Running a bank with less than $250 million of assets and just four branches, executives at West Town Bancorp in North Riverside, Ill., figured they needed to go beyond conventional community banking to produce a meaningful return.

For small banks, it's all about how they decide to compete, said A. Riddick Skinner, West Town's senior vice president for government-guaranteed lending. "We can't go out on the corner and offer everyone a cooler for opening a checking account. …You have to come up with a different business model."

Part of the solution at West Town, the parent of West Town Bank & Trust, has involved building a national Small Business Administration lending platform.

The practice is by no means original. Skinner acknowledged his team is not "doing anything 150 other banks aren't doing." Still, there's no denying West Town punches way above its weight where SBA lending is concerned.

Consider that during the agency's 2016 fiscal year, which ended Sept. 30, West Side originated 83 7(a) loans totaling $116 million. By way of comparison, West Town's 7(a) volume eclipsed that of the $71.3 billion-asset Comerica ($104 million), the $145.2 billion-asset Citizens Financial Group ($95 million) — even the $2.2 trillion-asset Bank of America ($100 million).

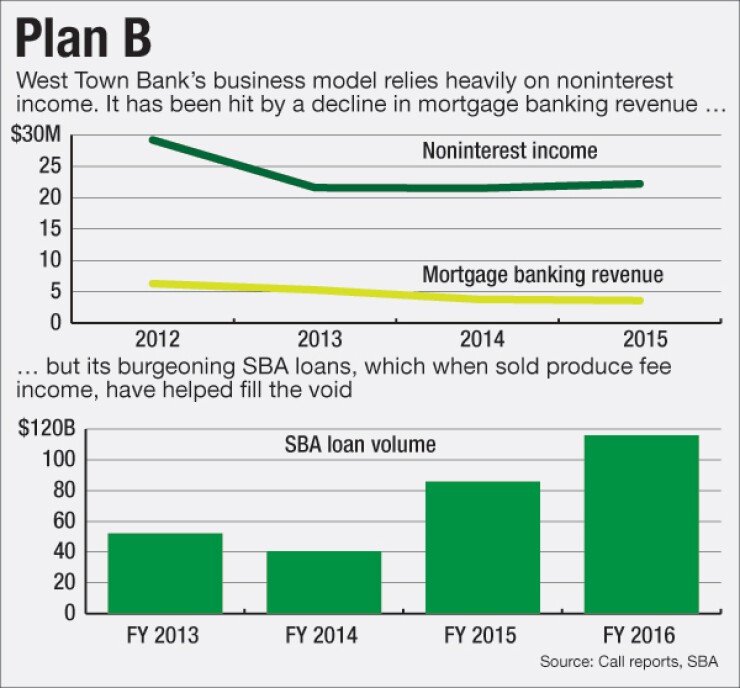

Moreover, West Town's fiscal 2016 7(a) production was nearly three times the $40.5 million it originated two years earlier.

The growth has proved timely.

West Town's other significant noninterest income business line, mortgage banking, has struggled with sharp declines in originations and revenue. SBA lending generated income of $2.7 million through June 30, and it has helped the company maintain profitability.

West Town, which operates branches in Illinois and North Carolina, reported net income of $1.5 million through June 30, down 25% from the same period in 2015 as the mortgage banking drop-off and a number of one-time charges took their toll. Even with the decline, return on average assets remained a respectable 1.33%

Nationally, the 7(a) program is continuing to ride an upswing that mirrors West Town's. According to SBA, the agency guaranteed loans totaling $24.1 billion in fiscal 2016, up a robust 26% from 2014. The program's growing volume appears to be attracting lenders. SBA said Thursday that 263 of them were added in fiscal 2016 — even as the number of banks and credit unions continues to shrink.

SBA has yet to comment officially on the fiscal 2016 results, but spokesman Terrance Sutherland wrote in an email that the agency was "pleased with the uptick."

John A. Howard, president of Raleigh, N.C.-based Equity Research Services, a firm that provides research and financial advisory services to small-cap companies, said banks that rely heavily on noninterest income often produce uneven profits, but he added the strategy "can be very lucrative if done well."

West Town "has established a reputation as a very good SBA lender," Howard said.

President and Chief Executive Eric Bergevin said in a recent press release that SBA and U.S. Department of Agriculture (USDA) lending would serve as the "primary driver of our business model going forward."

One of the keys to West Town's SBA success is rapid decision-making, which Skinner said is simplified by the bank's small size. "We're not a big bank with a lot of bureaucracy," he said.

Strict underwriting is the other key, Skinner added.

Skinner said his father, Stephen, who currently serves as a West Town senior vice president, is a longtime banker who talked frequently about debt service, coverage ratios and equity at the family dinner table.

"The apple doesn't fall far from the tree," Riddick Skinner said.

West Town applies the same conservative underwriting standards to the 7(a) loans it originates for sale that it uses to originate the loans it holds in its portfolio, Skinner said.

According to Howard, the average loan-to-value for SBA credits falls in the 50% to 55% range.

"We do not originate subprime loans and try to toss the risk off on the government," Skinner said. "We want [borrowers] to have skin in the game. We like loans to be secured by real estate, and we like people to have good credit."