This fall, a Massachusetts lender closed on a fully paperless mortgage. The work that led to this rare achievement captures the difficulties originators still face in digitizing the loan process.

Radius Financial Group in Norwell electronically closed six loans beginning in October. The process was created in partnership with the tech vendor DocMagic, the MERS loan registry, Fannie Mae and Santander Bank.

Electronic closings and e-notes have been kicking around for a long time. Fannie Mae and Freddie Mac have purchased e-mortgages since the early 2000s. But they remain rare, partly because there are few warehouse lenders that can handle these transactions. Rarer still are completely paperless loan processes that combine an electronic closing with an electronically signed promissory note and deed of trust.

Lately, however, momentum has been building to accelerate the move toward paper-free mortgages. A report last year from the Consumer Financial Protection Bureau found that transactions were faster and borrowers walked away feeling better when a loan was closed using digital means rather than paper.

While the choice to push for a digital mortgage process was largely a matter of improving the customer experience, it also has bottom-line benefits for the company as well, Radius co-founder and chief operating officer Keith Polaski said.

"The first thing for us was the consumer experience, but without a doubt there are tremendous derivative economic gains and efficiencies," Polaski said. "At the end of the day, decisions are made on surrounding economics. If I can save myself 200 bucks a loan, we should be looking at that."

The first loan done through the completely paperless process was closed on a Friday morning at the closing attorney's office "with cups of coffee and chocolate chip cookies," Polaski said. Radius had its technical staff on-site for the first two e-closings to ensure the process went smoothly.

The documents were signed using a tablet. (Notarized documents were also signed with ink for recording purposes because Massachusetts does not yet allow registries to accept electronically notarized documents, though the note and all other documents were electronic.)

That same day, Fannie Mae purchased the loan from Santander, the transaction's warehouse lender.

"For every [paper] transaction, there's five FedExes for that note—those go away," Polaski said. "How fast things turn around will save money."

More than 3,000 miles away, in Torrance, Calif., DocMagic followed the closing as it happened.

"What was interesting about the transaction was our ability to monitor its progress in real-time," DocMagic CEO and President Dominic Iannitti said. "Because we were controlling all of the different web service calls that collectively made up that entire process, we were able to monitor it from our offices and watch it transpire without actually being there."

These half-dozen loans were the culmination of a journey that took more than two years. It began when Radius was approached by an aggregator—Polaski declined to identify the company by name—about working together on an e-note pilot program, having heard of Radius' interest in this area. After a promising start, this project ultimately fell through.

"All of a sudden everyone was moving in the right direction and then it stopped," Polaski said.

Still the experience positioned Radius well to keep trudging along. In August 2015, Radius received seller-servicer approval from Fannie Mae, a process that Polaski said took roughly four months. Then, the company lined up its e-note approval from Fannie, which Polaski said took only 45 days thanks to the work already completed in the e-note pilot program.

"We were lucky because we had done a lot of the MERS and e-vault work ahead of time," he noted.

Radius and DocMagic were not the only parties to the closing that had to get the proper technology in place. Massachusetts is an attorney-closing state; Radius' closing agent had to get approved as an electronic notary from World Wide Notary, a vendor. This required him to obtain an electronic signature pad and install and learn software.

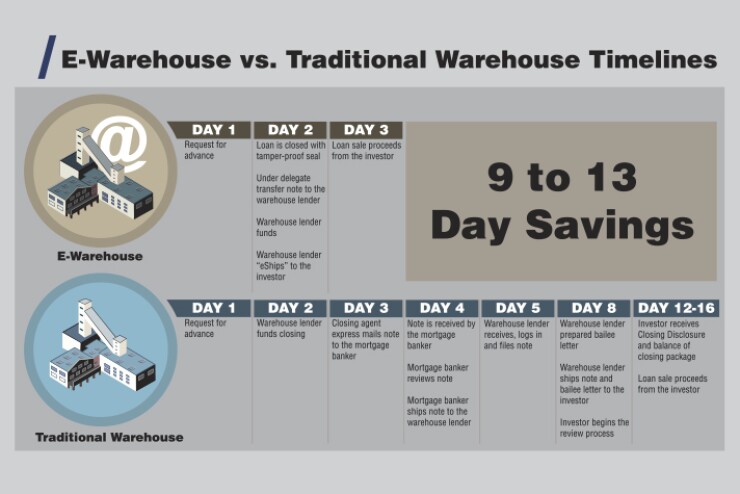

Perhaps the biggest challenge throughout the entire process though was securing a warehouse lender that was equipped to do electronic closings; there are only a handful of such providers.

"There are only a few e-warehouse lenders and that is definitely a factor," Iannitti said. "If you don't have a company that's ready to purchase that e-note then you haven't really accomplished anything at all."

Santander did not make executives available for interviews. According to Polaski, the bank had been pursuing the e-warehouse business for more than two years, and company executives even had to travel to the bank's parent company in Spain to receive the OK.

"The stars were aligned and we finally had everybody aboard," Polaski said.

The next step was identifying the borrowers from the large pool of customers who already had a digital relationship with Radius from the application stage and could act as guinea pigs for the new closing process. That included making sure they were "friendly," Polaski said, "because if stuff went sideways we wanted to be able to put a paper note in front of them and have them understand they were part of a pilot."

With a handful of loans closed, Polaski said, Santander is now reviewing the experience before it moves forward with further e-warehouse lines. He expects that his company will move "robustly" into the e-closing space next year.

Radius is close to receiving Freddie Mac seller-servicer approval. Currently, the company hopes to sell roughly 20% of its originations to the agencies annually; the company is aiming for $1 billion in originations total next year. Selling to Fannie and Freddie is one piece of its e-close strategy. One remaining obstacle Polaski sees on the horizon is the lack of aggregators willing to purchase these loans.

"If the only place to sell these loans is Fannie, I just don't have the execution there," Polaski said. "If I had a handful of aggregators step in, I think we would move the entire book of business to e-note if the consumer has e-consented."

DocMagic, meanwhile, came out of the transactions with no items left on its to-do list. And while the move toward greater adoption of e-closings has been a slow one, Iannitti said he is happy with where things are.

"We're very pleased with the rate of adoption and rate of interest that we're seeing right now," Iannitti said. "It definitely took longer than we thought, but now we're seeing the momentum and feel that everything is moving in the right direction."