Bank merger and acquisition activity continued its rebound with a pair of deals in California focused on growth in mid-sized markets.

CVB Financial in Ontario agreed to buy Suncrest Bank in Visalia for $204 million in cash and stock, while TriCo Bancshares in Chico inked a deal to acquire Valley Republic Bancorp in Bakersfield for $165.6 million in cash and stock. In announcements made after markets closed Tuesday, each buyer emphasized a need to build presence in growth markets.

California banks are

“You have to go where you can put revenue engines to work,” said Charles Wendel, president of Financial Institutions Consulting.

Another prominent would-be buyer made clear it was on the prowl. The chief executive of Pacific Premier Bancorp in Irvine, California, said this week he is eager to build upon the bank’s 2020 acquisition of Opus Bank — the $1 billion deal was among the 10 largest of 2020 — with an even larger acquisition. Opus had about $8 billion of assets.

The ultra-low interest

"We think that in this environment that M&A and consolidation makes as much sense as it ever has," Gardner said on the bank's second-quarter earnings call this week. “And we're going to continue to pursue it…At this point in time, we think it makes a lot more sense to be pursuing larger transactions, MOE-like, if you will.”

At least 10 deals have been announced to date this year in California, S&P Global data shows. This M&A is part of a nationwide

“I don’t know anybody who isn’t expecting more and more deals,” Wendel said.

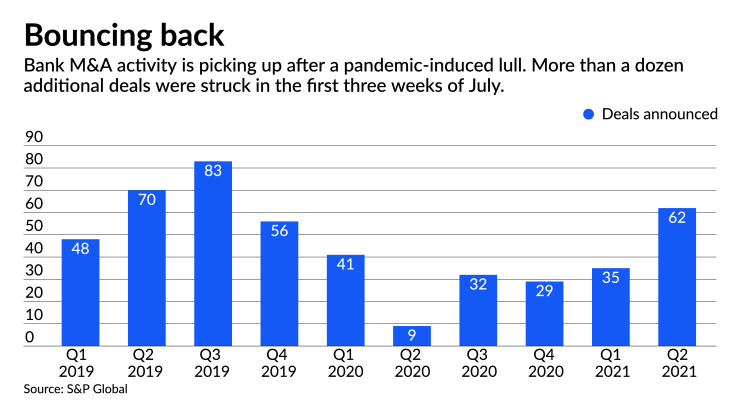

A total of 106 U.S. bank deals were announced through July 16 of this year, compared to 55 over the same period last year, according to an S&P Global tally. Total deal value in 2021 so far jumped to $33.92 billion compared to $27.84 billion for all of 2020, the firm said.

The trend was amplified on Wednesday when Providence, Rhode Island-based Citizens Financial Group

While on a smaller level, both CVB Financial and TriCo said the hunt for scale is propelling their M&A ambitions as well.

The $15.5 billion-asset CVB Financial agreed to buy the $1.3 billion-asset Suncrest Bank in a deal expected to close late this year or in early 2022. The transaction would give CVB Financial about $900 million of loans and $1.2 billion of deposits. The combined bank would have nearly $17 billion of assets.

CVB Financial, parent of Citizens Business Bank, would gain seven branches and two loan production offices throughout California’s Central Valley and in Sacramento. The buyer is expanding its existing footprint in the Central Valley region while also entering the Sacramento market.

Sacramento is an “important new market” that “presents significant growth opportunities," said David Brager, CEO of CVB Financial, during a call to discuss the transaction. Citing U.S. Census Bureau data, CVB Financial said in a presentation that Sacramento’s population grew by 11% over the past decade, well above the nation’s 7% rate.

The deal “helps us build scale” and, “importantly, expands our strategic alternatives in Northern California and throughout the Central Valley,” Brager said.

CVB Financial estimated the deal would prove 3.3% accretive to earnings per share in 2022, assuming cost savings of 40%. It estimated it would earn back tangible book value dilution of 0.8% in less than two years.

The deal marks CVB Financial’s fifth bank acquisition since 2012 and its second largest. Piper Sandler Matthew Clark said CVB Financial considers M&A a line of business, and he anticipates more to come should additional sellers in California emerge.

The $8 billion-asset TriCo, meanwhile, is buying the $1.4 billion-asset Valley Republic to create a combined institution that would have nearly $9.5 billion of assets, $8 billion of deposits and nearly $6 billion of loans. The deal would deepen TriCo’s presence in Bakersfield, another growth market, and make it the largest community bank based in that metropolitan area, the company said in a release announcing the deal. Bakersfield grew about 10% over the past decade, according to Census data.

TriCo said the acquisition is expected to be 5.5% accretive to its EPS in 2022, assuming 17% cost savings. It expects to earn back 1.6% dilution to tangible book value in two years.

The deal would mark TriCo’s fifth since 2010 — and its second-largest in that span — but its first since 2018.