For de novo banks, 2024 got off to a propitious start.

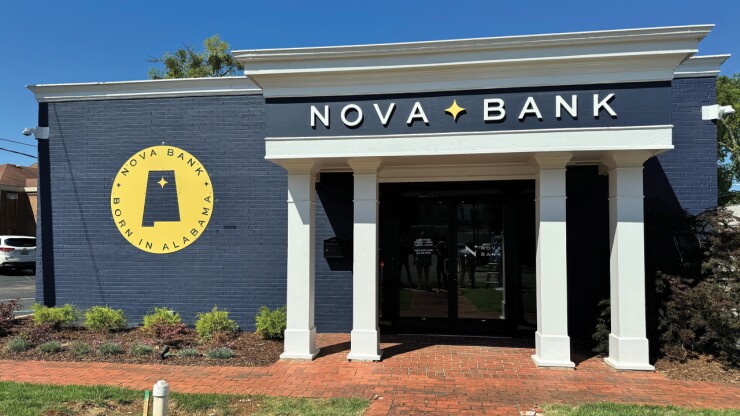

Nova Bank in Huntsville, Alabama, opened in January, accepting its first deposit on Jan. 26, according to Chief Credit Officer Marc Minish.

It wasn't clear at the time, but Nova proved to be something of a high note. More than six months later, Nova is one of two de novo banks to begin operations this year. The Carthage, Missouri-based Four States Bank opened earlier this month. Another group,

By most accounts, 2024 has been a slow year for de novo formation. It comes on the heels of another slow year in 2023, when five banks opened. The diminished rate of de novo formation, not surprisingly, has taken a toll on the overall number of banks. The institution count dropped from 4,706 at the end of 2022 to 4,546 as of Sept. 13, according to the FDIC.

"We really do need more banks," said Chris Cole, senior regulatory counsel at the Independent Community Bankers of America. The decline is creating what Cole termed "banking deserts, areas that desperately need more banking services."

"We're getting to the point where there are lots and lots of areas with only one bank," he said.

While Huntsville, Alabama's largest city, can't be considered a banking desert, it's proved a receptive market for a new, locally headquartered community bank, Nova's Minish said.

"We're not hurting for quality loan demand at all," Minish said. "There are so many business owners just starving for somebody that's willing to listen to them. They want access to their decision maker. They want some flexibility. … To tell you the truth, there's room for five more de novos in Huntsville. We wouldn't even be stepping on each other's toes."

Nova has been less fortunate on the deposit side.

"We're still trying to get our deposit operation sorted out. Even seven months in, we've still got some work to do there," Minish said. "We've got to get our deposit pipeline rolling to be able to utilize all the advantages and successes coming our way as far as loans are concerned."

Some of Nova's difficulties stem directly from its de novo status.

"What we learned the hard way is that there are so few de novos out there that all the financial software vendors and a lot of the other banks, they don't update their software for new routing numbers," Minish said.

One prominent bill-pay vendor was a case in point.

"People that wanted to bank with us, customers of ours were going in and trying to load their Nova account. Well, it didn't recognize us as a legitimate bank," Minish said. "It took us weeks to straighten things out. … Challenges like that have [forced] us to kind of slow-walk our full opening."

Putting a finger on the problem

Experts agree on the existence of a new-bank drought, although they differ on the reasons behind it.

For the ICBA's Cole, the issues are primarily policy-related. In particular, Cole pointed to the amount of capital regulators require de novo bank groups to raise, levels that are significantly higher now than they were just a few years ago.

"It's the single biggest impediment to de novo bank formation," Cole said. "There's no question about it. I've talked to a number of applicants and potential applicants. Capital is the biggest issue."

The FDIC required Nova to raise $21.7 million as a condition of opening. Four States Bank in Carthage, Missouri, was required to raise $23.5 million. De novo groups in larger markets have been given even higher initial-capital targets. Integrity Bank, which is seeking to open in Houston, was required to raise $37 million, and Greater Gotham, $50 million.

By contrast, when the $744 million-asset Maywood, New Jersey-based Freedom Bank opened in April 2008, its initial-capital requirement was $12 million. Three months earlier, in February 2008, Monument Bank in Doylestown, Pennsylvania, opened after raising $8 million. Monument sold itself to the $2.6 billion-asset Citizens & Northern Corp. for $43 million in 2019.

The 2008 financial crisis and the resulting wave of more than 400 bank failures, many involving relatively young institutions, affected the way regulators treat de novo banks, Cole said. "That experience really made a strong impression," he said. "That's why they turned up the requirements and said, 'We're going to want a lot more capital now.'"

