DogHero, an Airbnb for dogs, had a payment problem.

Urban dog owners who prefer a homelike experience for their dogs use DogHero’s online marketplace to find hosts that meet their requirements, such as no smoking. As soon as pet owner and pet sitter agree on terms, they need to settle quickly within the portal. As a result, the startup needed the ability to process payments instantly to meet dog-sitting emergencies. It is thinking about using an application programming interface from Citigroup to get that ability.

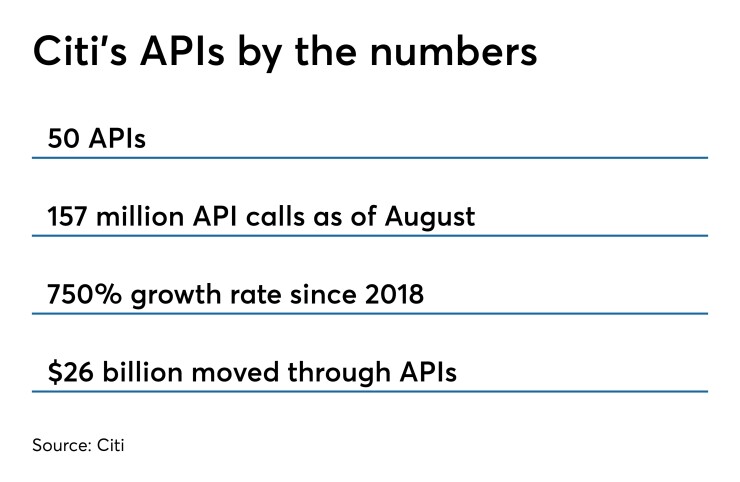

A growing number of e-commerce sites like DogHero need real-time payments to handle time-critical transactions. Many are increasingly using APIs from big banks like Citi, Wells Fargo and JPMorgan Chase to make that happen. Citi has seen use of its APIs spike this year, to the point where it has now handled 157 million API calls globally and handles about 15 million such calls a month.

“That number continues to grow,” said Tapodyuti Bose, global head of digital channels, data and analytics for Treasury and Trade Solutions at Citi. “Everybody is trying to move to real-time interactions with institutions like ours. They are trying to do transactions in real time and consume information in real time.”

Wells Fargo and JPMorgan Chase won’t share any numbers, but say they are experiencing the same thing.

The trend is a stunning reversal from when banks first started letting companies use their APIs several years ago to access bank data and adoption was slow. The interfaces' capabilities were limited and many companies weren't equipped to work with them. The large banks have since adopted standards to make their APIs easier to use and they integrate them with enterprise software applications like SAP and Oracle ERP systems. They’re also embedding financial software in other marketplaces.

“Financial products are increasingly less bought as products from factories, but rather as features inside of platforms,” said Lex Sokolin, a futurist and global fintech co-head at ConsenSys. “Amazon is a platform with thousands of features, and lending and payments are just some of the features within. You can think of payments flowing from Stripe to Shopify to thousands of online merchants as another example.”

And fintechs expect to be able to use APIs with a few lines of code, so banks have been forced to simplify their APIs.

“This is also in large part due to the competition from decentralized finance, where all the software is API-first,” Sokolin said. “APIs will be increasingly the glue holding finance together.”

Those 157 million API calls at Citi

Citi's Bose has seen a rapid expansion of APIs in recent years due to e-commerce's growth.

“If they are selling goods or services on their e-commerce site, and if they’re collecting money from customers, if they can get that collection done instantly as well get the information that the collection has been made and credited to their account instantly, they can ship the goods right there and then," he said.

A real-time understanding of how money is flowing in and out helps customers make better decisions about treasury funding, he said.

“If they’re working off their working capital positions based on the previous day’s data or the previous week’s data, they will make certain decisions about how to move the money from one entity to the other,” Bose said. “If they deduce that same decision based on absolutely current information, they can manage the funding across their different accounts in a far more efficient manner.”

Citi has also found that embedding APIs in enterprise resource planning systems makes them much easier for corporate customers to use.

“They can use our API as a part of their normal process,” Bose said.

One Citi corporate client, Flatio.com in the Czech Republic, has a marketplace for short-term apartment rentals of three to six months. Like DogHero, it embedded Citi’s API in its portal so that a safety deposit or rental payment can be made instantly. The food delivery service Deliveroo in the U.K. is another API user for real-time payments. Another client, Moni Online, does microlending in Argentina and uses a Citi API to disperse loan funds instantly to borrowers.

