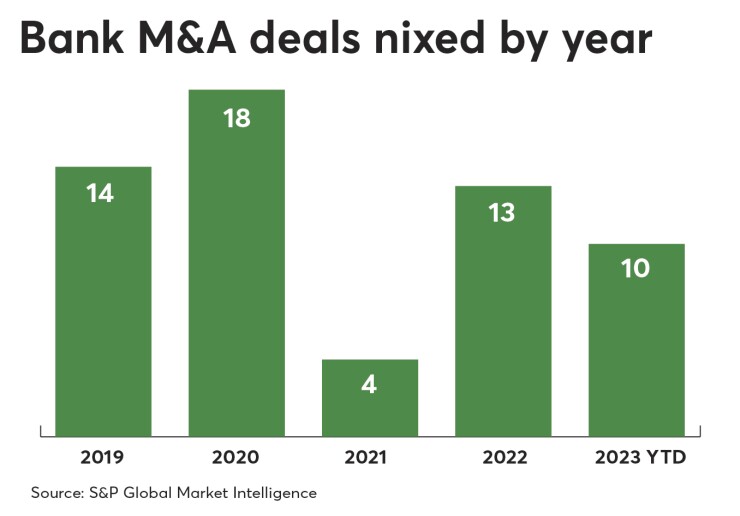

A total of 10 bank acquisitions have been nixed this year. That puts 2023 on pace to match the 13 deals called off last year. Only four deals were scuttled in 2021.

What gives?

The Biden administration in July 2021 called for

Bryan Jordan, chairman and CEO of the $82.5 billion-asset First Horizon in Memphis, Tennessee, said in an interview after the cancellation that both companies had become convinced they had no choice but to part ways.

Smaller deals succumbed to similar challenges.

"That's been the big reason cited, the high regulatory hurdles," said Mike Matousek, head trader at U.S. Global Investors.

But regulators do not own all the blame. A fragile economy also has played a role. Lofty inflation in 2022 — ignited by the pandemic and aggravated by fallout from Russia's invasion of Ukraine — galvanized Federal Reserve policymakers to ratchet up interest rates to contain soaring prices. Recession fears have lingered since then, given that escalating rates have historically stalled the U.S. economy.

High rates and economic uncertainty hurt borrowers' ability to repay loans, resulting in higher credit losses for banks. For acquisitive banks and their regulators, the specter of recession makes it difficult to gauge the health of would-be sellers' balance sheets and, as a result, some deal approval processes have dragged on much longer than first envisioned.

The latest terminated acquisition — Taichung Commercial Bancorp in Taiwan this month

Bank stocks that swooned in the aftermath of prominent

The deal, first announced in September 2022, would have given Taichung Commercial Bancorp a foothold in several U.S. markets.

A case in point: MVB Financial in Fairmont, West Virginia, and Integrated Financial Holdings (IFHI) in North Carolina called off their planned merger in May because of regulatory delays and hits to MVB's stock that dramatically altered terms of the all-stock deal.

MVB had agreed to buy IFHI in Raleigh for $98 million to

It was a "very tenuous environment," Larry Mazza, CEO of the $3.4 billion-asset MVB Financial, said in an interview after the deal was ditched. "It just came to a point where we both saw this was not the right time."

To be sure, even more deals were called off at the height of the pandemic — 18 in 2020. But that was due mostly to the sudden pause foisted upon the economy by lockdowns to contain COVID-19.

All the same headwinds also have pushed more buyers to the sidelines. Through September, there were 79 bank M&A transactions announced, down from 122 in the same period last year, according to S&P Global data.

However, there are signs of life. There were 34 deals announced in the third quarter, up notably from 20 in the first quarter and 25 in the second quarter.

More banks have figured out how to navigate the regulatory labyrinth and the economy so far has proven resilient, Matousek explained. U.S. gross domestic product grew at a 4.9% annual rate in the third quarter, a marked improvement from the 2.1% rate in the second quarter.

Matousek said these improved conditions may also reduce the likelihood of deal delays. "It's not like economic uncertainty vanished, but there seems to be less of it," he said.

Raymond James analysts said in a report this month that, according to a survey they conducted at their recent bank conference, 50% of executives were engaged in active M&A discussions, with confidence increasing alongside the desire to grow bigger and more geographically diverse to compete with the largest lenders.

"We believe the benefits of scale should become ever more apparent, leading to fairly robust consolidation over time," the Raymond James analysts said.