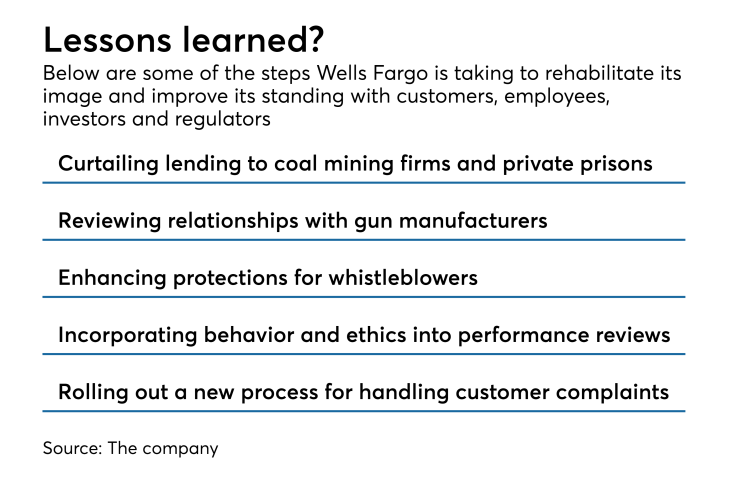

Wells Fargo pledged Wednesday to take new steps to protect whistleblowing employees from retaliation — and to improve its responses to customers who lodge complaints — amid ongoing criticism over a raft of scandals.

The $1.9 trillion-asset bank also vowed to subject corporate customers in certain controversial industries to detailed assessments related to environmental and social risks. Those companies include gun manufacturers, payday lenders and coal mining firms.

The reforms were included in

The document’s release comes as Wells faces renewed congressional scrutiny in the wake of an election that gave Democrats control of the House of Representatives. House Financial Services Chair Maxine Waters, D-Calif., is vowing to provide tougher oversight of the bank, which she has argued should be broken up.

“This report represents an important milestone in our work to rebuild trust with our stakeholders and our commitment to build a better company,” Wells Fargo CEO Tim Sloan said in a press release. “While we have more to do, we are making progress in our work to build the most customer-focused, efficient and innovative Wells Fargo ever.”

Since the biggest of the scandals — employees opening millions accounts without customers’ consent to meet sales targets — came to light in 2016, Wells Fargo’s management has faced criticism for its handling of complaints by employees who witnessed misconduct by their colleagues. Some former employees alleged that they faced retaliation after contacting the firm’s ethics hotline.

Wells Fargo said Wednesday that it has implemented a variety of changes to the 15-year-old ethics line process. Those measures include the creation of a process for third-party legal review of certain retaliation claims, the formation of a team to focus on issues raised through the ethics line, and new efforts to facilitate the consistent handling of allegations across the company.

But the bank’s report did not assuage some vocal critics of Wells Fargo’s management team.

“Wells Fargo still has a long way to go to rebuild trust with its employees, many of whom have no confidence that anything has changed,” Nick Weiner, organizing coordinator with the union-backed Committee for Better Banks, said in a press release.

Some parts of the report read like a response to critics who argue that Wells Fargo is too big to manage.

For example, Wells said that it is developing a new process for handling customer complaints in an effort to improve consistency in how such grievances are handled across different business lines. Under the new system, which the company expects to start rolling out in the fourth quarter of 2019, senior executives will have access to a monthly dashboard on customer complaints that includes summary data and commentary on trends.

Wells also used the report to respond to environmental and social activists who want the bank to cut ties with various corporate customers. The bank stated that it is no longer increasing its credit exposure to coal mining companies. The company is no longer actively marketing to private prison companies, and its credit exposure to those firms has declined significantly, according to the report.

Wells Fargo also said that its wholesale banking unit will subject certain controversial industries to an environmental and social risk management process. Such companies include oil and gas operators, coal and metal mining firms, gun manufacturers, private prison firms and consumer finance companies such as payday lenders.

After the risk assessments, higher-risk transactions may be put on a corporate watch list or escalated to senior management at Wells for a determination.

Amid criticism for its willingness to do business with gun manufacturers, Wells Fargo has argued that the regulation of firearms is the responsibility of government, not the financial sector. Wells

“I don’t know if banks or credit card companies or any other financial institution should be the arbiter of what an American can buy,”

Wells agreed to conduct the business standards review in response to a shareholder proposal by certain religiously affiliated shareholders. Those investors were concerned about the cultural and ethical root causes of the bank’s various scandals.

“This report has tremendous possibilities because it is a public acknowledgement by a major U.S. bank of its abuses of customers, team members and investors,” Sister Nora Nash of the Sisters of St. Francis of Philadelphia said in a press release Wednesday.

“I see the nearly two-year engagement to produce this report as a much-needed period of reckoning and introspection in order for Wells Fargo to emerge from its crisis with some moral and ethical clarity.”

Nash spearheaded the shareholder proposal that led to Wednesday’s report and also served on a stakeholder group that was convened by Wells to provide outside perspectives.

She said that if the document is going to represent more than an aspiration, the bank needs to take additional steps such as retraining employees and implementing accountability measures that track performance and are made available to the public.