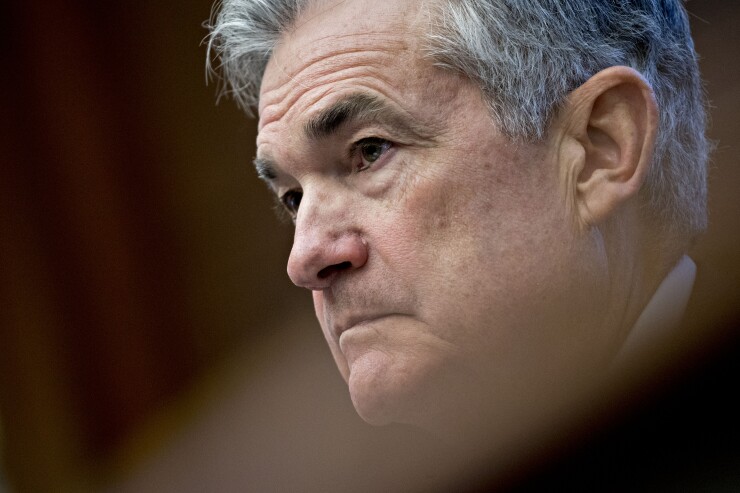

WASHINGTON — Federal Reserve Chairman Jerome Powell said Wednesday that the agency has a “pretty full docket” on regulatory issues, including implementing the recently passed regulatory relief bill and finishing up liquidity and capital regulations.

“It’s actually a pretty full docket right now,” Powell said. “There’s a lot of work to do, I think.”

Powell specifically cited rules related to the passage of a

“After … Sen. Crapo’s bill passed, we’ve got quite a lot of work to do under that, to figure out how we’re going to reach below that $250 billion threshold to assess, supervise, regulate the financial stability risk below that level," he said, referring to the Idaho Republican Mike Crapo.

Powell, who has been a member of the Fed board since 2012, took over the agency’s Supervisory Committee in April 2017 after the departure of former Gov. Daniel Tarullo. Soon afterward, he set out his regulatory

The Fed issued a proposal last summer that would give banks’ boards of directors more discretion in whether they personally sign off on supervisory Matters Requiring Attention or Matters Requiring Immediate Attention. Powell

In December, the agency

Also in April, the Fed issued a

Powell added that the Fed has not closed the door on raising the countercyclical capital buffer on the largest banks, but noted that the buffer is supposed to be raised when there is heightened risk of financial instability, which he says the current conditions don’t warrant.

“That certainly a possibility,” Powell said. “I wouldn’t look at today’s financial stability landscape and say that the risks are meaningfully above normal. They’re roughly at normal. Households are not really a concern, and banks are highly capitalized, so that’s not really a concern.”

When asked about recent

“We have state law, many state laws permit the use of marijuana, but federal law doesn’t, so that puts federally chartered banks in a difficult situation,” Powell said. “I think it would be great if that could be clarified. It puts the supervisors in a very difficult position. Our mandate doesn’t have anything to do with marijuana, but we’d just like to see it clarified.”

Powell’s remarks came as the Federal Open Market Committee voted unanimously to raise interest rates by 25 basis points, to between 1.75 and 2%. It was the committee’s seventh rate hike since December 2015 and the sixth in the last seven meetings.

FOMC members seem to have coalesced around at least one, probably two additional rate hikes in 2018, with five members calling for one additional 25-basis-point rate hike and seven calling for another two. Two members preferred no additional rate hikes and one member preferred three.

FOMC members appear to have settled on rate increases of an additional 2 to 5 basis points in 2019. Four members called for two hikes, another four members called for three rate hikes and another three members called for four rate hikes next year.

Several of the committee’s economic projections were also adjusted during the June meeting, revising inflation upward and unemployment downward.

The committee revised its inflation projections past its 2% target for the first time in years, revising its Personal Consumption Expenditure, or PCE inflation, to 2.1% from its 1.9% projection in March. Core PCE inflation — that is, PCE inflation minus food and energy prices — also edged up to 2% from 1.9%. The committee indicated that it expects inflation to remain above 2% in 2019 and 2020 as well.

Unemployment, meanwhile, was revised down to 3.6% from its 3.8% estimate — well below what has traditionally been considered full employment. The committee similarly revised its 2019 and 2020 projections down to 3.5% from 3.6% for both years. Longer-term unemployment was unchanged at 4.5%.

The committee said that monetary policy “remains accommodative” and that “further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2% objective over the medium term.”

The FOMC also began setting its interest rate for excess bank reserves, known as IOER, at 1.95% — a departure of the committees’ previous practice of setting the rate at the upper end of the federal funds target rate. Powell said that the move was in response to the federal funds rate creeping to the upper end of the target range, and the IOER rate is an attempt to move IOER into agency would attempt to hold the IOER rate “closer to the middle” of the target range.