The first generation of chatbots in financial services has yet to win over the majority of consumers. But as the technology improves, banks and payments companies foresee a variety of roles and abilities for these virtual assistants.

Today’s simple question-and-answer programs will evolve, experts say, to become sophisticated conversational agents, which will help customers transact and may even be capable of understanding emotional cues.

As that happens, banks expect more and more consumers will turn to chat platforms, such as Facebook Messenger and WhatsApp, to conduct their financial affairs. When they do, the bots will be waiting for them—helpful digital representatives of companies that are

"A decade ago we had the first big leap, and that was web to mobile," said Edrizio de la Cruz, co-founder and CEO of Regalii, a startup whose application programming interfaces are used by dozens of financial services providers to build their chatbots. "Now the next one is mobile to conversational."

The development of sophisticated chatbots and their mass adoption by consumers may take a couple of years, says de la Cruz. But once it happens, he says, the idea of handling your finances without a bot will be like trying to picture your life without a smartphone.

The basics and beyond

Banks and payments companies are experimenting both with bots that live in their mobile apps and ones that exist on Facebook Messenger. Going with the former give a bank more control over the functions of the bot, while the latter allows the bank to reach its customers where they already are. But experts say that in either case the guts of the technology are essentially the same.

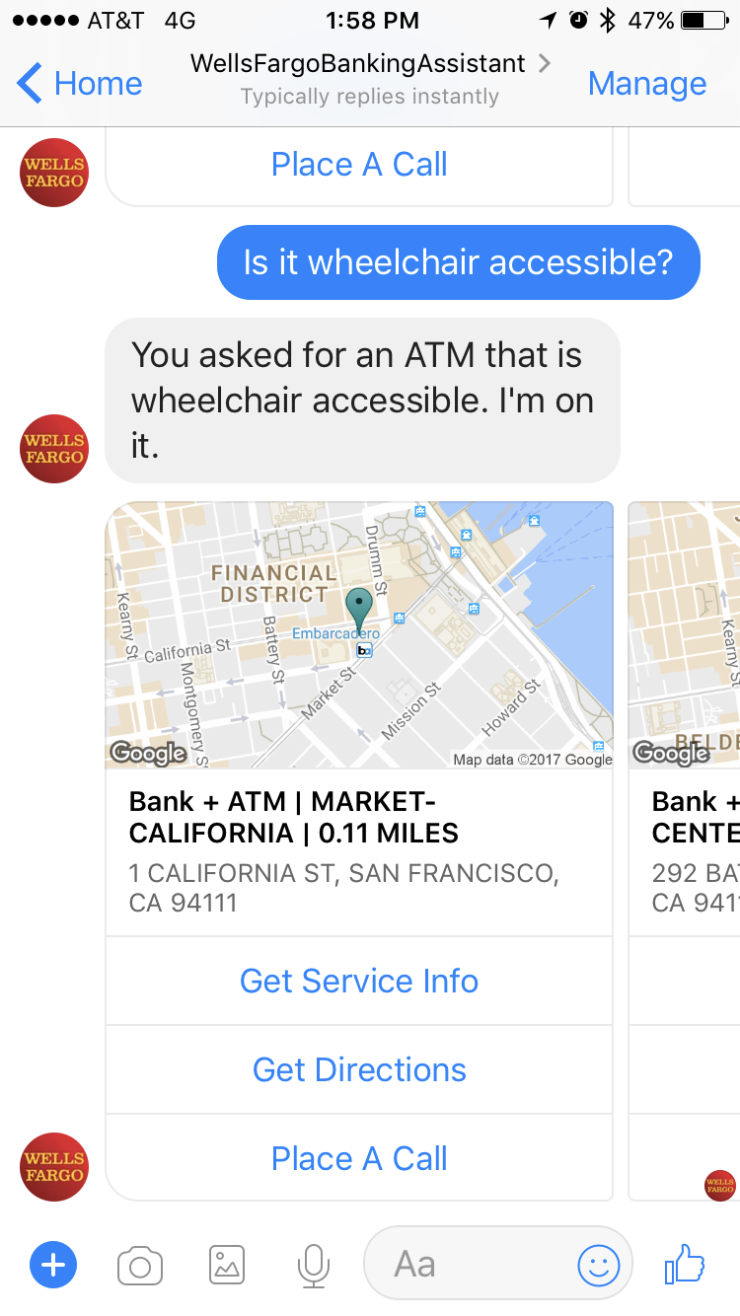

For now, most chatbots remain in the trial phase. In early May, after two years of studying the technology, Wells Fargo kicked off a six-month pilot of its Facebook Messenger bot. The current version can't do much more than tell users their account balance, give them the location of the closest Wells Fargo ATM or branch and provide a breakdown of how much they recently spent on specific categories such as food or at retailers like Starbucks.

But the bot is powered by an engine that learns over time, and eventually its keyword-based responses will be replaced with full conversation, says Steve Ellis, head of the bank's innovation group.

"It won't get fully there for quite some time, but it will get there," Ellis said.

Once the bot has mastered basic interactions, and even some complex ones, it will be time to teach it a new skill: emotional comprehension.

"When you get into emotional conversations—'Something's wrong with my account, I don't understand this, why can't you do this for me?'—that's different, and most chatbots aren't ready for that," Ellis said. "We are working on that in R&D, and those things will eventually get layered into these chatbot conversations."

For now, if the bot—built in partnership with the company Kasisto, one of 11 startups so far to graduate from Wells Fargo's accelerator program—can't answer a question, it will hand the conversation over to a human. (Unlike Bank of America's chatbot, erica, which is set to make its debut in the fourth quarter of 2017, Wells Fargo's bot doesn't yet have a friendly name.)