Bose expects more companies to go this same route as they sell goods and services online. In the U.S., consumption of APIs for real-time payments has seen slower adoption, partly because Americans are so used to using credit cards to purchase things online, Bose acknowledged.

JPMorgan Chase customers seeking visibility

Like Citi, JPMorgan Chase has seen a spike in adoption of its APIs that’s largely coming from corporate customers. Some of these customers are seeking real-time visibility of information like account balances and payments, according to Sairam Rangachari, head of open banking and API strategy, wholesale payments, J.P. Morgan.

“We're getting a ton of questions on reconciliation of receivables, money that they are expecting to receive from their partners and customers,” said Rangachari.

A large shipping provider plans to use the bank’s API to avoid a situation where its goods are stuck in a port and can’t be released to the buyer because some payments haven’t been confirmed.

“There’s a frustrated buyer who's potentially made the payment, but the company doesn't have real-time visibility, so the goods just sit there,” Rangachari said.

E-commerce marketplaces want to give real-time visibility and money movement capabilities for their gig economy workers and suppliers. “Demand for real-time payments has also driven API use, he said. Another J.P. Morgan client that operates in multiple countries is looking to use a J.P. Morgan API to do automated foreign exchange hedging.

“They want to be able to in real-time figure out which currency to pay from and then hedge against that currency in an automated fashion,” Rangachari said.

JPMorgan Chase is handling millions of API calls, though Rangachari would not give specific numbers.

“More excitingly for us is the number of industries, segments and clients that are embracing this and coming to us organically,” Rangachari said. “Even a year and a half back, we would go to them and talk to them about the power of APIs and what they could be doing. The conversation has really shifted to the other side where customers are calling us and telling us about a pain point or opportunity, and asking us, ‘What APIs do you have?’ ”

JPMorgan also works with fintechs like Trovata, developer of a cloud-based cash management forecasting system. The company uses an API to bring real-time bank data in to its forecasts.

Some demand for the bank’s APIs come from corporate clients who simply want to manage all their banking in one place.

“Customers don't want to go to 18 different places to manage this experience,” Rangachari said. “We strongly believe that the future battleground is on the customer experience and customers are going to push us as an ecosystem and market to say, how do you create this best experience for us? And that means some of us have to distribute our data and services through other systems.”

How Wells Fargo uses APIs

Wells Fargo described its API strategy as bringing the bank to the customer. Wells Fargo is more focused on U.S. customers than Citi is, though it follows those customers abroad when necessary.

Secil Watson, executive vice president of digital solutions for business at Wells Fargo, said the trend toward open banking has led corporate customers to embed the bank’s APIs in their team-member-facing and customer-facing solutions.

“There’s a lot of opportunity in this space,” she said.

Imran Haider, head of open API channel, manages Wells Fargo’s enterprise API gateway, which was created three years ago and runs across all the bank’s lines of business. Haider said the bank is running “substantial volumes” of API calls, but would not get more specific than that.

“Our focus has been a desire to get the bank to our customers in the experiences that are relevant to them,” he said. “Our customers have workflows that are outside banking, and in those workflows they have a need to connect back to the bank, check a balance, check activities, open an account, make a trade. And our desire is to use APIs to get the bank embedded into their context so they can interact and make good decisions on their side.”

Like Citi, Wells Fargo has built APIs that integrate with enterprise resource planning systems. This saves customers having to go back and forth between their ERP system and online banking.

"You’re really simplifying the customer’s experience by bringing the bank to the customer,” Haider said.

Wells Fargo’s APIs are also commonly used for account aggregation.

“Historically that market has been dominated by screen scraping, which is cumbersome, insecure, inefficient and ineffective,” Haider said.

Wells Fargo has APIs that let customers view their own bank data in the dashboard of their choice. The Control Tower feature the bank offers in its online banking site and mobile banking app lets consumers choose which accounts they want to bring into an aggregator experience and what information they want to share in that aggregator experience. Wells Fargo is seeing a lot of traction and activity in that aggregation use case, Haider said.

Some customers are using the bank’s APIs to perform account validation on the customers they bill through the automated clearinghouse. Watson said that overall, the bank has been seeing “hockey stick growth” for the past quarter.

“We’re reaching market acceptance,” Haider said. “Customers are receptive; they want to connect using modern APIs."