U.S. Bancorp's capital levels are under the microscope this week in the wake of a research report that claims the Minneapolis-based company isn't holding enough capital for a bank of its size.

The April 17

But U.S. Bancorp executives pushed back Wednesday on that idea, saying there is no need to raise capital at this point. That's because U.S. Bank's parent company expects to generate capital on its own, in part from earnings that will arise from last year's

A capital raise "is not part of our thinking as we sit today," CEO Andy Cecere told analysts during the company's first-quarter earnings call. Earnings accretion, risk-weighted asset optimization and other factors "will all get us to a point that we will be at the appropriate capital levels, and I can assure that is a high-focus area for myself and the entire management team."

Cecere said U.S. Bancorp expects to increase capital by 20 to 25 basis points per quarter as it completes the integration of Union Bank and begins to realize cost savings by bringing the two companies together. That projection does not include any additional capital that could be generated by focusing on less capital-intensive areas such as wealth management, company executives said.

The 84-page report by HoldCo, a Florida-based investment firm with roughly $1.2 billion in regulatory assets under management, criticizes U.S. Bancorp's capital levels and accuses the Federal Reserve of allowing the bank to "hold shockingly low amounts of capital relative to assets."

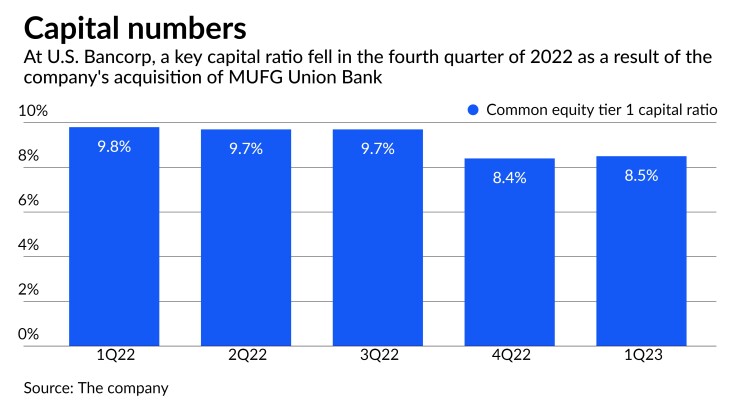

It takes specific aim at U.S. Bancorp's common equity tier 1 ratio, which fell from 9.7% in the third quarter of 2022 to 8.4% in the fourth quarter. According to the report, the 8.4% ratio ranks 391 out of 393 publicly-traded banks with assets of $1 billion or more.

HoldCo called U.S. Bancorp's capital levels "pathetic" and said the bank would rank "dead last" if it was treated as a larger bank. It also said that U.S. Bancorp has avoided including unrealized losses in regulatory capital by staying just below a key regulatory threshold. Unrealized losses have become

U.S. Bancorp's common equity tier 1 ratio ticked up in the first quarter to 8.5%, the company noted Wednesday. The decrease last year was due to the acquisition of Union Bank, executives said.

U.S. Bancorp is currently classified by regulators as a "Category III" bank, based on its $682 billion of assets as of March 31. When it crosses the $700 billion threshold, it will become a "Category II" bank, be subject to more rules, and be required to include unrealized losses on available-for-sale securities in its regulatory capital.

The company doesn't expect to surpass the $700 billion threshold until the end of 2024, Chief Financial Officer Terry Dolan said Wednesday during a post-earnings interview.

However, he expects regulators to tweak capital requirements following the March

"I think regulators are still working through future capital requirements," Dolan said.

As for the company's reaction to HoldCo's report, Dolan said the bank has no plan to respond.

HoldCo doesn't own any U.S. Bancorp stock, but it has shorted the company's shares, which gives it an incentive to seek to drive down the firm's stock price.

"We're aware of the report," Dolan said. "I don't think there's any real new information."

U.S. Bancorp is on track to complete the integration of Union Bank during Memorial Day weekend in May, Dolan said. Some of the systems have already been switched over, including corporate trust services this past weekend, he said. The decommissioning of Union Bank's old systems is expected to take place later this year.

For the first quarter, U.S. Bancorp reported net income of $1.7 billion, up 20.8% from the same quarter in 2022. Net revenues reached a record $7.2 billion during the quarter, the company said.