As merger and acquisition activity revives, the intensity of competition in particular markets can provide important context for the merits of a deal.

A region where business is fragmented among many smaller institutions could be ripe for consolidation. Regions dominated by a handful of large players that potentially have a measure of pricing power could suggest room for new entrants, or, alternatively, stiff competition for institutions working with a narrow purchase.

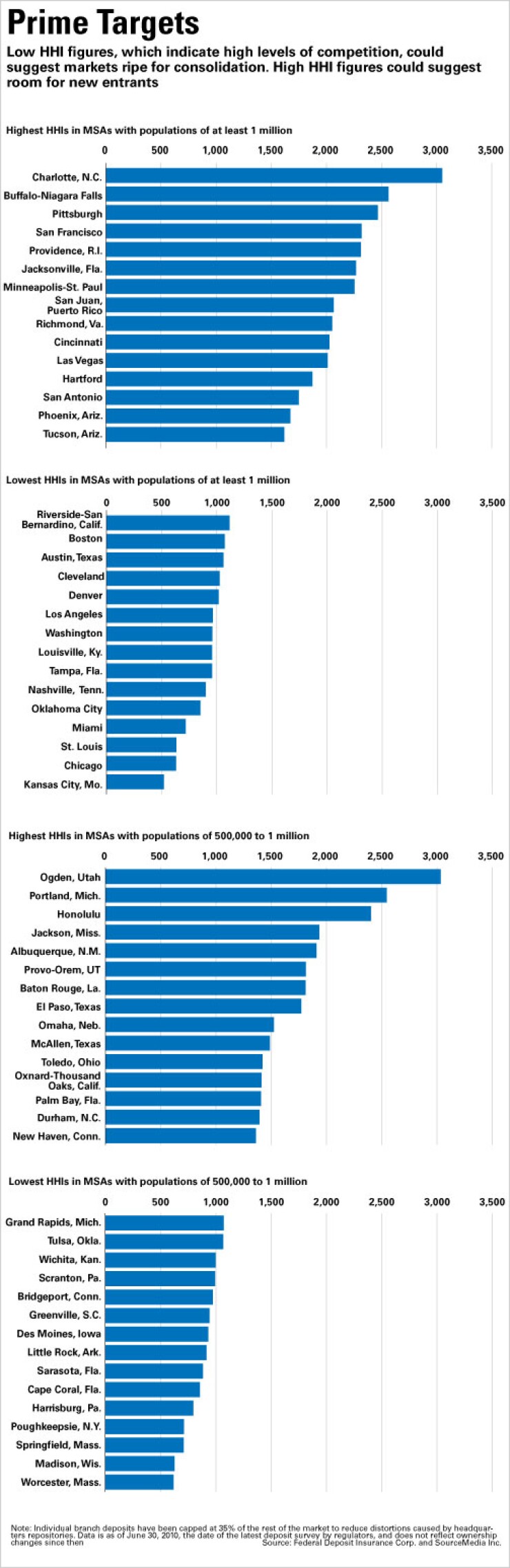

According to the standard antitrust scale, markets like the Kansas City and Chicago metropolitan statistical areas are among the most competitive, and markets like the Charlotte, N.C., and Buffalo, N.Y., MSAs are among the most concentrated (see charts, and, for a full list of MSAs and their HHI scores, click

The Kansas City MSA scored 521 on the Herfindahl-Hirschman index on June 30, 2010, the date of the latest deposit survey by regulators. The figure represents the sum of the squares of the shares of deposits held by institutions in the market, so that bigger shares translate into higher scores. Regulators scrutinize combinations that raise a market's HHI by more than 100 points in a market that already scores above 1,800, which they consider concentrated.

The Kansas City market has been

To be sure, HHI is a crude measure. National distribution platforms, including online banks, make geographic markets porous. Moreover, branches that serve as headquarters or regional repositories for deposits skew the results. (To try to reduce such distortions, individual branch deposits have been capped at 35% of the rest of the market here — a size that undoubtedly still allows for exaggerations of local market positions.)

Still, the data suggests a wide range of competitive environments in markets across the country.

[IMGCAP(1)]