Another area chatbots are moving into, according to de la Cruz, involves the bots advising and prompting customers to act. Beyond telling them how much money they have and how much they owe, he says, the questions are "Is there a better way? Can you make more? Can you invest better? Do you really need this credit card? Are there alternatives? Not just predictive data but specific actions on that predictive data."

When American Express launched the first iteration of its chatbot on Messenger in August 2016, all it could do was alert users to recent transactions and inform them of relevant card benefits and services. A high-dollar purchase might trigger a reminder from the chatbot that the cardholder had purchase protection if it was needed. By contrast, the new-and-improved chatbot, launched earlier this month, can answer customer questions about account and rewards point balances and even help them choose a new card to apply for.

"For the Platinum card, we'll serve up the list of its top benefits, like the $200 annual Uber credit and earning 5X points on eligible hotel and travel spend," said Matthew Sueoka, vice president and head of digital strategy and strategic partnerships at American Express. "All of these things the customer can click through—sort of like choose-your-own-adventure."

Two things have made this souped-up chatbot possible. The first is artificial intelligence and customer-service technology developed by American Express, and the second is a richer, more visually engaging user interface for Messenger, which provides "a carousel of images that will tell you these different categories of things you can do," such as learning when your bill needs to be paid, Sueoka said.

Bank of America's soon-to-be-released chatbot, erica, is

This is admittedly still a far cry from a chatbot that can serve as a wholesale financial adviser in the context of a natural—or natural-seeming—conversation. Such advances won't happen all at once, experts say.

"We're investing in artificial intelligence and other technologies so that we can make these services smarter, more adaptive, to continue to learn over time," Sueoka said. "And that's going to be an ongoing process. That's not something that's going to reach maturity in a few months. That takes years to really develop and refine."

Thinking less and learning more

For banks, the goal of better chatbots sounds like a paradox: to empower people to spend less time thinking about their financial obligations while nevertheless making better financial decisions. Banks benefit too. They learn more about customers from their interactions with bots, and this allows the bank to offer targeted products and services, says Jared Johnson, a principal digital strategist at Solstice, a mobile-tech consultancy.

Typically, a bank's data on a customer is fragmented across departments. The mortgage business doesn't necessarily know that a customer consistently pays her credit card bills on time, for instance. But to interact with a bot like Wells Fargo's, customers have to share their accounts with it. With the full breadth of a customer's financial life open to the bot, it should be possible for a financial institution to attain the

"The vehicle is the chatbot but the data that drives it is also very important," de la Cruz said.

