-

A sharper-than-expected decline in third-quarter mortgage revenues at Wells Fargo could spell bad news for other home lenders. The bank eked out another record profit by releasing loan-loss reserves.

October 11 -

Commercial lending perked up after the government shutdown ended, though bankers are still having to cut deals on pricing to land business. Consumer lending continued to decelerate.

December 30

As earnings season kicks off, banks are facing the same question they've been struggling with since the start of the recession: when will loan growth gain steam?

Some tentative but hopeful signals emerged Tuesday when industry giant Wells Fargo (WFC) reported a 1.7% increase in loans outstanding during the final three months of last year.

That's the second consecutive quarter of solid loan growth at Wells Fargo, and it reflects improvements across a diverse range of products including business loans, foreign loans and auto loans.

Scott Siefers, an analyst at Sandler O'Neill & Partners, called the fourth-quarter loan growth a favorable surprise. "Average loans grew at a 5.9% annual rate," Siefers wrote in a research note, "which was about twice the rate we had expected."

In a follow-up interview, Siefers cautioned that most banks have yet to report their fourth-quarter results. But he sees Wells Fargo's loan growth as a positive indicator.

"We're dealing with so many fits and starts in this recovery that I view it as a good sign," he said. "At least as early indicators go, it's a step in the right direction."

During a conference call with analysts, Wells Fargo Chief Executive Officer John Stumpf struck a similar tone of cautious optimism for 2014. Over the last two years, bank loans outstanding have grown at just over 1% annually, according to Federal Reserve data.

"I think there will be some loan growth at the industry level," Stumpf said.

"I'm hearing more when I talk with customers about their interest in building something, adding something, investing in something," he continued. "So there is more activity going on. I wouldn't say it's going to be a watershed moment, but yeah, I'm optimistic about the economy."

As for Wells Fargo specifically, the company expects its loans to grow at a faster rate in 2014 than they did last year, Chief Financial Officer Timothy Sloan told analysts.

Sloan argued that the firm's fourth-quarter loan growth was particularly noteworthy because it did not stem from any acquisitions. "This was all organic," he said.

Overall, Wells reported fourth-quarter net income of $5.6 billion which was 10% higher than a year earlier or $1 per share. The company beat the consensus estimate of 98 cents from analysts surveyed by Bloomberg.

But Wells' share price was flat in afternoon trading on Tuesday, as analysts found a few negative signs in the firm's earnings report.

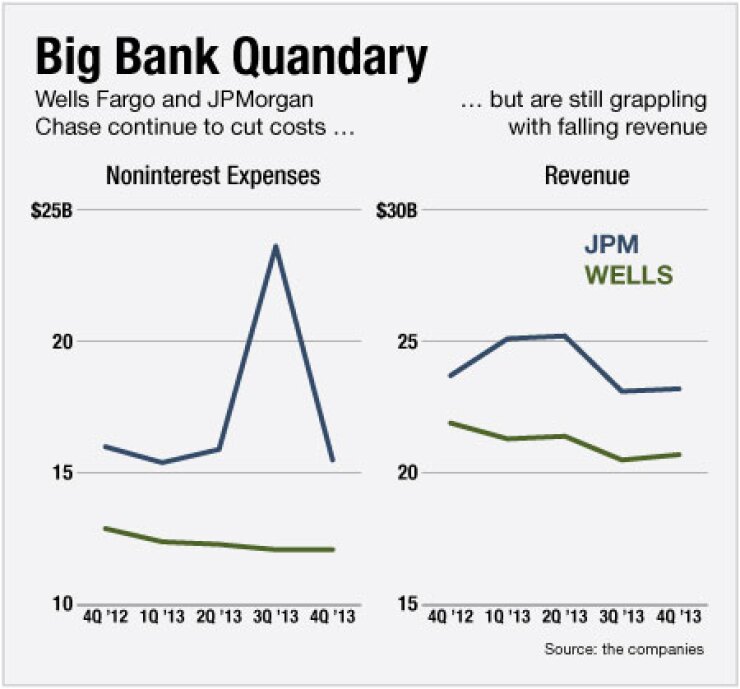

First, even though Wells Fargo announced more than 6,000 job cuts in the second half of last year, largely in an effort to downsize its mortgage operations, the company's expenses were still higher than some analysts anticipated.

Second, revenue in the fourth quarter was down 6% from a year earlier, largely due to a steep decline in mortgage revenue during the second half of 2013.

And third, the firm's net interest margin continued to decline; at the end of the fourth quarter it stood at 3.26%, down from 3.56% a year earlier. The bank attributed the decrease to growth in its deposit base, as well as to a series of steps it took to improve its liquidity in the fourth quarter.

Following the earnings report, Eric Oja, an analyst at S&P Capital IQ, downgraded his rating of Wells Fargo's stock from "buy" to "hold." Shares of the company rose by more than 30% in 2013.

Oja said in an interview that he expects Wells Fargo's net interest margins to remain below those of their peers in 2014. "As it is right now, they've got an awful lot of deposits out there," he said.

Wells Fargo is the nation's largest mortgage originator, and it's also one of the first banks to report its earnings each quarter, so its reports have come to be seen as an early signal about the strength of the mortgage market.

On Tuesday, Wells reported that its mortgage origination volume fell by 38% between the third quarter of last year and the fourth quarter, as the pool of mortgages available for refinancing continued to shrink. The company's mortgage application volume was also down by 25%.

JPMorgan Chase (JPM) reported similarly sized declines, and analysts at Compass Point LLC said that the big banks' losses could end up benefiting other mortgage originators. "These declines could open the door for many of the smaller originators to continue taking share," Compass Point analysts wrote in a research note.

Analysts were not uniformly negative Tuesday about Wells Fargo's mortgage results. They were particularly heartened that despite the continued fall in originations, the company's gain-on-sale margins were up by 25% from the third quarter.