In case you never heard of no-code software, Goldman Sachs is pouring millions of dollars into it. Got your attention?

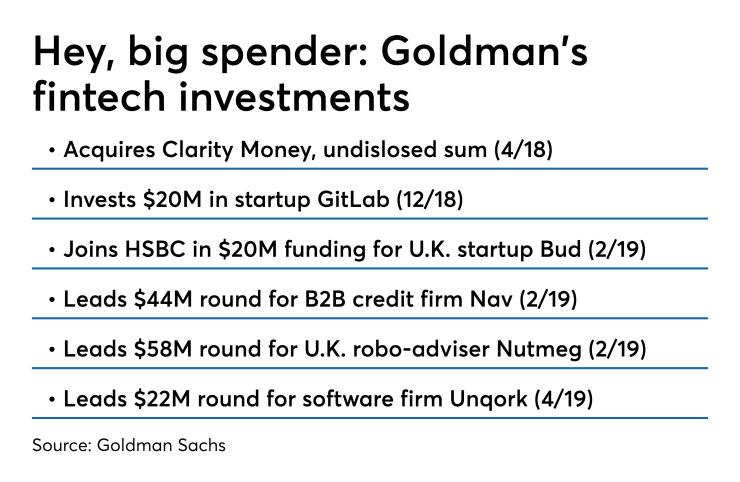

Goldman said Wednesday it is leading a $22 million Series A round of investment in an enterprise software company called Unqork. It has also begun deploying the technology internally.

The investment and the use of Unqork inside Goldman reflect financial services’ growing interest in this brand of software, which is sometimes called "low code" as well.

The term “no code” is a little misleading. It’s not that the software has no code. It is software that has prebuilt modules that are theoretically designed so flexibly that an ordinary user could drag and drop them into a useful workflow and deploy the software without the need for developers to create any code.

For instance, Unqork has built a driver's license component that takes a picture of an applicant’s license and captures information like eye color and age to fill out forms. It has a module that makes sure an applicant is not on a terrorist list. Biometric authentication modules can be brought in through application programming interfaces. Such elements can be combined for an account-opening process. Other companies, like Mantl, Alloy and Jumio, also offer a modular approach to account opening.

Moreover, Unqork has a customizable forms engine that can be used to gather data from any user for any purpose, such as account opening. Unqork is delivered in a pay-as-you-go, software-as-a-service model.

The promises of no-code software providers can sound too good to be true. There are skeptics in the industry who doubt the claims that everyday people can build applications with it.

But at Goldman Sachs, “the feedback from our tech teams internally is that Unqork is one of the closest to a real, no-code, low-code platform that we've seen in the workflow space,” said Sarah Shenton, vice president of principal strategic investments, a group that invests in tech and fintech startups.

Other investors in the funding round included all the original seed-round investors (which included Summerfield Capital Management, Blue Seed Collective and Bradford Brown Capital Partners) and Broadridge Financial Solutions.

Experimenting at Goldman

Shenton was introduced to Unqork last year by Rabih Ramadi, who at the time was working with different parts of Goldman as a KPMG partner. Ramadi is now head of financial services at Unqork.

The bank began testing the software as part of its proof of concept before making its investment. It has now rolled it out into production for a very specific purpose: to collect applications and data from people around the company who want to apply for an in-house incubator called GS Accelerate. Last year, 1,000 employees applied.

This deployment proved to Goldman that Unqork’s time-to-market and flexibility of configuration benefits.

Normally, even for a small application like this one, there would have been a lengthy process of documenting requirements, prioritizing the technology project, and then building the product itself.

“We were able to substantially shorten the timeline from design to production and have business owners themselves build out the application,” Shenton said.

She noted that for some financial services products, like insurance and loans, the approval of an application is the product. So where business owners can structure the data collection process, the rules of logic and the validation of whether someone should be approved for that product, they are building a client onboarding process and the creation and delivery of the product itself.

“That's why from an investing perspective we’re interested in Unqork,” Shenton said. “The company has the potential to fundamentally change how we structure operational flows across onboarding and fulfillment processes in the insurance and financial industry.”

Beyond GS Accelerate, Shenton said she could see Unqork’s technology being used for private wealth products.

Product potential

Gary Hoberman, founder and CEO of Unqork, also says the company’s technology could be used for almost any financial product.

“If you think about the consumer side of a bank with mortgages or opening accounts, or the institutional side of a bank with capital markets where you’re opening institutional accounts and mutual funds, all that could be generalized into capturing data, validating the data and processing the data,” Hoberman said. “When you open a mortgage, you’re going to fill out a form on who you are, what’s your home, what’s your income, your credit score. That form is defining rules: Let me ask you your Social [Security number], and because you gave me your Social, let me go out and get your credit score, and because your credit score was over 700 I don’t need to ask you this next series of questions.”

In Unqork, a user could drag in a text field called social, bind it with another field called credit check, and drag in a rule called decision.

“If you know how to use Excel," Hoberman explained, "you’re able to define that entire end-user experience from the customer’s viewpoint back in, instead of the traditional approach where the business defines a Word document describing what they think they need, gives it to an engineering team to code what they think they need, only for the business to find out a year or two later it wasn’t what they needed at all and doesn’t work.”

The startup typically pitches its technology as a way to handle account onboarding.

“In the example of a bank like Goldman, we start by telling them how we’re going to help them with a real problem like account onboarding, which every bank faces,” Hoberman said. “What happened with Goldman, and we find this with each of our clients, is they embraced it and said this is something we’ve been looking for to solve many problems besides account onboarding and how do we deploy this throughout different divisions.”

Before starting Unqork, Hoberman was global chief information officer for MetLife, where he oversaw technology in 47 countries. Before that, he worked in technology leadership roles at Citi and Solomon Smith Barney.

Hoberman said Unqork has 17 financial services clients, many of them in insurance, like the company’s first client, Liberty Mutual.

According to Hoberman, only 10% of the development work done in large financial services firms provides competitive advantage. That is where he would like to see Unqork applied toward.

“We eliminate code. Everyone’s talking about hiring more technologists or hiring digital officers — we eliminate all that code,” he said.

This can help banks bring products to market quicker, he said.

“Can you bring the time to market that much faster by not creating code but simply thinking through the business aspects of what you’re trying to achieve?” Hoberman said.

Goldman has placed a big bet on the company's future.

“The potential is quite impressive and powerful because not only have they created a thoughtful and sophisticated yet simple-to-use piece of technology, it's extremely scalable,” Shenton said. “Marrying that with subject matter expertise reduces friction in the build life cycle and allows for rapid development, which has tangible benefits to the firms that use the product.”

Editor at Large Penny Crosman welcomes feedback at