The biggest U.S. banks are throwing their considerable weight behind proposed legislation that would force shell companies to identify their owners in state government filings.

In a report issued last month, a trade group for the nation’s largest banks recommended that Congress prevent the 50 states from allowing the anonymous ownership of corporations. The report was written by The Clearing House, whose owners include JPMorgan Chase, Citigroup, Bank of America and Wells Fargo.

The recommendation was largely overlooked in coverage of a report that called for a range of steps that would make it easier and less costly for banks to comply with anti-money-laundering rules.

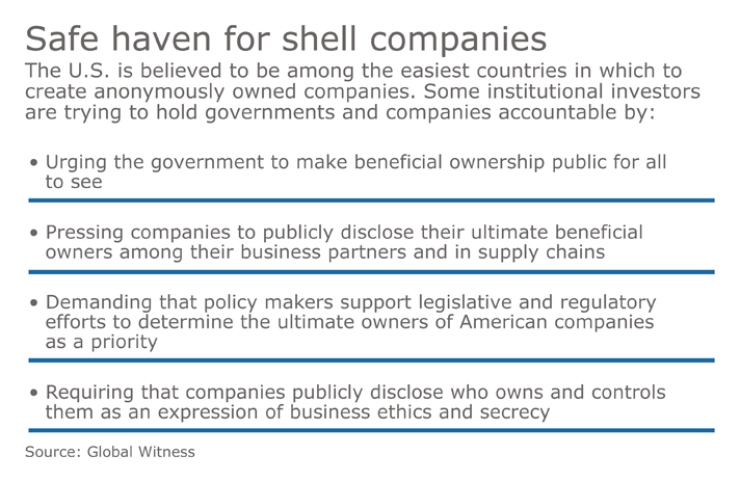

Proposals to require the disclosure of so-called beneficial ownership information have long enjoyed the support of law-enforcement officials and nonprofit organizations that advocate for a crackdown on illicit money flows. But they have drawn strong opposition from states that rely on the revenue generated from shell companies that incorporate within their borders. And so far, despite some bipartisan support, legislation has failed to gain momentum in Congress.

The big banks’ endorsement is significant because of the clout they carry on Capitol Hill. Their support was welcomed by Rep. Carolyn Maloney, D-N.Y., who has sponsored the legislation in previous congressional sessions and plans to do so again.

One academic study

“We should not be one of the easiest countries in the world for criminals and corrupt officials to set up anonymous shell companies and hide behind the walls of secrecy,” Maloney said in an email. “I’m glad that the Clearing House report shares this view.”

Maloney’s legislation could help the banking industry by easing the compliance burden. Last May, the Treasury Department’s Financial Crimes Enforcement Network

Greg Baer, president of The Clearing House, said that conducting due diligence on corporate customers can be challenging for banks when little information is available from the government.

“At a lot of banks, that’s a substantial effort. And then of course, they are always running the risk that they are missing something,” he said.

The big banks’ report states that the current federal regime makes it easier for money launderers and terrorist financiers to obscure their identities from both law enforcement agencies and financial institutions.

Supporters of the beneficial ownership legislation argue that it will help stem the flow of illicit funds.

“There’s an inherent tension between banks being told to know their customers and states allowing anonymous ownership,” said Aaron Klein, a fellow at the Brookings Institution, a nonpartisan think tank in Washington.

But any push to reduce corporate secrecy will likely draw opposition from states like Delaware, which has strict corporate secrecy rules and derives substantial revenue from incorporation fees.

In a 2012 interview, Delaware’s chief deputy secretary of state told American Banker that the responsibility for combating money laundering properly rests with banks, not state governments.

It is unclear whether beneficial ownership legislation will fare better in the current Congress than it did in previous sessions. But its supporters have been buoyed by recent signs of bipartisan cooperation on the issue.

Last month, after the House Financial Services Committee established a new subcommittee on terrorism and illicit finance, Chairman Steve Pearce, R-N.M., said that

Other banking industry groups have not gone as far as The Clearing House in support of beneficial ownership legislation.

Robert Rowe, a vice president at the American Bankers Association, said that his group would be more inclined to support the legislation if it required the federal government to collect ownership information, rather than each of the 50 states. He also said the legislation should allow banks to access the information that is gathered, rather than restricting access to law enforcement officials.

Lilly Thomas, a senior vice president at the Independent Community Bankers of America, said that her group has not taken a position on whether the states or the federal government should collect information on a company’s ownership.

But she added, “We totally support that information be collected at the government level.”