The struggle to avoid becoming the ‘dumb utility’

In trying to adapt and survive in an increasingly tech-dominated world, banks may unintentionally give up their most valuable commodity — their relationship with the consumer, and the data that comes with it.

By Kevin Wack

Over the next several years, U.S. banks are likely to become less relevant in the daily lives of their customers, less central in the economy and less profitable.

The major culprit will be the rapid evolution of technology, which will allow data-savvy bank partners to siphon off a larger share of revenue while relegating the banks to a behind-the-scenes role in customer relationships.

Banks will likely retain certain privileges, such as the ability to connect directly to the U.S. payment system and the right to accept government-insured deposits. But the value of those advantages will shrink as innovators find new ways to attack banks’ age-old business models.

Meanwhile, the rapid customer adoption of mobile banking — which represents the culmination of the industry’s decades-long march toward nationwide scale — will further erode the value of local franchises. Smaller banks that fail to establish niches other than those based on geography will be at risk of being gobbled up.

“We’re in the beginning of a digital disruption wave that will challenge banks at their very core,” said Nigel Morris, a venture capitalist at QED Investors who co-founded Capital One Financial in 1994.

As the speed of technological change increases, banks’ biggest advantage over competitors lies in the one of their principal complaints — their high level of regulation. That barrier has made it difficult for the Amazons and Facebooks of the world to break through. It has also led some tech firms, including Google, to partner with banks, rather than try to displace them entirely. But even these types of arrangements may not necessarily be advantageous to banks.

Citigroup is "very conscious around not being the dumb utility,” Citigroup’s chief executive, Michael Corbat, said at an industry event late last year, speaking of its new partnership with Google on consumer checking accounts. He said the company is intent on “not giving away unconsciously the client-customer ownership that’s there.”

Corbat’s comment aptly sums up the risk as banks move forward. In trying to adapt and survive in an increasingly tech-dominated world, they may unintentionally give up their most valuable commodity — their relationship with the consumer, and the data that comes with it.

