Consumers who use mobile banking and card apps are happy with them and even prefer them over any other channel banks offer. That’s good news for bankers.

The bad news is that the majority of consumers are not using mobile banking and there are major gaps that banks need to address if they want their customers to become comfortable using the channel.

In a study released Monday, J.D. Power asked 5,364 adults in the U.S. what they thought of the mobile offerings of the 10 largest banks and the 10 biggest credit card issuers and USAA. (The company doesn’t rank USAA because of its membership requirement, but it always scores high in its studies, so it’s included as a benchmark.)

Consumers score their bank and card apps 884 out of 1000, which is very high, according to Bob Neuhaus, financial services consultant at J.D. Power.

Banks and card issuers can’t necessarily chalk up their A-minus grade to anything they’ve done, he said.

“It’s a natural maturing of the mobile channel as it’s gotten better and consumers have gotten more savvy at using it,” Neuhaus said. “The

Neuhaus expects the scores to rise higher this year.

“Some of the regional banks didn’t implement mobile check deposit until late last year,” he noted. “As some of the providers catch up with functionality, the overall scores will go up.”

The study ranked Capital One as the top banking app in customer satisfaction.

Ron Secrist, head of online and mobile banking at Capital One, attributed the bank’s top ranking to “offering innovations that customers are looking for — not just innovation for innovation sake.”

Capital One’s app features a photo and profile of the customer, to personalize the app. “For Capital One, that’s really the goal: to have a bank fit into your life, not the other way around,” Secrist said.

The bank offers a product called Credit Wise — a free credit score along with details to help customers understand what makes up their score and ways to take action to improve it.

Secrist says banks have to seize on the chance to expand the role they play for customers in the digital world because of all the data they get.

Customers “share with us everything they buy; from the daily cup of coffee to the big screen TV to the subscription for movie streaming. We have an opportunity to make management of these transactions easier, allowing every customer to be perfectly connected to where their hard-earned money is going,” Secrist said. “We can deliver this information in real time, with the controls to take action whenever anything is not right.”

On the card side, Discover Financial Services came in first in the J.D. Power ranking of mobile app satisfaction.

Szabolcs Paldy, vice president of e-business at Discover, said the company focuses on delivering the best customer experience and providing a valuable product.

“What we try to do is make sure that as people go about their lives with the mobile app, they are serviced in a very simple, easy way as practically as possible,” he said.

Discover tries to keep its layout as simple as it can. “Customers’ expectations are shaped by the best app experiences everywhere,” Paldy said. “They’re accustomed to being able to get access to information and self-service any time they want. It shouldn’t be any different with our credit cards.”

Discover has also integrated its card app with Siri, Apple’s voice assistant. Customers can make payments, check balances or communicate with an agent through Siri.

Where the gaps are

Overall mobile adoption among Americans remains relatively low — 31% for banking and 17% for credit cards, according to J.D. Power. It’s not surprising that card apps are used less, because they’re typically limited to providing balances, payment due dates and loyalty points.

Online banking adoption, by contrast, is 80%.

“Eight out of 10 are comfortable doing their banking electronically, and mobile offers them a more convenient alternative to that, and they have the phone to do it, but they’re still not comfortable with it, particularly older customers,” Neuhaus said.

Because 80% of Americans have smartphones, “there’s a big pool of potential mobile banking users that have not gotten comfortable with it or have not seen the value yet in making that move,” Neuhaus said.

The study found significant gaps that, if filled, could bring mobile adoption and satisfaction higher.

A major barrier — and perhaps one of the easiest to address — is that many are unsure how to use mobile banking: Thirty-nine percent of users say they don’t fully understand their mobile banking and credit card apps. At least that’s down from 61% in 2012, when mobile banking was still in its early days.

“I don’t think banks as an industry are doing an effective job of educating consumers on their mobile apps, not only for new customers but throughout the life cycle,” Neuhaus said. “The impact on satisfaction is dramatic if they’re using mobile and extra dramatic if they understand it.”

Banks could provide more education and help with apps in branches, he said.

For instance, Bank of America

“The way you do it is going to vary based on the type of customer, the age of the customer, do they want to do basic simple things or a more complete banking relationship,” Neuhaus said.

Gamification might help some. “If you were to help consumers track their progress making use of mobile banking, you’d create a sense of accomplishment with them,” Neuhaus said.

Customers also have trust issues with mobile.

Only 32% of consumers trust mobile banking, the study found. This means that users of mobile banking trust it, and nonusers have concerns about it, Neuhaus said.

“As banks try to drive adoption and evolve this, they have to effectively deal with this trust gap,” Neuhaus said. “It isn’t purely education and functionality, it’s getting people comfortable.”

Letting customers decide how often they’ll be contacted about what can help further trust among users. “You might want a monthly reminder about your overall financial position or suggestions for investments, and you have control over that,” Neuhaus said. “That need for control also applies to how your personal data is used. I might want a bank to mine my credit card data to understand that I go to Home Depot and spend a lot of money the first week of April every year, and I would be interested in special offers from my bank.”

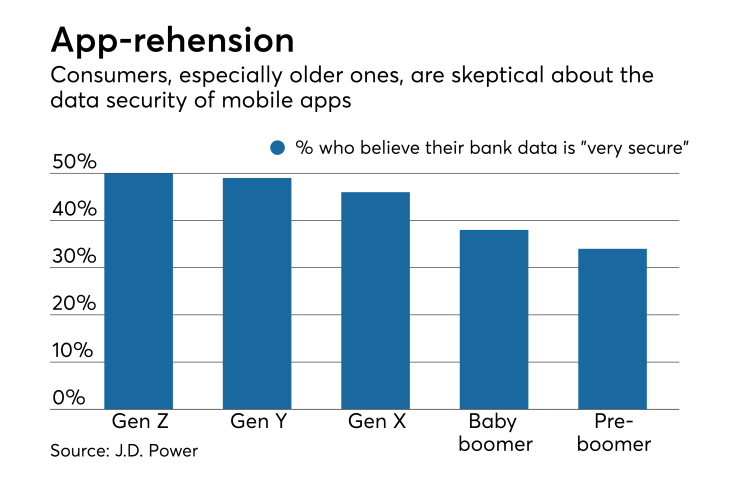

Along that same vein, only 42% of consumers feel their personal data is adequately protected by their bank when they use mobile apps.

“I think people read stories about hacking and it makes them nervous,” Neuhaus said. “You might see a retailer’s been hacked and that might impact how you feel about electronic banking and your willingness to trust it.”

Mobile deposit usage is at a surprisingly low 17%. Neuhaus suspects banks are not marketing mobile deposit effectively to their customers.

All the work to improve the mobile channel could bring a strong revenue stream, the study suggested. Among consumers who score their mobile app highly, 46% say they “strongly agree” the app makes them more likely to sign up for additional products.

Editor at Large Penny Crosman welcomes feedback at