Vince Delie is listening to shareholders who want F.N.B. Corp. in Pittsburgh to swear off dilutive acquisitions.

Delie, chairman and CEO of the $34 billion-asset F.N.B., was once a serial acquirer who bought six banks between late 2013 and early 2017. Its last acquisition — the $1.4 billion purchase of Yadkin Financial in Raleigh, N.C. — was dilutive to tangible book value and included $100 million in projected merger-related expenses.

Investors were far from pleased.

“The reaction from the last transaction ... was a clear statement that shareholders are looking for us to build our capital base, to continue to pay an attractive dividend and to provide above-peer returns,” Delie said in a recent interview.

F.N.B. isn't the only bank pressing the pause button on acquisitions.

Bank M&A has been sluggish this year. Activity at mid-2019 was down 12% from a year earlier, with 114 deals announced, according to data from Janney Montgomery Scott. Pricing metrics have also come down from transactions announced last year.

"M&A continues to be concentrated among smaller banks," Christoper Marinac, an analyst at Janney Montgomery Scott, said in a Monday note to clients, observing that only six deals announced this year involved prices above $500 million.

It is reasonable to think that shareholder reactions have contributed to a slower pace of deal activity, said Damon DelMonte, an analyst at Keefe, Bruyette & Woods. Negative investor reaction ultimately hurts the valuations of buyers and sellers.

“I also think the deals that seemed to have been received the best, based on the first few days afterward, are no-premium deals,” DelMonte added.

Highly dilutive deals continue to rankle investors.

Bankers should focus on a "five and five" strategy that keeps dilution to tangible book value below 5% and an earn-back period of less than five years, said Laurie Havener Hunsicker, an analyst at Compass Point.

At the same time, the financial benefits of M&A have been mixed for F.N.B.

Net income has increased significantly, rising from $33 million in 2009 to $367 million last year. The company returned $165 million to shareholders in 2018, Delie said. And the moves helped F.N.B. absorb the costs of post-crisis regulation.

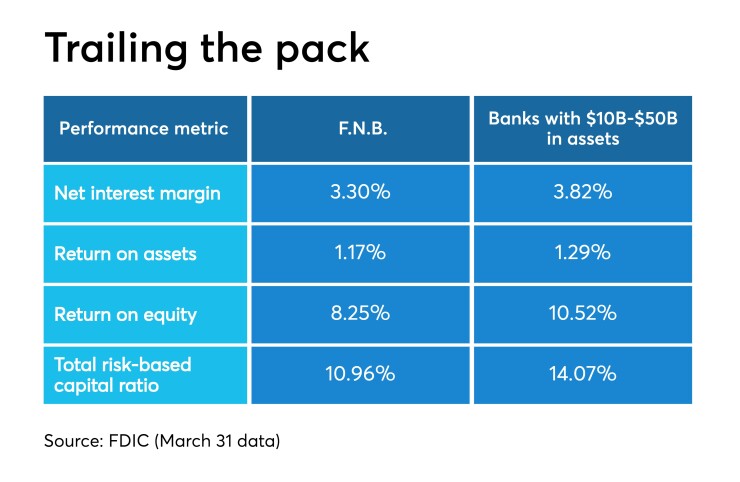

Many of the company's other performance metrics — including return on assets, return on equity, total risk-based capital and the net interest margin — trail those of banks with assets of $10 billion to $50 billion.

Delie said he is more comfortable pursuing organic growth. F.N.B. is among the 10 biggest banks in deposit market share in Pittsburgh, Baltimore and Raleigh, N.C., which provides a solid platform for expansion without M&A.

"The need for acquisitions, from a growth perspective or to overcome regulatory cost, is behind us,” Delie said.

F.N.B. plans to add three branches around Washington, and Delie said it is “highly likely” the company could open a loan production office or branches in Richmond, Va.

The company opened a loan production office in Philadelphia after it was unable to buy a bank there.

Many of these markets face potential disruption as BB&T combines with SunTrust Banks as Truist Financial.

“We think that we now can go in kind of selectively with the right people and drive commercial loan growth,” Delie said.

F.N.B. should be able to benefit from the merger as long as it stays the course and focuses on its small and midsize clients, Delie said.

"M&A can be disruptive and we're looking to benefit," he said.