It seemed like an idea that would catch fire.

More than two years have passed since BancorpSouth, Bank OZK and Zions Bank ditched the holding companies to reduce costs and eliminate regulatory bureaucracy. Those efforts

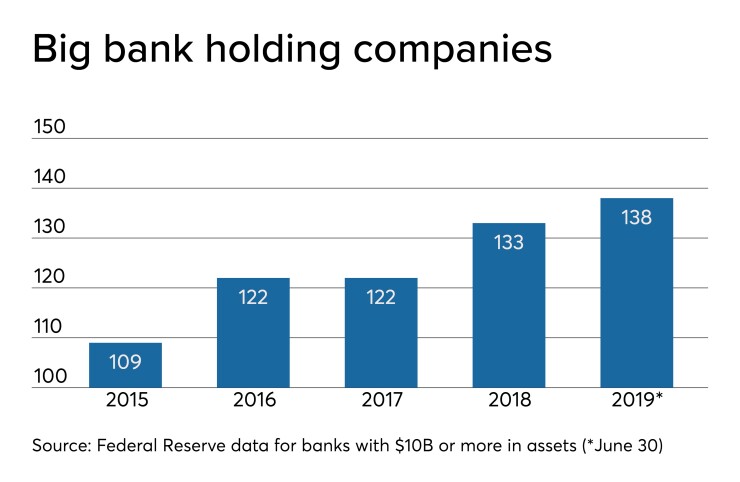

Very few banks have done that. The number of bank holding companies with assets of $10 billion or more — the group largely viewed as having the most to gain from scrapping their BHCs — has increased by 13% from late 2017, according to Federal Reserve data.

For many banks, the benefits of keeping their holding companies are outweighing the perks of abandoning them, industry experts said. For instance, rate cuts are making it advantageous for smaller banks to use BHCs to issue subordinated debt that can then be injected into their bank units, said Matthew Dyckman, a lawyer at with Goodwin Procter in Washington.

Banks with assets of less than $1 billion, under the Fed’s Small Bank Holding Company Policy Statement, can use debt to finance up to three-fourths of the purchase price of an acquisition.

"Absent specific regulatory or other reasons for doing so, we do not expect to see many banks to eliminate their holding companies," Dyckman said.

One reason to eliminate the BHC would be to remove some regulatory burden. Such was the case at the $1.2 billion-asset Northeast Bank in Lewiston, Maine, which announced plans in January

But it has been hard to determine the bottom-line benefits of such moves, industry observers said.

The only noticeable change at Bank OZK is that the Little Rock, Ark., company no longer files documents with the Securities and Exchange Commission, said Stephen Scouten, an analyst at Sandler O’Neill.

"Their releases have become more difficult for some investors to find," Scouten said. "I think it eliminated some redundancies ... but nothing visible."

While it is possible that other banks could scrap their BHCs, Scouten said other regionals, including Home BancShares, Simmons First National and Pinnacle Financial Partners, considered the move before opted to maintain the status quo.

"There's a view that this creates a negative optic," Scouten said. "Some investors seem to believe it’s an attempt to have reduced regulatory oversight. I don’t agree with that personally, but that’s one of the narratives."

Bank investor Phil Timyan said there was plenty of talk about poor optics when Bank OZK got rid of its holding company, noting that nearly 12 million of the bank's shares were shorted a year ago. The company was also dealing with investor concerns about its large concentration of commercial real estate loans.

Zions, meanwhile, made it clear that its move in 2017 was designed to

Chatter about abandoning holding companies has since died down.

David Chiaverini, an analyst at Wedbush Securities, said he's heard little talk of other banks making such a change. He recently brought the topic up with a midsize bank, only to be told that no changes were afoot.

"I haven’t been hearing or noticing any concerns in the industry regarding whether to retain or abandon their BHC structures," said bank consultant Danny Payne. "I think they’re here to stay."