BMO Financial Group's strategy of leaning more heavily on its U.S. operations has started to pay off.

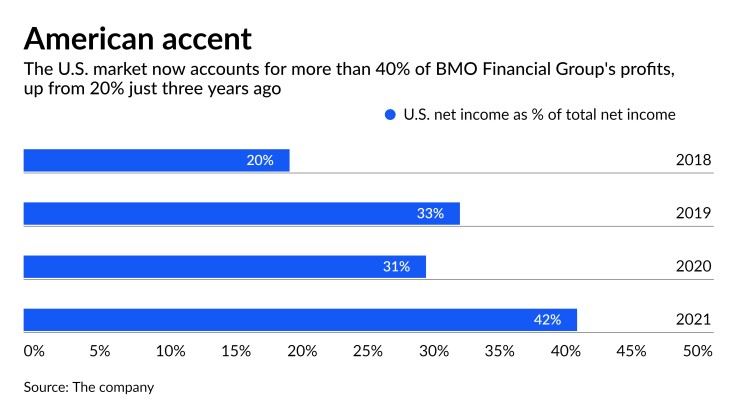

The Canadian company’s U.S. businesses, which include a diversified, far-flung commercial bank, contributed 34% of its total revenue and 42% of its net income during the 12 months that ended in October. The latter figure was up from around a quarter of total profits three years earlier, when CEO Darryl White

Company executives and outside analysts said that the $780-billion asset parent company of Bank of Montreal still has room to grow in the U.S., particularly in wealth management.

“In the U.S. we have a very strong opportunity to continue to grow in wealth and a very strong opportunity to cross-sell to our existing clients,” David Casper, the company’s U.S. CEO, said in an interview.

Bank of Montreal bought Chicago-based Harris Bank in the 1980s before

While the Marshall & Ilsley deal doubled BMO’s U.S. presence, the company subsequently

“Their U.S. franchise has really held up quite well throughout the pandemic. They’re proving out the strength of their operation there,” said Lemar Persaud, an analyst with Cormark Securities in Toronto.

BMO, which reports its financial results on a calendar that ends on Oct. 31, reported its fourth-quarter results last week. The parent company posted net income of $2.2 billion, up 36% from the fourth quarter of 2020.

Full-year revenue from BMO’s U.S. operations totaled $7.3 billion, up 14% from $6.4 billion in 2020 and up 28% from $5.7 billion in 2018.

More than half of the company’s U.S. revenue in 2021 came from states outside of BMO Harris Bank’s Midwestern footprint, which Casper attributed largely to various investments in the commercial bank. For example, BMO has opened commercial loan offices over the years in markets such as San Francisco, Denver and Atlanta. It’s also grown business in commercial banking specialties like asset-based lending and food and beverage banking.

Earlier this year, BMO sold its asset management business for Europe, the Middle East and Africa in order to focus on building its wealth management unit in North America.

In a recent conference call to discuss the company’s earnings, White said that BMO’s first priority for excess capital would be to invest for organic growth. Next, the Canadian bank would prioritize returning capital to its shareholders, he said.

A whole bank acquisition is likely off the table, but Persaud said he could see the company using its excess capital to make a nonbank acquisition that would “move the needle” in the U.S., perhaps in wealth management.

Wealth management is BMO’s smallest U.S. business and therefore the segment that has the most room for growth, Casper said. The company hopes to build that business by cross-selling wealth management services to existing clients in its commercial banking and capital markets businesses, he added.

BMO has improved the return on equity in its U.S. business, which was 14.8% in the fourth quarter of 2021, up from 7.8% in the same quarter of 2020. As the company has made investments, the U.S. business has become more productive and better able to generate returns, Casper said.

“We can grow, and we can grow fast through many channels, but we’re not sacrificing anything from a shareholder perspective,” he said.