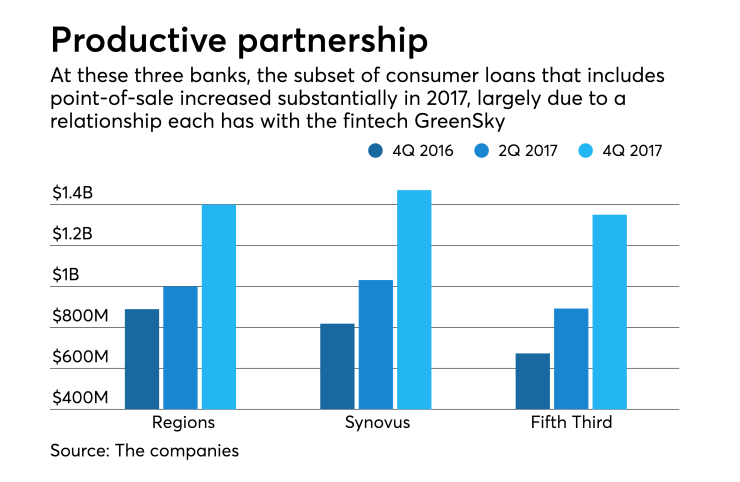

Regions Financial, Fifth Third Bancorp and Synovus Financial have all seen their point-of-sale loan portfolios swell since they joined forces with GreenSky, an Atlanta-based fintech whose technology platform enables home improvement contractors, medical firms and specialty retailers to offer instant loans and lines of credit to their customers. As of late 2017, GreenSky had partnerships with 16,000 merchants.

For banks, these loans have become a key driver of consumer loan growth at a time when many are tapping the brakes on car lending and demand for home equity loans has weakened. Maintaining consumer loan growth is a top priority for banks as they aim to diversify their loan books, which historically have been heavily weighted toward commercial real estate loans.

One of the biggest risks to bulking up in consumer lending is that the economy sours and consumers begin struggling to keep up with their monthly payments. Recent declines in personal savings rates, rising consumer debt levels and increasing delinquencies on consumer loans, while nowhere near financial-crisis levels, are all warning signs that some U.S. households may already be stretched thin.

Still, bankers say that they are well aware of the risks and that they are taking all the appropriate steps to mitigate them. Tim Spence, the head of payments, strategy and digital solutions at Cincinnati-based Fifth Third, said that the systems banks have built to run stress tests have gone a long way to helping them understand just how much risk in consumer lending they can tolerate.

Stress testing “has become an incredibly useful tool for strategic planning,” Spence said. “It’s what drives the decisions we make as it relates to the profile of the customer, to whom we are willing to extend credit and the size of a given portfolio on our balance sheet.”

Moreover, many of these loans are short term — generally for less than two years and sometimes for only a few months — and therefore pose much less risk to bank balance sheets than car loans or mortgages.

So, at least for the foreseeable future, don’t expect banks and fintechs to ease up on point-of-sale lending. Here are four reasons why they see it as a growth business.

Consumers want options

Affirm facilitates point-of-sale loans for a wide range of merchants, including clothing retailers, bicycle dealers and travel websites. As recently as late 2015, the lender had partnerships with just about 100 retailers. Today, it has more than 1,500 partners and is adding more all the time.

By rapidly adopting point-of-sale lending, merchants are acknowledging that their customers want alternatives to mainstream or store-branded credit cards when it comes to paying for products or services, said Max Levchin, Affirm’s founder and chief executive.

“Consumers recognize the need for credit, but are unhappy with the terms and lack of control associated with traditional cards,” Levchin said in an email.

In 2016, Affirm conducted a survey of more than 1,000 consumers ages 22 to 44 to gauge attitudes about consumer credit. Most said that they fear debt and nearly half said that they enjoy some purchases less if they are still carrying a balance on their credit cards.

Perhaps most tellingly, 87% of respondents expressed an interest in paying for large purchases via monthly installment loans and the bulk of those respondents said that the most appealing aspect of an installment loan is knowing exactly how much they will owe and when, including interest.

