By some metrics, Americans seem to be doing OK at managing their debt, but some potential warning signs have appeared in recent months.

Consumer debt

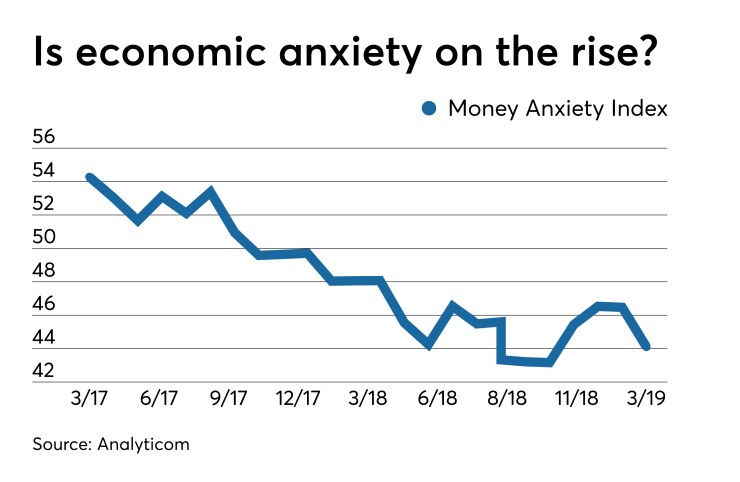

Then there are nontraditional indicators like the Money Anxiety Index, which measures consumer saving and spending habits. The basic idea is that consumers’ actual financial behaviors can serve as an early warning of an economic downturn.

After steadily declining for nearly eight years, the Money Anxiety Index has begun to reverse course.

“We are in an economic slowdown, and we’re going to go through the economic cycle,” said Dr. Dan Geller, who created the index and founded the San Francisco research firm Analyticom.

So how can banks minimize their losses when the economy inevitably turns?

Geller says banks will need to closely monitor consumer behavioral trends, like the type of accounts customers steer their money toward and the spending choices they make. Those insights could help them them pinpoint deposit prices and better anticipate weakening in credit conditions.

Geller created the index after the Great Recession because he wanted to understand whether certain consumer behaviors could be early indicators of a slowdown or recession.

Drawing upon publicly available data, the index basically tracks how consumers are spending and saving their money. Commerce Department data, for example, can tell Geller how people are spending on a range of consumer goods — whether they are buying more affordable goods and services, or feeling confident enough to spend a little more. Federal Deposit Insurance Corp. data tells him what kinds of accounts they are using to save money. When people are anxious, they keep more money in liquid accounts, like savings or checking as opposed to certificates of deposit, and they spend less, Geller said.

In analyzing about 50 years of data, Geller was also able to link upticks in the index to economic downturns about 12 months in advance.

The index hit a 30-year peak of 100.5 points in June 2011. The recession had technically ended by then, but many Americans still felt financially pinched, so they were spending carefully and keeping cash readily accessible.

The index hit its lowest point since the mid-1960s in November 2018, when it sat at 43.2, but it’s beginning to rise again. As of March, the index stood at 44.1 points, and according to Geller, that means another downturn is approaching.

The Federal Reserve’s decision on Wednesday to leave the federal funds rate unchanged validates this view, Geller said. Even though gross domestic product growth came in strong during the first quarter, there is also some underlying softness in the economy, like the core personal expenditure index, which slipped on a yearly basis.

Geller spoke with American Banker recently about what it all means for the financial services industry, how bankers can better manage rising deposit costs, and why they should get serious about behavioral economics.

What exactly does it mean for the banking industry when the Money Anxiety Index starts to rise?

DAN GELLER: November of 2018 was the turning point in the economic cycle. The economy reached its peak performance at that time, and right now we are in a slowdown mode with the economy. We are in a relative slowdown. We are not declining yet, but definitely the economy is slowing down.

When the economy started declining in 2008, we saw a shift of deposits from term accounts to liquid accounts, meaning when CDs matured, people actually took the money and moved it to liquid accounts, i.e. checking, savings and money market. In times of elevated money anxiety, people feel more comfortable knowing their money is readily available to them. This is an instinctive reaction.

In the last few years, when [interest] rates started increasing and the economy improved, people started shifting money into term accounts, but this is about to change as we move along in the economic cycle now. Right now [the Money Anxiety Index] is relatively low compared to the financial crisis. In the next year or two, it will be higher when we go into an economic slowdown, and we will see that shift again, from term accounts to liquid accounts.

Are there any other economic indicators you’ve seen lately to support this idea that there’s another downturn approaching?

In February of this year, the Federal Reserve Bank of New York issued a report

This could be a canary in the coal mine. People are starting to default on car loans, and it could spread to other things because of the slowdown in the economy.

I would definitely consider that as a major sign of an economic slowdown. We are not in a recession yet, we are not going to have a crisis, but definitely a slowdown. And since transportation, a car, is a necessity, people will not rush to default on that loan.

What’s something you think most bankers don’t necessarily know or think about when it comes to behavioral economics?

Unfortunately, the banking industry is among the last industries to really leverage behavioral economics into their operations. It’s a little surprising that such a sophisticated industry as the financial services and banking industry is among the last ones to do that. Many other industries already incorporate behavioral economics.

The lesson of the last financial crisis is, incorporate behavioral economics into your models for two reasons. First, it’s more objective than relying on subjective surveys. And it provides you with an advance notice. If you asked me the main benefit of using the Money Anxiety Index? I would tell you it’s an early warning system to economic changes.

What’s an example of how banks can incorporate behavioral economics into their business plans?

If the banking industry or individual banks would use a more sophisticated way to price and position their deposits, it would be much easier and much more cost effective for them to compete.

Anyone can get deposits as much as they want if they hike their rates to the roof, but it’s going to be very expensive and can hurt the bank. But where is the optimal pricing position for the rate to be in order to acquire the liquidity you need at the lowest level of interest expense? That’s the trick, and they can do that with the right models. The whole idea is to find the optimal pricing position.

When I talk to bankers, the best analogy is the cruising altitude of a jet. When the captain puts the destination and all the other parameters into the flight deck parameter, it says you need to maintain this speed and this altitude in order to get to your destination on time and at the lowest level of fuel consumption. The jetliner can get to the destination sooner, but the fuel consumption is going to be a lot larger and therefore very expensive.

We’re seeing more banks launch financial wellness initiatives — usually to help consumers save more or become financially healthier in some other way. What do you think about that, given what you know about money anxiety and economic downturns?

Overall, it’s a positive thing to encourage savings. The banking industry can leverage the knowledge from the Money Anxiety Index to help them do that.

We know now that we are in a slowdown phase of the economic cycle. This means that from now to the next few years, we’ll slow down and gradually decline until we pass through the next slowdown and recession.

When this happens, money anxiety goes up and people instinctively shift money to savings. They spend less and save more. If [banks] develop programs for savings, they will be riding the wave of the instinctive tendency to hoard money during a slowdown in the economy.