As their region's economy continues to stagnate, Midwestern banking companies are increasingly willing to travel to find growth - and Arizona is proving a popular destination.

"It appears to be the next Florida," said Gary Cohn, the president and chief operating officer of the Palm Beach Gardens, Fla., market research firm U.S. Datatron Inc. "I think if you track the retirement community and the dollars that are going there, it would not shock me if more dollars are headed there, given that Florida seems to get storms with ladies' names."

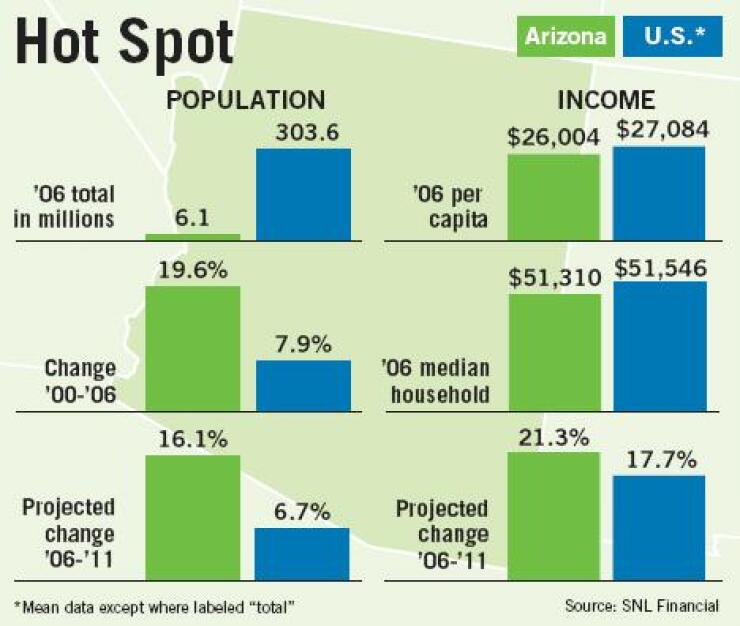

Arizona is projected to have the second-highest population growth rate (16.1%) from 2006 to 2011, behind Nevada, according to data from SNL Financial LC. Perhaps more importantly, Arizona also is projected to have the second-high average household income growth rate (21.3% ) in that time. And unemployment there has held steady at 4% over the last year and a half, compared with the national rate of 4.5% at the end of May.

Among the Midwestern banking companies headed to Arizona is the $350 million-asset Maritime Savings Bank of West Allis, Wis., which plans to open two branches in the Phoenix area next year. The branches would be its first outside of Wisconsin, where it has nine.

James F. Maas, the chairman, chief executive, and president of Maritime Savings, said in an interview that it decided to open branches in Arizona after the mortgage operation it started there four years ago began drawing commercial business.

"We thought eventually we'd grow into the commercial area, but with the residential slowing last year, it just became more apparent that this was a direction we needed to go," Mr. Maas said. "We have a customer base and a name and presence there now, and the natural flow would be to open a full-service branch."

Several larger Wisconsin companies are already in Arizona. The $56.5 billion-asset Marshall & Ilsley Corp. of Milwaukee has 48 branches in the state, and the $4 billion-asset Johnson Financial Group of Racine, Wis., has nine.

TCF Financial Corp. of Wayzata, Minn., entered Arizona by opening a Phoenix branch in the fourth quarter as it sold 10 branches in slower-growth Michigan to fund its expansion elsewhere.

"We concluded that a better use of shareholders' capital would be in faster-growing areas like Denver or Arizona," Lynn A. Nagorske, the $14.9 billion-asset company's CEO, said at its investor conference June 4. "Arizona is an urban market, densely populated, young, and fast-growing."

The $17 billion-asset AmTrust Bank, which was known as Ohio Savings Bank until this year, opened its first branch in Phoenix in 2000 and now has six in Arizona. It also has branches in Florida.

One of the most recent entrants to the Arizona market through acquisition was Wachovia Corp., which bought Golden West Financial Corp. of Oakland in October.

Robert S. Patten, an analyst with Regions Financial Corp.'s Morgan Keegan & Co. Inc., said small Midwestern banks are probably feeling more of a crunch than the large ones.

"I'm much more concerned about small banks today than big banks, because of lack of diversification, both in terms of geography and revenue," Mr. Patten said. "To put it simply, banks want to be in Arizona because there's growth."

Despite the migration of banking companies to the Southwest, Mr. Cohn said his firm has not fielded too many questions about Arizona competition lately.

"We've got a pretty good pulse on it, and I would not say that we are bombarded with, 'Tell me what's going on in Arizona. Tell me what's going on in Arizona,' " he said. "The move to go there is predicated on the fact that there is not a lot of competition."

Mr. Maas acknowledged that competition is a big consideration in Maritime Savings' case. Wisconsin has 302 banking and thrift companies operating in the state, while Arizona has just 53, according to the Federal Deposit Insurance Corp.

Also, there is the matter of timing.

"The opportunity presented itself more so now, because we're seeing a much slower market here in the Milwaukee area," Mr. Maas said. "We're very dependent on residential originations, and out there it's growing in every direction. There's so much residential [development] going on, certainly on higher-end properties, and commercial is on fire, with office condos and multifamily condo conversions - you name it."

Behemoths stand at the gate. JPMorgan Chase & Co. had a 24.9% deposit share as of June 30, 2006. Bank of America Corp. had 19.5%, and Wells Fargo & Co. had 19.2%.

But Mr. Patten said those share figures could work in favor of small institutions, because they do not have to be the largest player in the market to get substantial growth.

"Bank of America or Wachovia or JPMorgan are not going to cry over losing 1% or 0.5%, but a 1% share gain for a little bank is huge," he said. "I think this is the phenomenon we will see across the country, where the little banks pick at the big banks, and the little banks try to out-big the big banks, and the big banks are trying to be better at being a little bank, and share will continue to roll to the little banks."

From June 2002 to June 2006, each of the three giants' share in Arizona fell more than 115 basis points, according to FDIC data.

Overall, Mr. Patten said, the competitive dynamic in Arizona is very similar to the one in Florida, where the top three banking companies - B of A, Wachovia, and SunTrust Banks Inc. - hold nearly 50% of the market's deposits.

Mr. Maas says he believes in chasing snowbirds and retirees because he is one - he has vacationed in the Phoenix area for the last 20 years.

"With the Baby Boomers retiring, they're going to be looking for the sun, and we've also got customers here that have banked with us for 30 years that are moving to the south, and they want to continue that relationship," he said.

Mr. Patten said there is some credence to the theory of following the Midwesterners who vacation in warmer states, "but I don't know if a single branch will allow you to grab that share."

In addition, just putting a branch in a growth market will not negate the need to offer a wide range of products and services, he said.

"For a long time banks sat back a little too comfortably on the fact of the stickiness of the customer," Mr. Patten said. "Now, with yields being what they are, customers are more aggressive in looking for yield, searching for services, and if their bank doesn't provide them, they'll go somewhere else."

Wachovia also has plans for Arizona as it integrates Golden West. Though the bulk of the Golden West branches were in California, the purchase also gave the $706 billion-asset Charlotte company 15 branches in Arizona in cities such Phoenix, Tempe, and Tucson.

Robert McGee, the chief operating officer of Wachovia's retail bank, who is coordinating the integration, said in a December interview that his company wants to add branches in Arizona, particularly in Phoenix. "It is a very attractive market and very consistent with our business model. There are lots of opportunities there to keep us busy for some time."