When BOK Financial wanted to add digital advice to its offerings, it decided it had to do more than just launch a robo adviser.

The $42 billion-asset financial services firm created an entirely new adviser unit that can provide person-to-person investment counseling to customers who start with digital advice and need extra help, said Benjamin Munos, BOK's digital product manager.

“Google and Apple have dictated the user experience,” Munos said. “Our customers are becoming more aware, and increasingly more intelligent about the experience, so knew we had to evolve our digital wealth offering.”

In a recent webinar hosted by American Banker, Munos and other guests acknowledged the crossover of fintechs and wealth management firms into banking is having an impact on lenders.

While banks are unlikely to lose all their customers to a single fintech, the number of digital-first firms adding banking products, like credit cards and cash savings accounts, has grown rapidly. In the last few months, Betterment, SoFi, Acorns and Personal Capital have all

And upstarts are eager to show off successes. The robo-advice provider Wealthfront announced it now has $20 billion in assets, nearly half of which likely has come from a cash management account that features high interest rates for checking and savings customers. It does not break down its assets gained from deposits versus investment management.

Traditional banks are bleeding roughly 4% to 6% of client assets annually to such upstarts, according to Harvest Savings & Wealth Technologies, a provider of white-label digital banking platforms.

“Banks have become paycheck hotels,” Harvest CEO Drew Sievers said during the online panel discussion.

Such momentum is pressuring banks to accelerate innovation around their wealth management offerings, Munos said, so that existing small customers do not go elsewhere for such services.

“We decided to focus on consumer banking customers who are in that $5,000 to $50,000 range, who may not be that typical wealth client, but still need to be serviced in some manner,” Munos said.

BOK, of Tulsa, Okla., last week launched InvestOn, a mobile app that pairs digital advice with real advisers and features instant account verification and integration into existing platforms.

Munos said that in the process of setting up the app and platform, his bank learned valuable lessons about offering digital advice.

One ability that digital-first customers must have, Munos said, is to painlessly sign up and get going. “It’s a nonstarter. People are going to have to be able to instantly verify their account and fund their accounts within a very reasonable amount of time.”

Another is that digital advice is not a set-it-and-forget-it offering.

“Servicing is as important as sales,” Munos said. “We really needed to rebuild our existing digital platforms to reflect the new customer, who may not interface with a rep on a daily basis.”

That is why the bank set up a dedicated unit, he added. “We really wanted to pair digital advice with an actual real-life adviser. We now have an investment center that is able to take phone calls, offer advice and really make sure digital advice is a product in the best interests of the client.”

The unit's expertise helps with meeting regulatory requirements, which have made it harder to offer retail banking and investment products.

“We knew regulation was going to be challenging, but it was three times as hard as we thought,” Munos said. “The biggest challenge we faced was how to target our consumer banking clients without breaking any regulatory rules. It can be hard to do in an often ambiguous regulatory environment.”

In the long run, full-service banks may win a majority of the market, said Simon Roy, chief executive of the digital wealth management platform Jemstep. Customers still would prefer to do all their financial transactions in one place, he said, citing industry research that found the majority would prefer an institution that offers banking, credit cards and investments in one place.

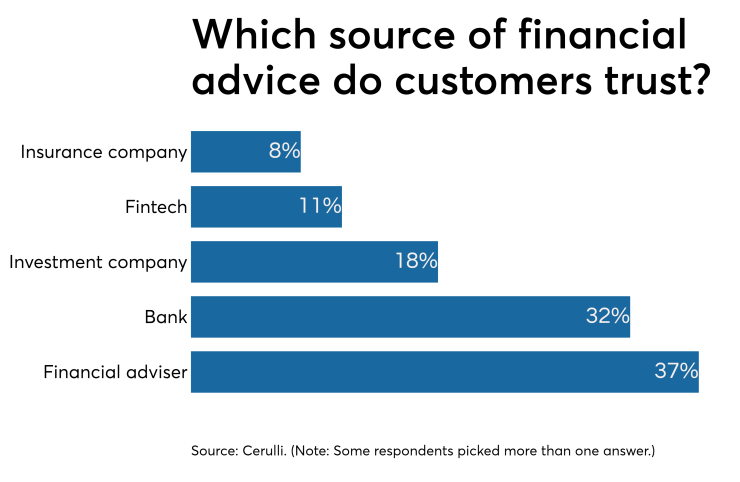

Furthermore, Roy noted a Cerulli study that found three in 10 investors would trust a bank to provide advice — on par with those customers that would trust a financial adviser (37%).

“The elephant in the room, and the real opportunity for banks, is to offer wealth to tens of thousands or more clients by opening up the tap to wealth through digital channels,” Roy said.

Sievers of Harvest agreed. “Robos don’t exist in a vacuum. Digital advice is part and parcel to the entire digital banking journey.”

BOK Financial aims to build a universal platform for all the financial products it offers, Munos said.

“Our growth, paired with an explosion of interest in digital platforms, has really made us have to rethink and build a new strategy for how do we service our customers digitally, and how do we get the most out of our user experience,” he said.