Raisin, a fintech based in Germany, is on the verge of introducing a new type of financial subscription model in the U.S.: deposits-as-a-service.

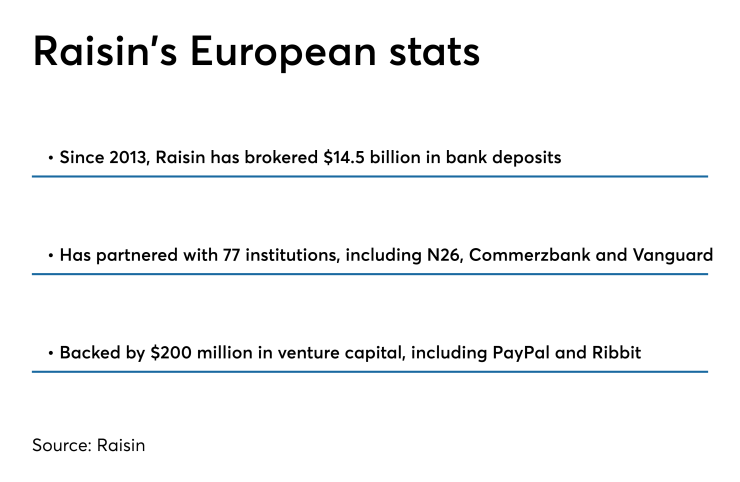

That’s how Raisin Chief Operating Officer Michael Stephan described the company’s online marketplace that aggregates high-yield savings accounts and CDs, which has garnered 13 billion euros ($14.5 billion) in deposits brokered across 75 partner banks in Europe since 2013.

Raisin, which has PayPal as an investor,

“In Europe, we were growing really fast, so the question became, what else can we do around the world?” Stephan said. “The U.S. is a sophisticated type of market, and while there are areas we are still learning about, it’s an attractive market to get into.”

Raisin CEO Tamaz Georgadze has already acknowledged one potential drawback — persuading Americans to save money. The U.S. net savings rate is 2.9% while the global average is 9.6%, according to the latest figures from the World Bank.

“We’re not really a nation of savers,” said Ryan Gilbert, a partner at Propel Venture Partners, the investment arm of BBVA. “We’re a nation of spenders. Have a look at the credit card data. It’s through the roof.”

Despite that difference, Raisin could find success in the U.S. because of the market’s size.

"It’s super smart of them to attack a market that’s likely two times larger in consumer deposits than the EU,” Gilbert said.

Stephan said Raisin quickly gained ground in Germany and the European Union for a couple of reasons. While the company was founded well before the open banking directive PSD2 became law in the EU, it’s helped Raisin more easily connect to banks. Raisin also has benefited from European consumers’ lack of loyalty to their primary bank.

“People shop around more, specifically when it comes to relationships online,” he said. “There’s convenience there, and we think that’s happening in the U.S. as well.”

Raisin’s other challenge is that it will need to build American consumer awareness. Georgadze said the fintech will seek to do so through various marketing efforts and partnerships. In Europe, Raisin grew its profile through partnerships with various financial institutions such as mobile-only bank N26, Commerzbank and Vanguard, which is one of the world’s largest investment management companies.

Georgadze envisions a scenario where Raisin could partner in the U.S. with the likes of Bankrate or NerdWallet, two of the most popular personal finance comparison websites.

“There is functionality" — account opening and management — "we can offer to third parties that would benefit them from such a partnership,” he said.

Midsize banks in particular could benefit from Raisin as a way to decrease customer acquisition costs, which average about $200 per new account. That might set a new trend for fintechs seeking to partner with banks.

“The Raisin announcement, along with banks’ increased interest in acquiring stable deposits, will see the launch of a bunch of startups that will focus on the customer acquisition of financial services as opposed to building another PFM or creating another lending product,” Gilbert said.

For now, Stephan said, Raisin’s immediate focus is to wade through regulatory waters to officially launch its marketplace here.

“It will be likely that some of the activities we do here will require a banking license, and we will very likely have to partner with a sponsor bank so that we can operate under their license,” he said.

“I don’t think we’d get a license through an acquisition, but will likely have a sponsor bank, and we’ve had some discussions with potential partners.”