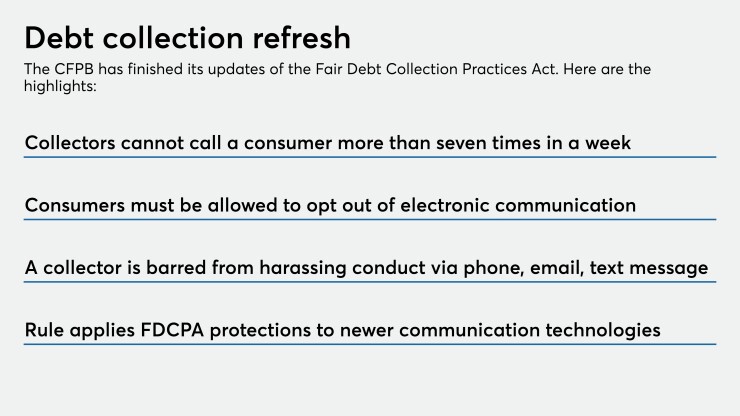

The Consumer Financial Protection Bureau released a final debt collection rule on Friday that restricts how often collectors can call borrowers to seven calls per week but for the first time allows communications by voice mail, email and text messages.

The CFPB established rules to allow the use of technologies developed after the Fair Debt Collection Practices Act passed in 1977. Consumers can opt out of such modern communications.

“With the vast changes in communications since the FDCPA was passed more than four decades ago, it is important to provide clear rules of the road,” CFPB Director Kathy Kraninger said in a press release. “Our debt collection rulemaking provides limits on debt collectors and provides clear rights for consumers. With this modernized debt collection rule, consumers will have greater control when communicating with debt collectors.”

Debt collectors are required to offer consumers “a reasonable and simple method” to opt out of communications sent to a specific email address or phone number, the CFPB said. If a debt collector uses electronic communications to reach a consumer, the consumer can use the same technology to submit a "cease communication" request or notify the debt collector that they refuse to pay the debt, the CFPB said.

Consumer advocates have criticized the rule for opening the floodgates for collectors to bombard consumers with texts and emails.

The

The rule provides a safe harbor to debt collectors that call consumers seven times a week or less by phone. But violating that limit may not automatically result in a penalty. The CFPB said other factors must be considered when a debt collector exceeds the seven-call cap, such as whether the calls “had the intent to annoy, abuse, or harass the person at the called number.” Still, when a collector exceeds the seven-call cap, it is grounds for a consumer to sue.

Also notable is that the CFPB did not provide clarity to the industry about validation notices, which debt collectors are required to send to consumers notifying them of an outstanding debt. The notices are a critical piece of the debt collection process that can have an impact on a consumer's right to dispute the debt. The bureau said it is still doing qualitative testing on validation notices.

“Much of the litigation in debt collection revolves around validation notices so for industry that is a big punt because it harms all stakeholders,” said Joann Needleman, an attorney at the law firm Clark Hill.

In another win for collectors, the bureau dropped its so-called "meaningful involvement" requirement, under which an attorney who sends a letter using letterhead must actually be involved in the collection process.

The National Creditors Bar Association thanked the CFPB in a statement for its "careful attention to our members' concerns on regulating attorney conduct and the importance of the independence of the practice of law."

The rule clarifies that the FDCPA’s general prohibition on harassing, oppressive, or abusive conduct applies to email and text messages, not just phone calls. The final rule restates the FDCPA’s prohibitions on false, deceptive, unfair and misleading practices.

The rule created a new term — limited-content message — to describe a voice-mail message left for a consumer that does not contain information subject to FDCPA's restrictions on communication.

“This definition permits a debt collector to leave a voicemail message for a consumer that is not a communication under the FDCPA or the final rule and therefore is not subject to certain requirements or restrictions,” the rule states.

The rule also clarifies debt collectors’ obligation to retain records showing compliance or noncompliance with the FDCPA and Regulation F, and prohibits the sale or transfer of certain debts.

It also clarifies debt collectors’ obligations when responding to duplicative disputes. The rule also generally allows collectors to discuss a debt with a personal representative of a deceased consumer’s estate.

The CFPB said it intends to publish a second rulemaking in December focused on the disclosures of time-barred debt that essentially would prohibit collectors from suing or threatening to sue on debts they know or should know have exceeded the statute of limitations.