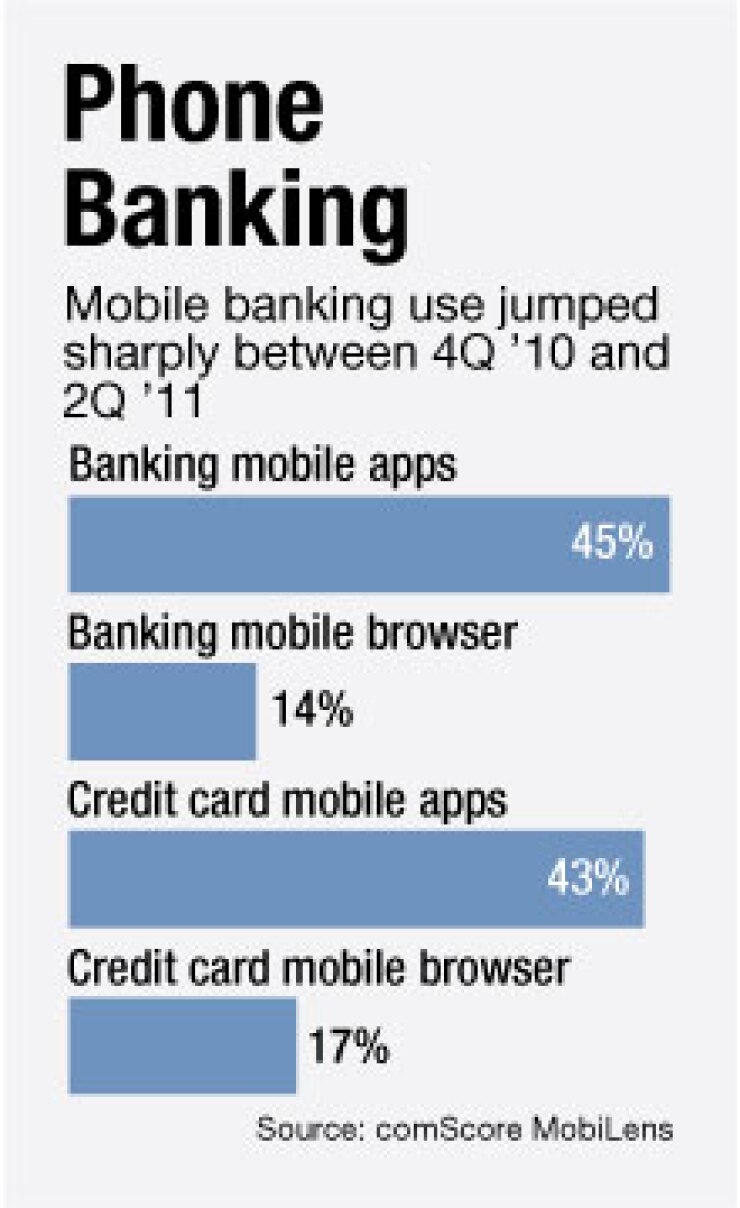

Mobile financial services usage rose sharply during the second quarter of 2011 compared to the last quarter of 2010, according to

The use of mobile devices to access credit card information also grew at an extremely high rate, by 43% for mobile apps and 17% by mobile browser.

Much of this phenomenal growth can be attributed to the popularity of smart phones themselves. “All ships rise when the tide comes in,” notes Marc DeCastro, research director - consumer banking and community banking at IDC. “We’ve been predicting that smart phone growth in 2012 would exceed the feature phone. There’s been steady period-over-period growth in mobile banking.” In addition to more people having smart phones, banks’ awareness campaigns have also helped drive mobile banking adoption, DeCastro says.

He cautions, however, that overall mobile banking adoption numbers are still low. “It’s easy to show growth in high percentages when there are still low numbers of people using the channel,” he says. “Mobile is still the channel of last resort,” versus branches, ATMs and online banking. Over the past three months, IDC estimates that most banks have had a 10-15% mobile banking penetration rate. This is strong, considering that it took online banking 10 years to get to the 50-60% adoption ranges.

The comScore study found that credit cardholders used mobile devices to access banking services more frequently than fixed-line computers in the second quarter of 2011. Sixty-two percent of credit card customers reported using a mobile app to visit a bank’s web site at least once a week, and 52 percent reported checking in with the same frequency via a mobile browser. In comparison, only 34 percent of users were found to be checking into their accounts with the same frequency from a fixed-line computer.