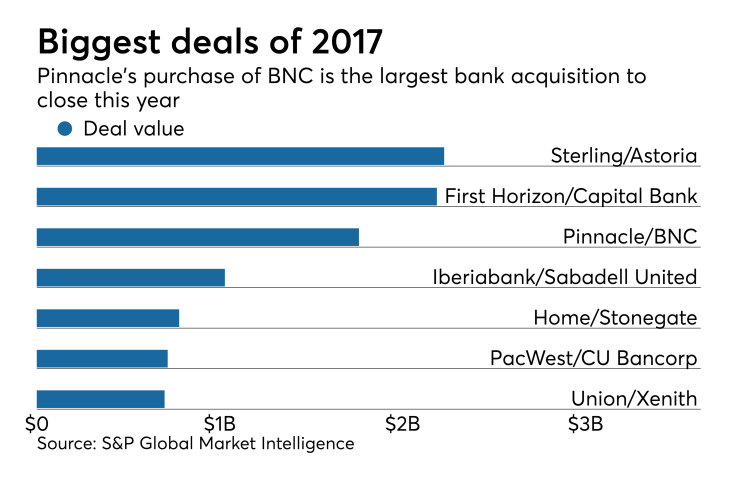

Terry Turner still has a long to-do list despite closing the biggest acquisition of his career.

For one, Turner, the president and CEO of Pinnacle Financial Partners in Nashville, Tenn., must focus on successfully integrating BNC Bancorp in High Point, N.C. — another serial acquirer — without scaring off customers possibly wary of another transition.

Turner and his team also need to step up efforts to build upon a commercial lending platform in the Carolinas that BNC had been working on before its sale.

Finally, the roughly $20 billion-asset company has to adjust to life as a midsize bank with more regulatory demands.

“Scale has become more important than ever,” Turner said when asked about crossing over $10 billion in assets. “Golly, Pete, if you have the opportunity [to cross the threshold] why not go after it?”

Turner started this year with a list of nine Southeastern markets he wanted to enter as part of a plan to expand beyond Tennessee. Pinnacle's

Timing is critical when it comes to acquisitions, and Pinnacle has entered North Carolina during a period of rapid change in the state. Yadkin Financial was

North Carolina “will be an interesting state to watch, not so much because of M&A, but for market-share movement,” said Catherine Mealor, an analyst at Keefe, Bruyette & Woods. “With so many out-of-market banks, it will be very competitive and interesting to see how … growth happens for those banks.”

Turner, however, doesn't consider the other new entrants to be his primary competition. Rather, he is gunning for bigger institutions in a state that has heavy hitters such as BB&T, SunTrust and PNC Financial.

“We draw the line of scrimmage at regional banks,” Turner said, refraining from identifying specific institutions. “Why compete with them? Because that’s where you find the clients and the vulnerability.”

Turner said he believes certain decisions will give his company a leg up. For starters, Pinnacle will convert its systems to BNC’s platform. That move will save customers at BNC, which had bought 13 banks since April 2010, from going through yet another conversion, he said. Pinnacle will put its name on BNC’s branches in September; the banks’ systems are set to merge in February.

Pinnacle also agreed to retain Rick Callicutt, BNC’s president and CEO, allowing him to oversee operations in the Carolinas and Virginia. Callicutt, who has hired six commercial lenders since the deal was announced in January, is still looking to poach talent from other banks. Pinnacle also plans to cut just a quarter of BNC’s annual expenses, leaving much of the bank intact.

“That will be an incremental positive,” Turner said of hiring good lenders. “It allows you to grow rapidly and you tend to have better asset quality.”

Pinnacle closed the deal quicker than expected, which should help as it looks to integrate BNC, cut costs and increase revenue.

The company, which largely focuses on urban markets, should be well equipped to compete against bigger institutions, said Lee Burrows, the CEO of Banks Street Partners, an Atlanta investment bank.

“It comes down to the talent and the capital base,” said Burrows, whose firm advised BNC as part of the sale to Pinnacle. “I think they compete very effectively in the middle market. They have the product offerings. As far as bread-and-butter banking, Pinnacle has proved itself to be a real force.”

While North Carolina hasn’t always been very welcoming to new banks, Tony Plath, a finance professor at the University of North Carolina at Charlotte, said that is changing because of to a rapid decline in the number of institutions based in the state.

“You’ll see out-of-state banks gain traction,” Plath said. “Out-of-state banks had trouble because … so many banks here were locally owned. It was tough to compete, but that’s not true anymore. I think it will become easier for out-of-state banks to gain share because North Carolina has largely become a banking colony.”

While Pinnacle didn’t factor revenue growth into its financial projections, Turner said it is a key reason for doing deals. Opportunities in the Carolinas include increased lending in areas such as health care and trucking.

As for added regulation, Turner said his team is prepared for mandatory stress testing and caps on interchange fees, since Pinnacle had crossed the $10 billion asset threshold shortly before agreeing to buy BNC.

Turner has also been monitoring talks in Washington about regulatory reform. While hopeful, he isn’t changing his strategy based on optimism. “We aren’t running our company any differently,” he said.

Pinnacle is still keeping an eye on the three markets — Richmond, Va., Virginia Beach and Atlanta — that weren’t addressed by buying BNC. It is possible Pinnacle could enter any of those cities this year by hiring a team and opening an office. (Roughly 60% of the company’s assets are still in Tennessee.)

Turner, however, said most of his focus over the next six months will be on BNC. He also noted that it costs about $2 million to enter a market and up to 18 months to turn a profit. Pinnacle also prefers to get to at least $2 billion in assets in a given market to make the effort worthwhile.

To that end, Turner said Pinnacle could return to bank acquisitions as early as next year to enter markets of fill in gaps in the Carolinas.

“There are a good number of opportunities for acquisitions,” he said.

Pinnacle has the ability to make a big splash with another acquisition, industry experts said. It has a strong currency and is viewed as a seller-friendly acquirer given its track record or retaining executives at the banks it buys.

“When you’re a bank as large as Pinnacle, you have the size and scale” to do a meaningful deal, KBW's Mealor said.

“They’d be a preferred acquirer in the Richmond and Atlanta markets," Mealor added. "If Pinnacle comes knocking on your door, you want to entertain that conversation. Pinnacle will be able to, within some limitations, choose its path. That's a great place to be in. But first they want to get the Carolinas right."