-

Fintech startups continue to captivate venture capital firms and angel investors, giving a boost to a program in which the operators of startups get advice from mentors and make presentations to hundreds of bankers at an annual event in New York.

June 26 -

A growing number of startups and banks are trying to design digital experiences that train users to manage their money more responsibly, starting with small amounts in mundane situations.

June 23 -

As marketplace lenders, robo-advisers and other startups nibble away at the profitable, customer-facing parts of banking, executives at last week's Digital Banking Summit discussed how banks can defend against "unbundling."

June 15

Santander's fintech mavens have identified three technologies that could help banks stave off disruption in areas like lending, payments and money management.

The Internet of Things can help banks monitor physical assets used as collateral in trade finance by attaching sensors to things like shipping containers, according to a white paper co-written by Mariano Belinky. The distributed ledger technology used in cryptocurrency blockchains could be used to streamline processes that today require centralized clearing, according to the report, entitled "

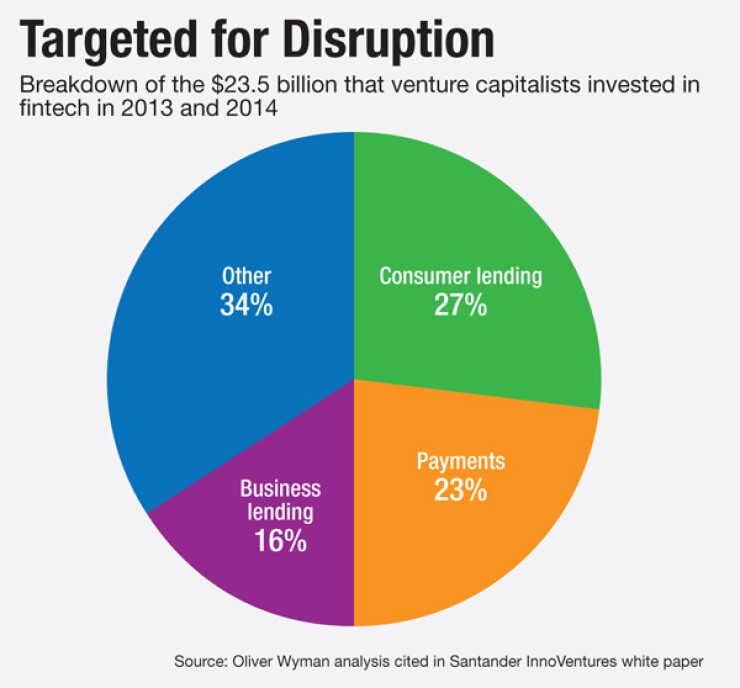

The report's suggestions come at a time when bankers are increasingly worried that, in the words of JPMorgan Chase CEO Jamie Dimon, "Silicon Valley is coming" to nibble at their business with reengineered financial products and services. The report cites an estimate from Oliver Wyman that venture capitalists have poured $23.5 billion into fintech startups in the last two years.

To leverage any of the emerging technologies will require a culture change at financial institutions.

"Our chairman a year ago said we spent eight years getting out of the crisis, and skipped a full generation of users," said Belinky, managing principal of Santander InnoVentures, the Spanish bank's venture capital arm. "We need to figure out how we service this client. Having someone at the top who believes this is key. If you have resistance from the bank, you're not going to be able to change much."

The paper, which Santander technologists produced in partnership with Oliver Wyman and another advisory firm, Anthemis Group, also advises financial institutions to partner with innovative startups as part of an effort to make banking "frictionless."

"A company with the right idea can partner with a bank and scale up swiftly," said Belinky. "We don't see a competitive situation anymore."

Internet of Crates?

The Internet of Things could let banks automate many collateral monitoring processes, said Belinky, a managing principal of Santander InnoVentures, the Spanish global bank's venture capital arm, which has received $100 million from the bank and has invested in five startups.

"We want to automate and take the friction out of a lot of what is already happening in terms of collecting data for physical assets," he said.

Sensors already exist that can track and monitor the condition of equipment and containers and send data to the cloud, he said. They need to be hardened to withstand extreme conditions.

