The initial meeting de novo organizers have with regulators is similar to a job interview — so a good first impression is imperative.

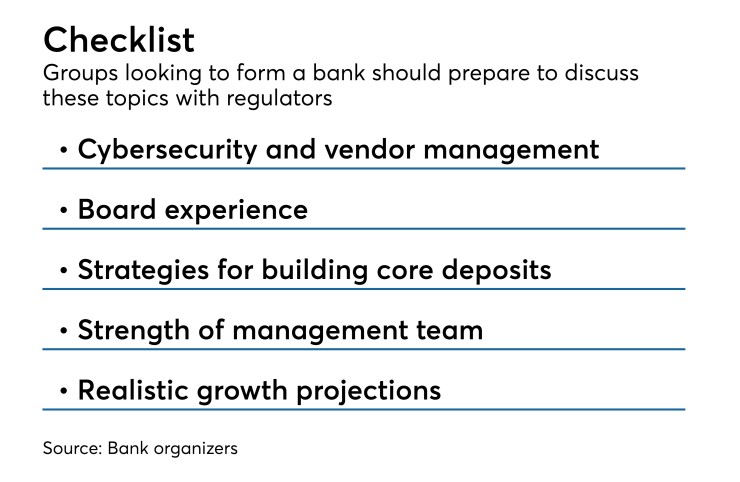

Subsequent conversations with regulators involve detailed questions about a group's application, according to organizers going through the approval process. Frequently covered topics include board and management composition, a business plan's viability, methods for bringing in core deposits, cybersecurity and vendor management.

Regulators appear largely receptive to proposed business plans. In some cases, examiners' questions have led to improvements.

For instance, the group behind the proposed Spirit Community Bank in Statesville, N.C., was told that the geographic area it used for Community Reinvestment Act compliance was too large.

“We are working on cleaning that up,” said William Long, who is leading that group’s effort. Regulators “have been really helpful in pointing out some of those things.”

Michael Stevens, a senior executive vice president at the Conference of State Bank Supervisors, summed up the areas of high importance into three categories: Money, management and market.

"You really need a good, solid team from top to bottom," Stevens said.

The Office of the Comptroller of the Currency is encouraged to see more interest in de novo activity, spokesman Bryan Hubbard said. He declined to discuss specific areas of interest for the agency.

The Federal Reserve did not respond to a request for comment. A spokesman with the Federal Deposit Insurance Corp., referencing its

Following a lengthy hiatus, the current class of organizers is eager to show regulators how their plans differ from the young banks that failed during the financial crisis.

Some de novo groups grew faster than expected in the mid-2000s, stoking fears among regulators that organizers were understating their growth, industry observers said.

“I think it’s very helpful to read the history behind the de novos and what happened in the last recession and how they would position themselves to avoid what happened,” said David Baris, a lawyer at Buckley Sandler who has worked with 30 de novo banks in his career. “Regulators don’t want to have an unsuccessful bank that they’ve chartered.”

It is important to walk into the meeting with a robust understanding of the application, business plan and potential questions regulators could ask, Baris added.

A detailed and thorough application is critical, said Shaun Dalton, a consultant at Community Capital Advisors. While de novo banks once got away with having a few holes in their applications, Dalton said that is no longer the case.

Bank examiners “want to see a complete application on day one,” Dalton said. “That goes for the business plan as well.”

Once approved, organizing teams need to follow their business plans closely, said Gary Young, founder and chairman of Young & Associates. Any anticipated change must be approved by regulators, increasing the importance of putting together an initial plan that accurately reflects the local market and demographics.

“To be honest, if regulators approach things in that way, we will have a much sounder group of community banks in this round of de novo activity,” Young said.

A solid understanding of an organizing bank’s management team and board is also important. In particular, regulators are looking for directors with previous bank experience, said Mary Collum, president of Vantage Strategic Consulting.

“They're looking to see senior-level individuals who know how to work with regulators and talk the talk, if you will,” Collum said.

Stevens said de novo organizers need to do their homework on who they are working with from the beginning. Regulators will know if an organizer has any criminal background or financial problems in the past. It's best to know early if someone is not fit to serve the bank.

"When your bank is up and running, it’s about knowing your customer," Stevens said. "It’s about knowing your investor when you're going through" the application process.

Vendor management and cybersecurity are also emphasized by regulators, said Randy Helton, adviser to American Bank & Trust in Monroe, N.C. Helton added that cybersecurity was not nearly as much of a concern when he helped start American Community Bancshares 20 years ago.

Matthew Pollock, proposed president and CEO of Watermark Bank in Oklahoma City, which applied with the FDIC

“I couldn’t say enough good things about our process,” Pollock said. “It has gone pretty efficiently. We've gotten a sense" that regulators "are trying to accommodate and help us.”