Still on the fence about EMV? High uptake from an early adopter, the United Nations Federal Credit Union, is allowing it to expand the card's availability, and provides evidence U.S. cardholders really like to use chip and PIN cards when traveling overseas.

And if that's not enough, Friday's news of a new international payment card crime wave that took advantage of the U.S. payment industry's intransigence on EMV compliance confirms the argument that the U.S.'s addiction to magnetic stripe cards is low hanging fruit for fraudsters.

First, the positive news. The United Nations Federal Credit Union says that since it first made Gemalto-produced chip and PIN cards available, there's been substantial increase in demand among the user base for the cards. The credit union found that between October 2010 and February 2011, there was a 153 percent increase in card applications, 382 percent spike in credit lines booked, 20 percent growth in revolving branches, and 15 percent jump in overall purchases.

As a result, the credit union is scheduled to expand its EMV card issuance by early 2012, broadening the income range of cardholders eligible for the product and offering a new EMV debit card to all checking account holders.

Before the card was available, "we were missing our top-of-wallet status because the card was missing the chip particular for use outside of the United States," says Merrill Halpern, assistant vice president of card services for the United Nations Federal Credit Union. "It was a frustration. If people can't use the cards in venues in which the card must work, it will hold up a line."

Gemalto provides most of the technology and processing for the EMV cards for UNFCU, with are processed by First Data. Halpern says the credit union configured the cards to include daily and transaction limits in dollar amounts for both security and personal financial purposes, because the transactions are being approved under local standards and jurisdiction. First Data handles the processing in separate tracks, but Halpern says there's no discernable difference for UNFCU in terms of speed or accuracy. Halpern also says the credit union's members have not reported any glitches or denials of service for the new cards.

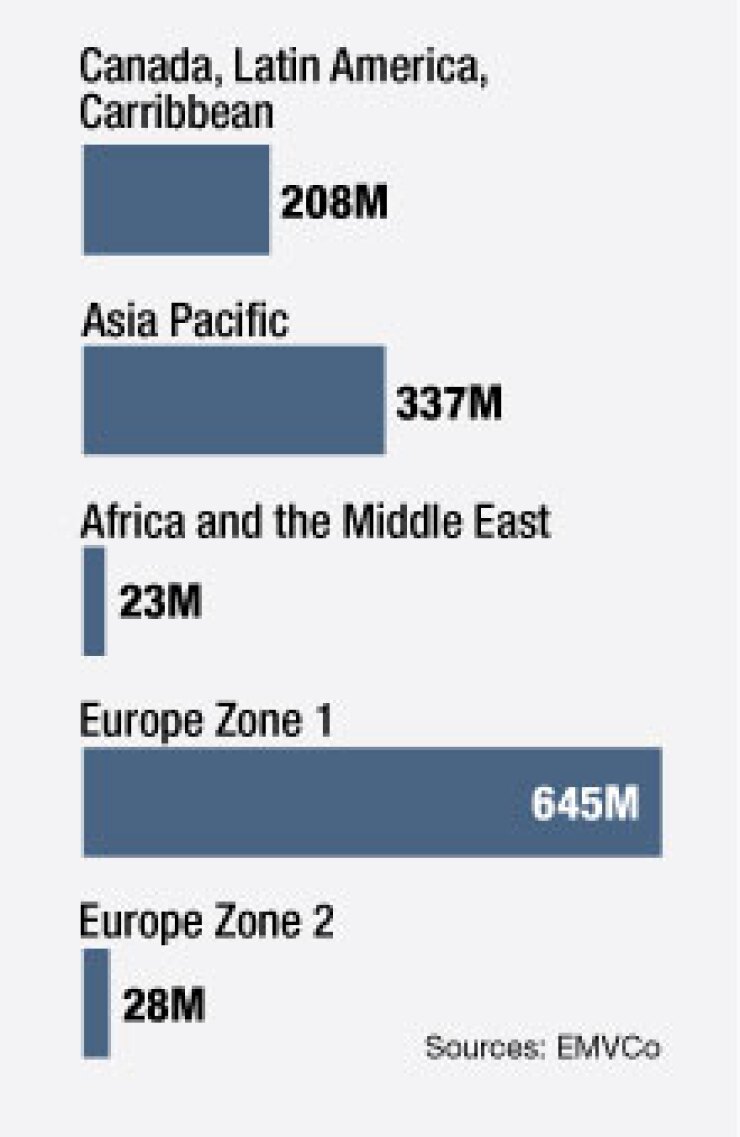

More recently, Wells Fargo and JPMorgan Chase adopted EMV card payments for international travelers, and Gemalto and Travelex are manufacturing EMV cards designed for U.S. travelers. But a domestic migration has yet to commence, even though Canada is nearly 100 percent EMV complaint and the cards are ubiquitous in many European and Asian nations.

The action by Wells and JPMorgan is expected to spark an eventual move to EMV cards in the U.S. for domestic use. But criminal action overseas is creating fresh pressure to expedite that migration. U.S. and European lawmakers on Friday said they've rounded up an international skimming gang accused of skimming thefts totaling more than $75 million.

Called Operation Night Clone, 47 people were arrested in Bulgaria, Kenya, South Africa and the U.S. The group instructed small time local crooks to make illegal withdrawals, then used cards skimmed to hit accounts in non-EMV compliant regions such as the U.S. and South Africa.

In a statement Rob Wainwright, director of Europol said the investigation has provided a unique insight into skimming, highlighting that fact that illegal card transactions targeting the U.S. from outside the country are a major part of the problem, and that as long as cards have magnetic stripes, they will be vulnerable to skimming.

The sound you hear is a collective "I told you so" from Wal-Mart and the Atlanta Fed. Both have called for a reduction of reliance on mag stripes in the U.S., saying the growth of EMV compliant cards outside the States not only opens U.S. travelers to card denials when overseas, but makes the U.S. an isolated wealthy target for international fraud. Wal-Mart has started adopting EMV compliant terminals in some locations.

With the adoption of EMV for travelers on the upswing, it would appear that the glitches for travelers problem is being addressed by the U.S. card industry. But the new crime wave suggests the lack of an EMV ecosystem in the U.S. does create a strong counterargument to the $12 billion price tag of a nationwide migration to EMV compliance point of sale terminals.

"This kind of crime wave has an impact on issuers, they have to admit once and for all that the U.S. is the only major issuing card country in the world to not have this technology. The cards are unprotected," Halpern says.