Just as sensors in cars could track everything about the condition of the vehicle from the brakes to fluid temperatures to the owner's driving skills and share that with an insurance company to lower rates, banks could monitor a fleet of vehicles to set rates for a credit line, suggested Brad Leimer, head of innovation at Santander Bank, the company's $83 billion-asset U.S. subsidiary, based in Wilmington, Del.

The automatic monitoring of cars, fleets, containers or equipment could lead to better pricing, improved risk management and ultimately better informed lending.

And perhaps more importantly, it could speed up the financing process.

"The other day I was talking to a blockchain-based trade finance company about the ability to track containers shipping coal from China to Australia," Leimer said. "We were talking about the release of funds immediately [or close to it] when those containers are guaranteed in port. You can drop 30 days off the release of those funds between parties that don't know each other, that speak different languages, and that have a lot of reasons to have this be a slow exchange of value between them."

Set in (Digital) Stone

A blockchain or distributed ledger is an indelible record of transactions that's kept on servers in different places. It eliminates the need for a central clearinghouse. The unchangeable record is a clearinghouse of sorts.

Santander has begun working on proofs of concept for using distributed ledger technology for payments, for instance for international money transfers, trade finance, syndicated lending and collateral management.

Another place where distributed ledger technology could streamline operations is securities clearing. Belinky acknowledges this would take more time, to get all parties to securities trades to agree on a common method and version of the technology.

"It's an area where we see the potential for disruption. It's one that will take longer to adopt," he said. It may take five to seven years for any blockchain technology to be used live in banking.

David Reilly, the chief technology officer at Bank of America, also sees practical uses for blockchain technology in banking.

"We think the database tech may have broader applicability than just how you would match, settle and clear digital and traditional assets," he said last week. "We could find that database having applicability in places where today we may use

Bank of America's equities team is working with Digital Asset Holdings, the startup led by former JPMorgan executive Blythe Masters, on ways to use the startup's technology in the handling of stocks.

"It's early days. It's too early to say how that's going to conclude, but I'm glad we're doing it," Reilly said.

Data Drilldown

Smart data seems to be replacing Big Data as the top data management and analytics buzzword.

"Digital technology has greatly increased the volume of data available," the Santander report states. "However, the banks have found it difficult to use this new data to create value for their customers and themselves. In contrast, online retailers and social media firms have found ways to create value from data."

Banks have performed analytics on reams of customer data for many years, but smart data would use greater precision.

"My take is we've tended to look at it the wrong way," Belinky said. "We say, 'we have all this data, let's wrap algorithms around it and see what insights come about.' That's the approach of many Big Data companies that come to us today."

What companies are starting to get better at, he said, is asking very specific questions, such as, how can they help clients avoid bumping up against their credit card limits? Then they figure out what data is needed to answer those questions.

"You can use a limited subset of data that's easier to provide and access for the bank and solve one piece of the question at a time," Belinky said. "That's where we have failed as banks." Banks need to take their data to the next level and truly predict customers' needs, Belinky suggested at the point when a customer is about to buy a house, for instance.

Leimer noted that Facebook, Google and FourSquare have done well leveraging users' data and preferences to add value to everyday interactions, and that keeps people coming back.

"People are getting used to the idea that they're getting value out of that offering. If they see that [sharing certain types of data] makes no sense for them, they can turn that off," he said. "One thing financial services companies can do is, understand how to be advocates on behalf of people, to educate why we're doing what we're doing to offer you value. And take a position on whether you should be leveraging smartphone sensors in your daily life. Take a stance on it and explain to people what's good and bad about it."

Reilly at Bank of America agreed that banks have work to do to achieve smart use of data.

"No one's got one repository for all the information we have to integrate with multiple sources," he said. "If you start with a more narrow focus [as fintech startups tend to do], then you don't have that legacy problem. God created the earth in six days, but he didn't have any legacy [systems] to deal with, so he got to rest on day seven. We don't have that. We're doing a lot of work on that integration layer with our chief data officer."