As the nation's Hispanic population continues to swell, more community banks are hiring bilingual employees and offering services such as online and telephone banking in English and Spanish.

But are they offering the right products?

Nearly half of the 340 banks the Independent Community Bankers of America surveyed recently are making concerted efforts to market to "recent immigrants, ethnic communities and other groups who might be outside of the financial mainstream," the survey report said.

Of those doing this marketing, however, less than half offer some type of lead-in product — such as remittances, noncustomer check cashing, or prepaid phone cards — that could help move largely unbanked or underbanked consumers into banking relationships, the report concluded.

Bankers appear to be skittish about offering such products because they are unlikely to generate enough volume to turn a profit.

But Luz Urrutia, president of El Banco de Nuestra Comunidad, a unit of the $480 million-asset Peoples Banktrust Inc. in Buford, Ga., said those are the products that will get unbanked and underbanked consumers — many of whom are Hispanics — in their doors.

"Banks are missing a huge opportunity by not offering the nonbanking ancillary services that this consumer needs," said Ms. Urrutia, who has been developing banking and financial services for the Hispanic market since 2002. "The only way to develop a profitable relationship is start a relationship at the customer's level of sophistication."

It was the first such survey by the ICBA, which released its report last week. It developed the survey to get a better understanding of the community banking industry's relationship with emerging markets — loosely translated as the underbanked.

"Part of why we did this survey was to get a baseline and see what they are doing," said Karen Tyson, a senior vice president and director of communication with the trade group. "Are they doing anything different, or are they just opening their doors to customers?"

Forty-seven percent of the respondents, polled in February and March, said they serve emerging markets. Of those, more than half offer services in other languages — mostly Spanish, though some banks also have services in Hmong, Japanese, Korean, German, Urdu, Arabic, Polish, and Hindi, among others.

Sixty-four percent of the outreach banks are also offering financial literacy programs, often in partnership with schools or community groups.

Still, when asked what they needed to be more successful with this audience, two-thirds of respondents cited "a better understanding of the financial needs of underserved consumers."

And though 77% of those doing outreach report some success, lack of understanding could be why only 20% said their outreach efforts were "profitable" or "very profitable," while 39% said they were "somewhat profitable." Ten percent said their efforts to attract unbanked consumers are not yet making money and 31% said it was too soon to tell.

Ms. Tyson said one reason for low profits is many have just started "dipping their toes into the market. … And one would think that as they start reaching into those markets they would start creating new products for them."

Fifty-three percent of banks that said they do not aim services at emerging markets and the most common reason for not doing so was "local demographics." The second-most cited reason: "profit and risk concerns."

Among the survey's other findings:

- Forty-seven percent of bankers said that serving the unbanked is important or very important to their future business.

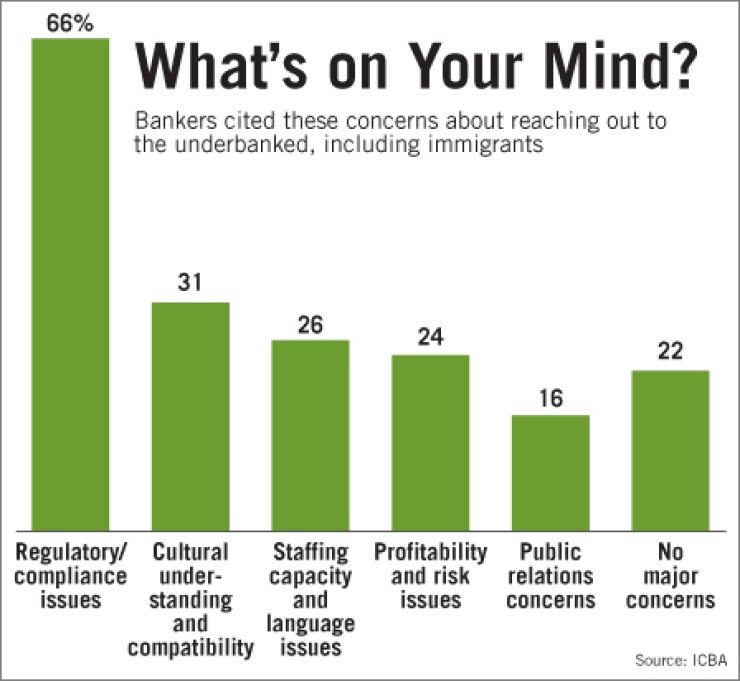

- Banks already pursuing this market are most concerned about the regulatory issues it could entail.

- About one-third of those that do not target emerging markets said they could begin doing so over the next two years.

One bank considering adding Hispanics to its target market of small businesses is the $135 million-asset Allegiance Bank Texas in Houston.Its branches are in Harris County, which has the second-highest population of Hispanics by county in the country, according to the Census Bureau.

Allegiance opened for business in late 2007, and while it is still adding typical community banking products, it is also thinking about focusing on the large Hispanic market in its area some time next year, said Daryl Bohls, the bank's president.

"We are talking about the fastest-growing population in Texas," he said. "You better start targeting it, because it is getting bigger."