The approach has paid dividends in some respects. Just 22 banks have failed since 2017. But the number of new charters has dropped precipitously, too, with 66 institutions opening in the same eight-year period. Prior to the financial crisis, new charters were an almost daily occurrence. In 2007, 181 banks were chartered, according to the FDIC. In 2006, the new bank count was 191.

"I think they've dialed it up too much," Cole said of de novo capital requirements. "If they want new banks, they have to dial it back."

At least one high-profile regulator, Federal Reserve Gov. Michelle Bowman, has identified the declining number of banks as a cause for concern.

"In my view, the absence of de novo bank formation over the long run will create a void in the banking system, a void that could contribute to a decline in the availability of reliable and fairly priced credit, the absence of financial services in underserved markets, and the continued shift of banking activities outside the banking system," she said.

While Bowman did not point to a specific policy or strategy the way Cole did, neither did she exempt regulators from blame. Indeed, the chartering process "can be a significant obstacle to de novo bank formation," she said.

"It often takes well in excess of a year to receive all of the required regulatory approvals to open for business," Bowman said. "These delays present unique challenges for de novo founders, including incurrence of more start-up expenses, difficulty recruiting and retaining qualified management … and challenges in raising additional start-up capital investment."

Regulators often are wary of de novo applications, fearing the repercussions that might accompany a misstep, according to Steve Scurlock, retired director of government relations at the Independent Bankers Association of Texas. "It's hard for a government employee to make a decision because they might be wrong," Scurlock said. "I think some of the elected officials love to pull these people up in a committee hearing and show them how smart they are, how [regulators] were asleep at the switch and all the rest."

The upshot, Scurlock said, is a frustrating, lengthy process for de novo applicants. "It's hard to find someone who's going to take the responsibility to say, 'Yeah, let's give these people a chance,'" Scurlock said. "They have covered it up with paperwork. … It's gotten so ridiculously hard to get anything done."

A business problem

James Stevens, co-leader of the financial services industry group at law firm Troutman Pepper in Atlanta, is far from convinced that regulatory action or inaction lie at the heart of the de novo drought. "The regulators I deal with are open for business," Stevens said. "They encourage new bank formation."

Regulators, Stevens said, calculate a de novo group's capital requirement with a key principle in mind: an institution's need to maintain about an 8% leverage ratio after three years of operations. That means that in addition to that core capital requirement, a de novo must raise enough cash to pay the regulatory and other costs during the startup phase, acquire a building and technology, pay staff and have enough money to weather a year and a half or two years of initial losses.

It all adds up.

"I think the challenge for new bank formation is in the ability of these groups to find people that are willing to invest," Stevens, who has helped launch five de novo banks since 2018, said. "It's hard to produce a compelling investment case when somebody can go into the stock market and mabe make more money in the same period of time."

Stevens doesn't deny compliance costs have increased for de novos, but they are up across the board, he said. Regulators "are certainly regulating tougher and stronger as a general matter, and that costs more to comply with," Stevens said. Ultimately, however, the de novo problem boils down to a business case, Stevens argued.

"I don't believe the regulators are working against or opposed to new bank formation. I think it is the people that are forming those banks and their ability to produce an attractive transaction."

There are some reasons for hope. New bank groups that are "true community banks, typically in a smaller town, where you can circle it and say this is the bank for this town," typically see good success raising capital, as do groups that intend to focus on a specific demographic community, such as Asian-Americans, Stevens said.

That appears to have been the case for Nova, which raised its capital from more than 500 investors, most of them from Huntsville. "We went into this thinking we might have 200 to 300 shareholders," Minish said. "We ended up having 538, so way more than we thought, and 86% [invested] $100,000 or less. … It gives us a whole lot of cheerleaders in the community."

"That's a good number," Stevens said of the Nova investor base. "It's the kind of capital raise that we need to see if we're going to get new bank formation."

A number of recently chartered banks have also gotten off to promising starts. The $230 million-asset Craft Bank in Atlanta opened in October 2020 and broke even before the end of its second year. The $280 million-asset RockPointBank in Chattanooga, Tennessee, which opened in March 2021, and the $100 million-asset Moultrie Bank & Trust in Moultrie, Georgia, which opened May 2022, have also reached break-even.

Their successes demonstrate the community bank de novo "is alive and well," said Leo Mallamaci, director of sales at Jack Henry & Associates. "They're built from the ground up, looking for local investors and trying to create something special for their local communities."

Stricter regulatory scrutiny and higher capital requirements present hurdles for de novo bank groups, "but it makes for a much stronger bank when it opens up," Mallamaci said.

"The bankers that are doing it now are really skilled," Mallamaci said. "They're well-known in their communities and their industry. People will take a chance on making the investments in them."