Even as consumers benefit from the data and predictive analytics powering chatbots, then, their interactions with bots "are empowering the financial institution[s] to make better decisions" about how to serve their customers, said de la Cruz, whose startup is working with 31 financial services companies, including Mastercard, and has signed 27 more that it has yet to bring on board.

Another role chatbots may take on is that of transaction agents. In 2016, Facebook users gained the ability to use PayPal as a payment option in Messenger and on the social network itself. They can also link their PayPal accounts to the messaging platform if they want to have transaction receipts delivered directly into a chat thread.

Bill Scott, PayPal's vice president of consumer engineering, praised the "flexibility" of the Messenger platform and "the simplicity of the [its] code" in a collection of quotes from partners released by Facebook last month.

American Express is also dipping its toes into bot-assisted transactions. Last fall, the card company updated its chatbot so that it could store card information for users, making it possible for them to use the card for purchases on Facebook. And Bank of America executives say the bank's erica bot will be able to transfer money from one account to another.

Wells Fargo’s Ellis agrees that transactional capability is on the horizon for chatbots. Some banks may be slow to take that step, though.

"We move over $100 billion a year," Ellis said. "That's different than, 'I just want to text my son.' If we're moving a lot of money through digital means, we have to think differently about it."

Enhanced security will be required to provide comfort to consumers and reduce the chance of fraud. Bipin Sahni, who works under Ellis as the head of Wells Fargo's innovation research and development, says that his team is working on an upgrade to the bank's bot that will protect customers from their own foolishness. If a customer should reveal his account number or other sensitive information in a chat, the bot will detect it and automatically encrypt the chat to protect the data.

It is crucial for customers to feel secure interacting with chatbots because the data users provide—everything from the way they ask questions to the services they request—gives financial institutions better insight into their financial lives, and in turn allows the companies to build better bots to serve them.

However it happens and however long it takes for the technology to mature and for customers to adopt it en masse, Wells Fargo remains "very bullish on conversational interactions with our customers," said Ellis, who sees chatbots as of a piece, in this sense, with the face-to-face interactions that happen every day at teller windows across the country. "Conversational interaction is the natural evolution of online services."

Where the future of chatbots lives

The future of chatbots is already happening in East Asia.

In Japan, for example, SMBC Nikko Securities is

Bots in the U.S. are "really not that sophisticated compared to what's going on in Japan," said industry analyst David Weiss.

Similarly, 200 million users of the Chinese chat app WeChat are already using its payments service, which allows them to buy goods online, send money to friends and pay bills, among other features. WeChat's "rich messaging culture," said Weiss, "has also led to a proliferation of chatbot services on that platform, including financial [ones]."

It will take the U.S. "several steps" just to catch up to China and Japan on chatbots, according to de la Cruz. "I think we're further behind than we realize," he said.

One thing holding back bot development in the U.S. is, as so often in fintech, the legacy core banking infrastructure with which many financial institutions are saddled. De la Cruz sums it up as "old, outdated enterprise software that's not in the cloud. It's running on a

And then, too, the majority of consumers are not yet comfortable interacting with their financial institution through a chatbot. An HSBC report released this month and based on a study of more than 12,000 people in 11 countries found that only 11% of people would trust a chatbot (or any type of robot) to open a savings account for them or provide mortgage advice. A greater number of people, 14%, were actually willing to trust a humanoid robot to perform heart surgery.

And yet U.S. companies are forging ahead, working rapidly to develop and find commercial applications for chatbot technology. They may transition from first-generation bots to more advanced ones more quickly than China and Japan did, Weiss says.

Of all the Fortune 500 companies with which Solstice works, "not one of them is disinterested in chatbots," said Johnson. "All of them are asking what is the right experiment to run."

Once chatbots have become emotionally intelligent customer service specialists, transaction agents and financial advisers, what's next?

"Beyond that, I don't know," said de la Cruz. "We might be at the Terminator stage by then. I have no idea."