U.S. Bancorp may soon jump back into the business of offering small-dollar loans to cash-strapped customers.

During a conference call Wednesday morning, CEO Andy Cecere said that the company is considering “a number” of different options for offering so-called deposit advances now that the Office of the Comptroller of the Currency

“We’re looking at a number of different products in that category, and that may be something we pursue over the next few quarters or the next year,” Cecere said, when asked about the OCC’s revised stance.

The comments offer the first sign that big banks are hungry to get back into short-term, small-dollar lending, a business they largely abandoned several years ago under pressure from federal regulators and consumer advocates.

U.S. Bancorp

The guidance was viewed as a

Two weeks ago, however,

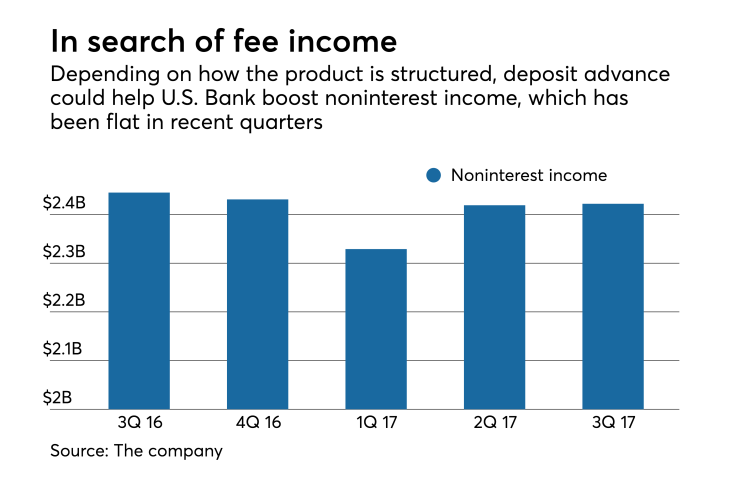

Still, it’s too early to say how a potential offering would be structured – or what kind of benefit, if any, it could provide to the U.S. Bancorp’s bottom line. While deposit advances were once a solid source of noninterest revenue for the Minneapolis company, any move to get back into the business would likely be done on a much smaller scale this time around, executives said.

In an interview Wednesday, Chief Financial Officer Terry Dolan emphasized that the company is in the “early stages” of exploring its options. In the past, deposit advances were only offered to existing customers with direct deposit, but future iterations of the product could be geared to unbanked or underbanked consumers, he said.

“As a company, if you’re going to be a good citizen in the community, you need to think about how you’re going to serve unbanked and underbanked citizens,” he said.

During the call, Betsy Graseck, an analyst with Morgan Stanley, asked if any move back into deposit advance could once again generate 2% of total fees, as it did before the $459 billion-asset U.S. Bancorp got out of the market three years ago.

“Likely not,” Cecere said. “If it comes back, it would probably be at a different fee level and probably not the same size as what you saw historically.”

Fees at U.S. Bancorp have recently been flat. During the third quarter, noninterest revenue dipped slightly from a year earlier, falling by about 1%, to $2.4 billion.

A number of factors contributed to the decline, including an industry-wide drop in mortgage banking revenue, as higher mortgage rates lead to fewer refinancings.

Lower merchant payment revenue was also factor, falling 1.7%, to $405 million. Over the summer U.

U.S. Bancorp, in particular, processes payments for a “fairly significant amount of merchants” in Puerto Rico. Nearly a month after the island

“We have a nice business in Puerto Rico,” Dolan said, acknowledging the destruction experienced by merchants the island. “It’s probably going to be several quarters before they start to come back.”

During the fourth quarter, fee income in general, and merchant processing revenue in particular, are expected to be flat, the company said during the conference call.