One of the largest U.S. banks is beta-testing a new tool that gives online customers insight into their financial picture, and predicts how it will look 30 days down the road.

The service, called Cash Flow Monitor, is designed to show customers outlooks of their balances for up to 30 days in an effort to help them better plan for upcoming expenses like rent payments or large purchases. "The objective is to help customers be in control of their near-term finances," Billy Robins, vice president, personal financial management, product management, tells BTN. "We are trying to convey a good estimate to the customer."

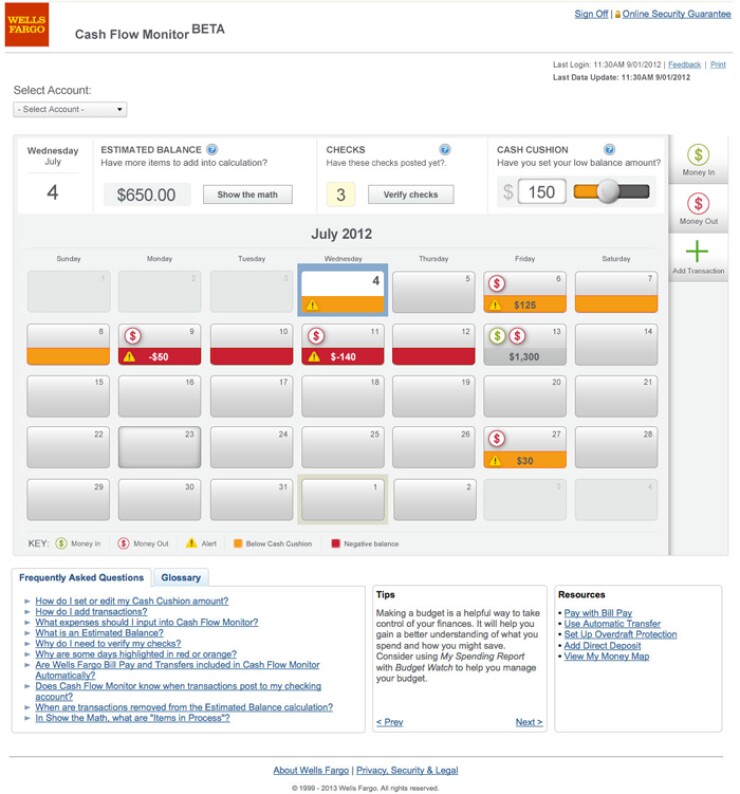

To that end, the bank pulls in available customer data, like scheduled bill payments and direct deposits, which a consumer confirms, to opted-in testers of Cash Flow Monitor. The tool allows customers to view their financial outlooks in calendar formats that highlight potential low-balance days. For a more accurate model, the customer would need to manually cough up data points that the bank wouldn't be privy to, such as any checks written that have yet to be cashed.

"The forecast is only as good as the data as the customer puts into the app," Robins says. "It is team effort between the customer and Wells Fargo.

"We are trying to make sure our customers are financially successful, which includes paying bills on time."

The forecast tool fits within other existing Wells Fargo services, like account alerts, he says. Customers can opt-in to test out the cash-flow estimate feature in

The latest effort by Wells points to an evolving trend of financial services players providing consumers with more meaningful transaction insights.

Vendors and startups have been designing software that includes forward-looking personal finance tools for many months. Banno and Strands are among the personal finance management companies that offer customers financial information and estimates before they conduct a transaction. Consumer-facing software from startup Simple and

The lexicon varies by player and includes: Safe to Spend, Ask the Fortune Teller, Help Me Decide, and What If. In providing cash flow forecasts to retail customers, such companies are taking a cue from technology available on the commercial side, says David Albertazzi, senior analyst at Aite Group. "It's widely used in business applications,"Albertazzi says. "It's more advice and guidance, which has been missing so far [for retail customers]. …I think it's great."

One challenge that lies ahead for Wells Fargo's Cash Flow Monitor is the bank needs to market the tool clearly so that people understand the outlooks are estimates, rather than certainties. This requires a strong

Cash Flow Monitor does not provide certainty in what customer funds will be available, but rather provides a forecast that's based on the information entered by the customer." In other words, Robins says the bank wouldn't want a customer to think he was financially okay and then get dinged with an overdraft fee for a check he previously wrote to a friend who forgot to cash the funds.

Robins views the tool as valuable to most of the bank's customers.

"The majority of Americans are living paycheck to paycheck at least a few months every year," Robins says. "A Wells Fargo customer who accurately enters their income and expenses into Cash Flow monitor will find a sophisticated tool at their disposal for free."

Recent