The battle over big data

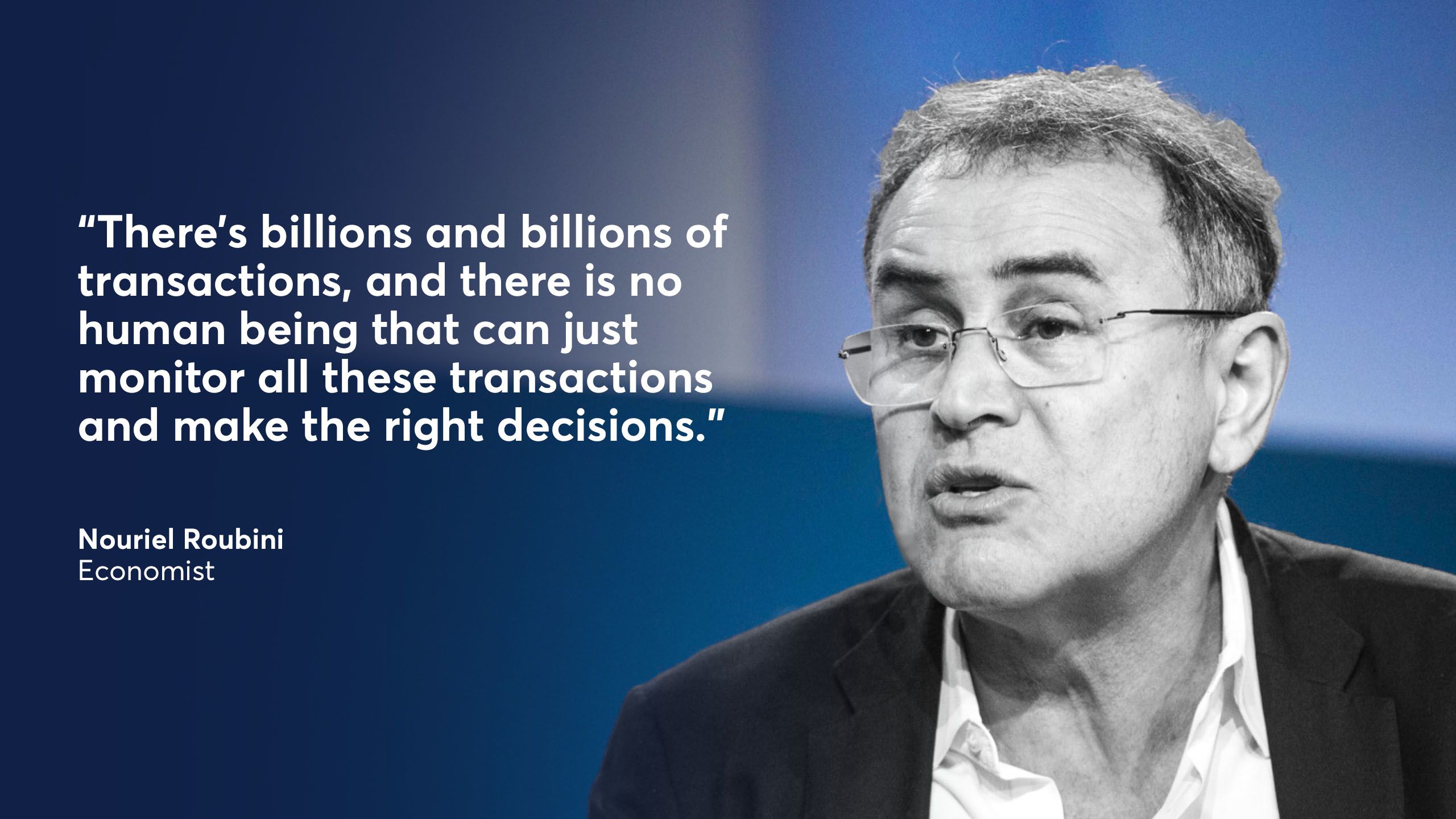

The acclaimed economist Nouriel Roubini was recently asked for his views on the potential of big data to transform the financial services industry. Roubini, who rose to fame for calling the U.S. housing bubble, has drawn a lot of attention over the last few years for his blunt skepticism about cryptocurrencies and blockchain technology.

But during an onstage interview in October, Roubini made clear that he believes big data, along with machine learning and artificial intelligence, are revolutionizing everything from lending to asset management to fraud detection.

“The question is not whether, but how long is it going to take,” he said.

Roubini noted that in the run-up to the financial crisis, mortgage underwriters were subject to biases, had bad incentives and lacked the right data. He suggested that big data will help address all three problems. “There’s billions and billions of transactions,” he said, “and there is no human being that can just monitor all these transactions and make the right decisions.”

Banks are of course awash in data that holds insights about their customers. “We’re sitting on over 28 Libraries of Congress,” Wells Fargo’s chief data officer, Zac Maufe, said at a recent conference.

But traditional financial institutions are, by and large, poorly equipped to exploit the mountains of data that they possess. The data often sits in silos. Cleaning it up and combining it in ways that enable deep learning both present big challenges.

Banks are typically hamstrung by aging technology, cobbled together over many decades. Very few U.S. financial institutions have been willing to make the massive, multiyear investments that would be necessary to install a modern technological core.

Moreover, luring the best tech talent is an ongoing struggle, particularly for banks that are outside of the industry’s top tier and in cities that highly compensated workers find less attractive.

At the same time, banks are facing increasing pressure to accommodate customers who want to share their own banking data with other companies. Banks have pushed back on those demands in recent years, which has led to friction with data-hungry fintechs.

But as more banks have begun to embrace application programming interfaces, which enable different kinds of software to talk to each other, the dynamic is changing.

In the U.K., the government has mandated that banks enable open banking, which means that customers can access other companies’ products from their primary bank’s app. Though a similar regulatory fiat seems unlikely in the U.S., technological and market forces are pushing banks on this side of the Atlantic in the same direction, whether they like it or not.

“Customers should be able to make an informed decision about what data they’re sharing,” Don Cardinal, managing director of the Financial Data Exchange, which is promoting a common interoperable data standard, said at a recent congressional hearing. “At the end of the day, it’s their data.”

The growing incursions from fintech

Banking profits remain robust — last year, industrywide net income totaled $237 billion — in large part because of what amounts to the government’s stamp of approval on the companies allowed to engage in that business. This advantage is often called the moat — a metaphor that casts regulators as sharp-toothed crocodiles who keep invaders at bay.

The most important edge that banks have over less regulated companies is probably their right to accept deposits backed by the Federal Deposit Insurance Corp., since it gives them the exclusive ability to offer the product that remains at the center of people’s financial lives, the checking account.

As a result, startups have often chosen to target more peripheral parts of the banking business. Consider the example of credit cards, which have historically been a high-margin product for banks, but have faced new competition in the post-crisis era.

The initial competitive threat came from companies like LendingClub and Prosper Marketplace, which allowed U.S. consumers to refinance their credit card debt in less expensive personal loans. More recently, firms such as Affirm and Klarna have launched more direct attacks on credit cards by offering lower-cost loans to shoppers at the moment they make a purchase.

Still, banks enjoy a degree of protection from these startups, which generally spend a lot of money to acquire new customers, struggle to sell multiple products to those customers, and borrow at higher interest rates than banks.