Americans still love their credit cards, as evidenced by the fact that card debt outstanding is now at an all-time high of $800 billion, according to the Federal Reserve Bank of New York. Yet the number of active accounts is well below pre-crisis levels, a clear sign that many consumers are trying to avoid revolving debt. In its research, Fifth Third found that millennials in particular dislike carrying credit card debt but have little problem taking out a loan to pay for a specific product or service, such as a laptop or a vacation.

“There is a natural psychological affinity within this group for credit products with a purpose,” Spence said. “That was a big ‘aha moment’ that drove us to offer a financing solution at the point of need.”

Fifth Third’s research also found that many homeowners are less inclined these days to use home equity loans to pay for a kitchen remodeling, the installation of solar panels or other home improvement projects. Those who have memories of the financial crisis worry that tapping the equity in their homes to fund upgrades could leave them underwater if a recession hits and home values decline. Others simply find home equity loans to be more trouble than they’re worth, especially when there are other financing options available to them.

“If a tree falls on your garage, you don’t want to wait 45 days to get an appraisal and for a proper closing package to be put together … before the loan gets funded,” Spence said.

This is where GreenSky loans come in. The loans, which range from about $5,000 to $55,000, are offered through thousands of contractors and can be funded in minutes by any one of the roughly 15 banks in the GreenSky network. The loans carry higher rates than home equity loans because they are not secured by a home’s value, though most at the outset will offer a 0% promotional rate that allows a borrower to avoid interest charges if the loan is paid off before the promotional period expires.

Steve Adams, the head of investor relations at Synovus, in Columbus, Ga., said that while home equity loans will always have a place, some homeowners looking to finance an upgrade or an addition are drawn to GreenSky loans for their speed and simplicity.

“This type of transaction is very appealing to a customer because it happens very quickly,” said Adams, who until recently headed consumer and small-business lending at Synovus. “We believe, in a lot of ways, this is where the industry is going.”

Point-of-sale loans help sell more stuff

It’s easy to see why thousands of home improvement contractors would want to partner with GreenSky and hundreds of retailers and web merchants would want to team with Affirm: The more payment options they can offer to prospective customers, the more likely they are to close the sale.

Brendan Coughlin, the head of deposits and consumer lending at Citizens Financial Group, in Providence, R.I., said that merchants were very much top of mind when his company began building its own internal loan platform a few years ago. Not only did Citizens’ executives see point-of-sale lending as a way to better serve consumers, they also viewed it as an opportunity to help existing — and future — business customers “achieve a dramatic improvement in sales,” Coughlin said.

Arrangements between merchants and lenders can vary, but in many instances the merchants will pay a fee to participate in a point-of-sale partnership. GreenSky, for example, makes its money off of contractors who pay it a fee for facilitating loans. (Those fees are adding up too. The Wall Street Journal recently reported that GreenSky is the country’s second-most valuable fintech, with a market value of roughly $4.5 billion.)

Citizens makes its loans directly, not through a third party, and it also charges merchants a fee on each loan it originates. Importantly, the loans are interest-free, and Coughlin stressed that the 0% offer is for the life of the loan, not for a set promotional period after which borrowers would have to pay accumulated interest.

Merchants “are giving up a little bit of a profit margin to run a program like this, but the bet they are making is that this very frictionless experience will provide more accessibility to their products by making them more affordable,” Coughlin said.

Citizens currently offers point-of-sale loans for Apple and Vivint, but Chairman and CEO Bruce Van Saun told investors and analysts in January that it expects to announce partnerships with more merchants later this year.

“We’re working on things that are in pilot, so stay tuned,” he said.

The partnership with Apple may not stay exclusive for long. The Wall Street Journal reported Wednesday that Goldman Sachs is in talks with Apple to offer point-of-sale loans on iPhones and other Apple products. Goldman would make the loans through its consumer-lending arm, Marcus, which it launched in 2016.

Tech advances have simplified point-of-sale lending

Apart from 0% interest, the other main selling point on Citizens’ iPhone loans is the speed at which they can be approved and funded.

According to Coughlin, loans can be approved “in less than one second” with a simple swipe of a credit card already in a prospective borrower’s wallet. That smooth customer experience is among the reasons why Citizens’ portfolio of unsecured consumer loans has more than tripled since mid-2016.

Similarly, GreenSky loans can be approved in a matter of minutes and are generally funded the same day.

