Banks that lend to farmers appear to be emerging from the recession relatively unscathed, with the latest federal data showing that agriculture lending continued to outperform most other segments of the banking industry in the third quarter.

Profits were up while chargeoffs were flat for so-called agriculture banks, a classification regulators give to lenders with at least 25% of their loan books tied farm loans. Farm loan volumes rose slightly while most other lending categories fell, including commercial and credit card loans, according to the Federal Deposit Insurance Corp.

Agriculture lenders for the most part have stayed strong through the downturn, and industry experts say things are looking good for them as the year winds down. Corn and soybean producers are on track to deliver some of their largest harvests ever thanks to a delayed frost and an unusually rainy growing season. That means most crop growers should be able to pay back their operating loans. Farm real estate prices have also held firm, even as other types of commercial properties, such as offices and retail strips, remain stressed.

"Agriculture, in general, compared with the rest of the economy, is probably a bright spot," said Dallas Kime, regional credit and agriculture lending manager for TierOne Corp. of Lincoln, Neb. "We have seen very little delinquencies in our agriculture portfolio."

He said farm lending in general has been up for a few reasons. Farm operating loans — the annual credit lines farmers receive to buy seed and fertilizer — have also swelled in recent years as a result of rising up-front costs, he said. More farmers have also been taking advantage of favorable interest rates to refinance their real estate loans.

"It's been a fairly active real estate market," he said. "We just haven't seen the decrease in real estate values that some have anticipated."

Ross Waldrop, a senior banking analyst with the FDIC, said agriculture lending isn't a sexy business, but it's steady. For instance, agriculture banks have had a higher return on assets than banks classified by the FDIC as a credit card, commercial, mortgage, or consumer lender, or international lender. ROA is a ratio that indicates how efficiently a bank uses assets to generate profits.

The 1,578 agriculture banks tracked by the FDIC also had a lower level of net chargeoffs as a percentage of total loans and leases than all those other lending groups.

"Most of these other groups have all risen and fallen with the credit cycle — the one exception has been ag banks," Waldrop said. "In the boom times, they are probably a little on the lower end of the performance spectrum. But that is still kind of the performance we're seeing now, which looks really good. It's kind of a tortoise-and-hare comparison, if you suppose."

Agriculture lenders have outperformed their peers. Only three such banks have failed this year, according to the FDIC. In contrast, 83 commercial lenders have failed.

Agriculture banks posted third-quarter net income of $419 million, up 25% from the prior quarter and down 1.2% from a year earlier, according to the FDIC's quarterly banking profile report, released last week. Industrywide, farm loans were $60 billion as of Sept. 30, up 2.9% from the prior quarter and 0.7% from a year earlier.

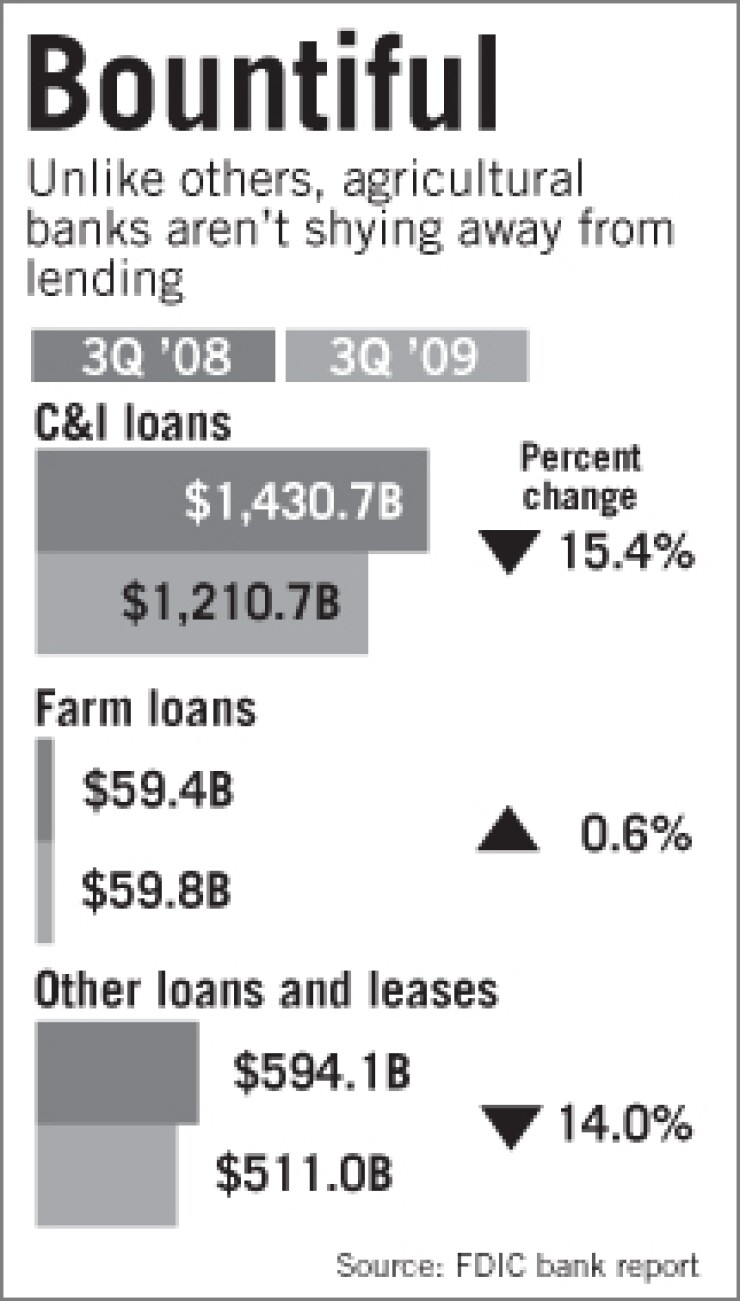

While that loan growth appears modest, it is substantial compared with falling volumes in other lending segments, such as commercial and industrial (down 15% year over year) and construction and development, down nearly 20%.

"Farmers are making money this year in spite of what you might read in the paper," said Keith Carlson, president of the TierOne subsidiary United Farm and Ranch Management, which manages more than 400 farms in Nebraska. "It rained all summer, so they are producing phenomenally. So the lenders are — they're very eager to get a good loan out on the books with their company. There is an ability to repay the loans."

That is not to say the farm industry is without its problems, including soft livestock prices as a result of low demand. A slow economic recovery could still hurt the agriculture sector.

Still, David Christensen, a banking consultant in Grand Island, Neb., said this recession has been relatively pain-free for farm lenders. He said most farmers and their banks learned their lesson during the great agriculture bust of the 1980s, which resembled the recent housing crisis in that farmers took out real estate loans they could not service because they believed prices would keep rising. Agriculture lenders stayed conservative during the credit boom earlier this decade, he said.

"Banks are doing a better job underwriting — they know where the risks are at," Christensen said. "It's a healthier marketplace than maybe it has ever been. I don't see any aggressive lending out there."