Recruiting

The legal and ethical obligation to disclose sponsorships needs to be balanced against giving internet personalities the freedom to

Assessing return on investment can also be tricky: how do views, likes, comments and shares translate to greater engagement with the brand itself and sincere interest in its mission?

The

It is the trade association's self-described "tentative foray" into social media influencing and rare outreach directly to young adult consumers. The association, in its words, wants to clear up misconceptions about credit cards and produce "best in class" consumer education.

"If you want to reach younger generations, social media is the spot to do it," said Meghan Phillips, managing director of brand relationship design in the U.S. for R/GA, a brand design agency.

Banks such as FNBO and Ally Financial have taken to the social media channel to appeal to younger customers.

There are takeaways for banks and other financial brands considering this method, especially in the credit card space.

Credit card education "is one of the most appropriate spaces [financial companies] can play…where the risks are universal and the benefits are clearly mapped," as opposed to giving advice on specific products such as stocks, said Phillips.

One lesson is to take a calculated risk with the choice of influencers.

"The people they chose are fantastic," said Josh Mabus, president of banking marketing firm Mabus Agency. "They are people I see in the sphere and seem to be trusted."

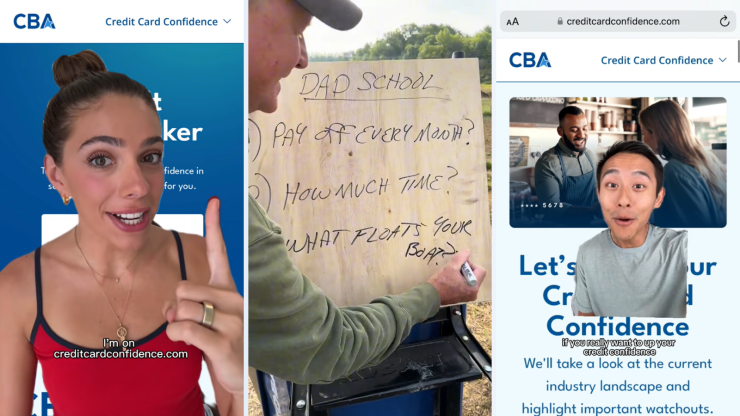

The CBA homed in on a mix that it hopes will appeal to different audiences. One named John Liang already has a brand centered on personal finance. Another influencer named Taylor Price has less than half of John's following but Kelvin Chen, head of policy at the CBA, was drawn to the multimodal ways she connected with her followers. In one "Get Ready With Me" styled TikTok clip, she applied makeup while talking about credit cards.

"I sat down with my 13-year-old daughter and her friend, and this was the video they responded to the most because they found it relatable," said Chen. "It was a real learning moment for me."

A creator dubbed DadAdvicefromBo appealed because of his folksy charm and plain-spokenness. In one video, he discusses balance transfers while demoing his bacon recipe.

"He is not trying to chase trends," said Chen.

@dadadvicefrombo #Ad Balance transfers are a common credit card 'trick' and actually pretty simple to understand. Let's make Dad bacon together while I explain the dos and don't of balance transfers Dad style bacon: Thick cut bacon (always) Cook low and slow Add rib rub as the secret ingredient Take it off 1 min before it looks done (the sugar in the rib rub will burn it faster than you'd like) Love, Dad #PaidForByConsumerBankersAssociation ♬ original sound - DadAdviceFromBo

Some choices are more counterintuitive. A creator called "Your DC Bestie," who releases videos weekly about events in Washington, DC, was someone CBA employees followed personally. Her niche gives the CBA a chance to see if its message resonates with a different audience.

This kind of experimentation is important, said Brian Reilly, vice president of digital marketing at marketing firm BankBound. Reaching the right audiences takes trial and error.

However, the campaign could finesse its scripting and framing, according to some.

"The sponsorship disclaimer was heavy handed," said Mabus after watching some of the TikTok videos, noting that he finds this is common with newcomers to influencer campaigns. "It did not feel natural in [the influencers'] regular flow of content."

Companies, and the influencers they hire, need to communicate when any endorsements in a video clip or static post are part of a relationship with a brand, according to Federal Trade Commission disclosure rules. But Mabus says there are ways to weave the disclosures more elegantly.

"It felt like CBA wanted to be mentioned, like hey, people don't know about us," he said. "It kills suspension of disbelief."

For him, a good place to start would be encouraging the hired influencers to "lean into" the truth of why the influencer was willing to take the call from the CBA. In his experience, many influencers are selective about who they partner with.

On its part, the CBA said it wanted to "over-index" on the compliance and accuracy aspect.

The website may look simple, "but everything is pressure tested," said Chen. It reviewed the content with its lawyers and cited data from the Consumer Financial Protection Bureau. The CBA is also not collecting data from consumers, requiring any kind of registration, or naming specific credit cards.

"Most card education sources involve some form of lead generation or compensation for the specific products offered," said Chen. "We made it a point to have a platform that would offer what we thought was best in class information but didn't drive people to one particular brand or another."

To some observers, that erases a lot of utility, especially as there are many other resources online that dispense credit card advice with specific recommendations — albeit ones that typically generate

Reilly understands the reluctance to promote a particular brand, but the website "left me wanting more in terms of tactical best practices or next steps," he said.

Another puzzle is how to measure an influencer campaign's resonance with people and subsequently, the return on investment. The CBA declined to comment on the cost of the campaign.

The CBA points to one video that received a million views across Instagram and TikTok, which could be up to a million people who had not heard of the CBA before.

But this metric has a caveat.

"On a platform like TikTok especially, the views of content are easy to come by," said Reilly. "People are scrolling continuously."

For Reilly, a better indicator of engagement is the number of users sharing or commenting on posts or videos — especially thoughtful comments or questions, as opposed to bot-produced spam.

For Mabus, there is the micro approach and the macro approach to determining success of a campaign.

Micro is topline: views, likes, comments. Macro means measuring bottom-line results such as accounts opened and new deposits over a quarter or six-month period from working with influencers while adjusting for economic and other factors.

"The bottom line is, did we perform better than we would have without this influencer?" said Mabus.

Some banks observe measurable impact. FNBO in Omaha, Nebraska, frequently uses influencers. For example, it recruits

Some of the resonance will lie in the hands, and charisma, of the chosen influencers.

"I'm extremely skeptical of advertisements because I've worked in advertising for a long time," said Reilly, "but I will stop and listen to sponsored content if it's entertaining."