The process has to be simple not just for the borrowers, but also for the contractors and merchants that are offering the financing and leasing options in the first place, said Bob Wickham, an investor in Microf, a fintech lender that makes point-of-sale offers to homeowners seeking upgrades to their heating, ventilation and air conditioning systems. The six-year-old Microf has partnerships with thousands of HVAC dealers and dozens of distributors and primarily works with homeowners with slightly blemished credit records.

“The point-of-sale financing has to be quick and easy for contractors to use,” said Wickham, a partner at Rotunda Capital, a private equity group in Bethesda, Md., that invested roughly $18 million in Microf in 2015 and 2017. “During the busy season, these guys are often working 7 a.m. to 7 p.m. and they aren’t going to take the time, nor do they have the time, to suffer through a complicated application and funding process.”

Lenders are continuing to refine their technology so that consumers can access funds when they most need them. Fifth Third will soon roll out a new personal loan for which existing account holders can apply through a mobile app. If the loan is approved, funds will be deposited in the customer’s account the next business day and could be used, conceivably, for any big-ticket purchase.

Affirm also recently began offering a new type of loan that lets consumers borrow to buy a product or service from any merchant, not just one that has an existing partnership with Affirm. App users who are approved for a loan are given a temporary credit card number that can be used at the point of sale to complete a purchase.

Any item — as small as a new pair of jeans — could be paid for with the loan. Affirm loans start at around $150 and can go as high as $17,500. The average loan size is $650, Levchin said.

“We believe the future of credit is not a piece of plastic but an app that gives consumers flexibility to spend where and when they want, along with transparency into the true cost of a purchase,” Levchin said.

For banks, it’s all about portfolio diversification

As recently as late 2016, Fifth Third barely had any point-of-sale loans on its books, but since then it has originated hundreds of millions of dollars in such loans and expects to reach $2 billion within a few years, all thanks to its partnership with GreenSky, said Spence. The bank is so bullish on the business model that last year it invested $50 million in GreenSky to help fund the fintech’s expansion into new business lines.

Regions doesn’t break out GreenSky loans in its financial statements, but at Dec. 31 its portfolio of indirect consumer loans totaled $1.4 billion, up 57% from a year earlier. Much of the growth can be attributed to its relationship with GreenSky, said Tracy Jackson, Regions’ senior vice president of consumer lending.

“A bank like ours doesn’t have the existing technology to provide the infrastructure to these thousands of locations,” Jackson said. “GreenSky has that technology, plus all these relationships with the home improvement contractors. For a bank, that’s just too much overhead to support.”

This access to GreenSky’s technology is helping banks diversify their loan books. Synovus nearly failed a decade ago after overloading on commercial real estate and construction loans, but its loan portfolio has become more balanced in recent years as it has pursued more small-business and consumer credits. At Dec. 31, Synovus had nearly $1.1 billion of indirect consumer loans on its books, up 130% from a year earlier.

Adams, its head of investor relations, said that the company made a conscious decision a few years ago to expand its point-of-sale lending and concluded that partnering with GreenSky was the best way to do that.

“The choice was to build our own solution, go out into the market and buy somebody or find a partner,” he said. GreenSky “had the most compelling value proposition.”

Regions’ Jackson added that the partnership is cost-effective as well because it allows banks to make loans “without always relying on branches.”

If there’s one drawback for banks in partnering with GreenSky it’s that there is little opportunity to deepen relationships with borrowers. GreenSky by and large assigns loans to its bank partners on a round-robin basis — this one to Fifth Third, the next one to Regions and so on — so more often than not banks end up funding loans to borrowers in markets where they have no retail presence. A borrower in Seattle might get a monthly statement from Regions, but otherwise will likely have no other interaction with the bank, which operates in the South and Midwest.

Jackson said that there is some point-of-sale lending Regions can do on its own, without the help of a third party. For example, it works directly with several energy companies within its footprint to offer loans to homeowners seeking to finance energy improvements, such as duct replacement or a heat pump tune-up. The bank is also exploring partnerships with hospitals and other medical providers in its markets to offer loans for medical procedures not fully covered by insurance, all with an eye toward developing deeper relationships with the borrowers.

“At some point, we want to provide all this ourselves and not have to rely on a third party,” Jackson said.