A financial industry trade group wants to help U.S. banks use an old-fashioned hiring tool — apprenticeships — to reach a younger and more diverse group of prospective employees.

The American Association of Bank Directors said Monday it’s aiming to sponsor apprenticeships in several job categories at banks, including information technology, accounting, advising, lending, compliance and administrative work.

“Bank directors appreciate the importance of talent in their banks,” said the association’s president, David Baris. “Talented individuals can come from various backgrounds and educational levels.”

Baris said some bankers have expressed interest in the program — called the Bank Apprenticeship Resource Coalition — and that the association would be reaching out to prospective bank participants soon. He declined to name the banks.

The financial services industry is trying to rightsize its workforce — hiring in some specialties and cutting other jobs — and ensure it’s ready for a looming increase in retirements. A study from Deloitte last year showed that in 1998, about 86% of the banking industry’s workforce was between the ages of 24 and 54. But the share of younger workers had fallen to 74% by 2018.

Apprenticeships are paid positions that can offer specific on-the-job training along with classroom work, depending on the program, giving those who did not obtain a degree the chance to break into the labor market. American businesses are slowly offering more of these positions to develop needed recruits, especially as education costs soar.

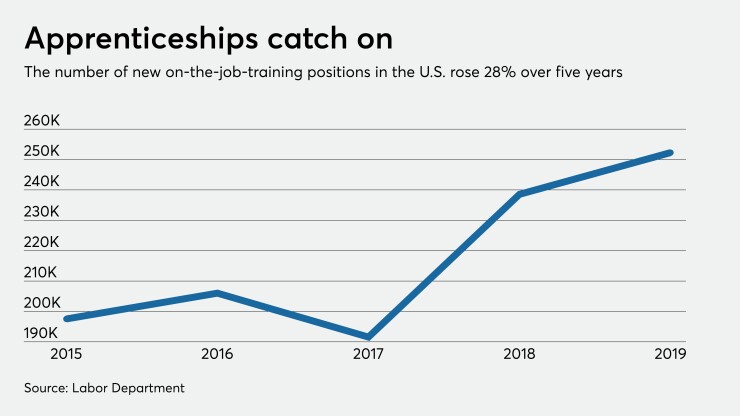

There were 3,133 apprenticeship programs in the U.S. last year, a 65% increase from 2015, according to U.S. Labor Department data. New apprentices have increased 28% over that time to more than 252,000 in 2019, the data show.

The bank directors association has long run training programs for new directors, but this is its first attempt at addressing rank-and-file jobs. Baris attended college with Robert Lerman, a fellow at the Urban Institute and one of the preeminent scholars of apprenticeships in the U.S. Baris is partnering with Lerman to develop the program and is modeling it on similar efforts that have taken root in the U.K. banking industry, which has seen many apprentices become branch managers and other high-ranking positions.

“A lot of the jobs in banking lend themselves to apprenticeship,” Lerman said. “There’s no limit to the mobility prospects if you start in finance in one way or another.”

The program is being offered at a time when the banking industry is under scrutiny for how it recruits workers. Wells Fargo CEO Charlie Scharf

Some banks have in recent months have

About one year ago, Lerman

“The broader question is why we don’t have a more robust apprenticeship system in the country, and one of the answers is knowledge, marketing and what I call organizing,” Lerman said.

Apprenticeship programs could have broader economic implications as well. The Bureau of Labor Statistics estimates that of the 15 occupations expected to have the most job openings over the next six years, just five offer pay above the national median, according to Lerman’s study.

Some banks have launched successful apprenticeship programs, starting with Barclays Capital in the U.K.; it allows prospects to work toward a degree while learning on the job at the bank. HSBC also has an apprenticeship program that gives recruits the chance to become operations analysts. Santander U.K. offers a three-year apprenticeship program that requires prospects to rotate throughout multiple offices in the country.

In the U.S., Wells Fargo

Baris said the association’s program will be available to banks “regardless of size or location.”

“Apprenticeship is proven to be an effective training model for enhancing businesses’ performance and competitiveness,” Baris said.