In the coming years, bigger, better established tech companies pose a more substantial threat. These firms, built in the internet age, are expert at monetizing consumer data. They are masters at designing intuitive, pain-free customer experiences. They already have large user bases, so they don’t have to spend a lot to acquire customers. And some are now eyeing the checking account, which could offer a base from which to offer more financial products to customers.

“They’re all after that customer relationship,” said Todd Baker, a senior fellow at the Richman Center for Business Law and Public Policy at Columbia Business School.

Both Google and Uber announced new checking products this fall. Uber Money is aimed at the company’s large army of U.S. drivers. A big selling point is that a driver’s bank balance will go up immediately after the passenger gets out of the car. “It’s free, it’s real time and it’s fast,” Peter Hazlehurst, Uber’s head of payments, said in a speech when the product launched.

Google’s product is still under development, and its value proposition is less clear. But the search giant’s checking account will be integrated into the Google Pay mobile wallet and will likely incorporate money-management features.

Both Google and Uber have no choice but to work with banks, since they lack their own charters. But over time, the tech giants’ strategy should dilute the value of a bank license. Customers will increasingly believe they’re banking with a tech company, which will give the tech firm leverage in negotiations with potential bank partners. Certain depositories that specialize in banking-as-a-service may still benefit, but the industry as a whole will suffer as they lose control of customer relationships.

“Banks will be around,” said Asheet Mehta, a senior partner at the consulting firm McKinsey & Co. “But unless they evolve, I think it’s going to be difficult to earn returns significantly above the cost of capital, which makes you a utility-type industry.”

It is possible that the U.S. government will prevent the tech industry from expanding further into financial services. Distrust of the tech sector has been surging. Libra, the proposed digital currency from Facebook, got an icy reception in Washington. A bill from Rep. Jesús “Chuy” Garcia, D-Ill., would bar online platforms with at least $25 billion in annual revenue from functioning as financial institutions.

But the government can only do so much to restrain technological trends. And it’s not just the tech industry’s behemoths that are expanding into financial services.

Take, for example, digital accounting platforms, which are already a frequent destination for small-business owners, and which collect a lot of data about their customers’ finances. Intuit’s QuickBooks and other accounting platforms now offer numerous banking-like features, including payments and financing, Javelin Strategy & Research said in a recent report.

“For many small businesses, accounting platforms have already become a de facto primary bank. That should be alarming for bankers,” the Javelin report said.

Outsized peril for small banks

The trends described above are working against the U.S. banking industry as a whole. But thousands of smaller, locally oriented banks are in a particularly tough spot.

Between 1992 and 2006, the industrywide return on equity never fell below 12.98%, according to data from the FDIC. In the 12 years since, that metric has never climbed above 12.01%.

Those percentages are averages that mask important distinctions between large banks — relatively well positioned to weather rapid changes in the business climate — and smaller, more vulnerable institutions.

Last year, institutions with more than $250 billion in assets posted stronger returns on equity than those with between $10 billion and $250 billion in assets, which in turn performed better than those with between $100 million and $10 billion in assets, according to FDIC data. Institutions with under $100 million in assets performed worst of all.

The differences are relatively small at the moment — in 2018, about 1.5 percentage points separated the average returns on equity at the largest banks from those at the smallest ones — but an institution’s size is likely to matter significantly more five years from now than it does today.

“As technology and scale become more important, it will force more consolidation,” said Mehta, the senior partner at McKinsey.

That seems particularly true as fintechs and big banks extend their reach. More than three decades after interstate banking began to gain momentum, any startup that develops a good mobile app can attract customers from coast to coast. At the same time, big banks are having an easier time finding customers in locales where they do not have branches.

“The millennials are now the largest generation ever, and they’re expecting good technology. And they’re not going into bank branches,” said Jo Ann Barefoot, CEO of Barefoot Innovation Group.

Still, there are steps that even smaller banks can take to set the stage for a thriving future. Small banks have access to a lot of the same technology as their larger peers, and they have the advantage of nimbleness, said Tripp Shriner, a venture capitalist at Point72 Ventures.

In an era where distribution is national, specialization is perhaps the biggest key for smaller institutions. This is the path forged by CBW Bank in Weir, Kan., and Cross River Bank in Teaneck, N.J., both of which have carved lucrative niches by providing services that cater to fintech companies.

Still, with roughly 5,300 banks now operating in the U.S., a lot of consolidation seems likely over the next five years. Only so many specialties are available.

“Many organizations underestimate the increasing momentum of digitization,” Jim Marous, host of the “Banking Transformed” podcast, wrote in a recent report. “New digital tactics are important, but not enough. The organizational culture must also be upended, silos must be torn down, and agile processes must be put in place.”