It turns out focusing on Know Your Customer compliance is helping banks really get to know their customers.

In the post-crisis era, compliance has become a hot topic in banking, with regulators expecting better oversight of things like

Compliance "is driven by regulatory expectations, but it is also driving horizontal benefits," said James Hardy, chief data officer of State Street in Boston. "We get a much more holistic view of our institutional customers and our relationship with them, and that informs us which products and services" might be best suited for them.

-

Buyers of certain syndicated corporate loans have had an incentive to drag their feet closing trades; they will soon pay a hefty price if they don't do their part. The reform should help lenders get assets off their books faster.

March 29 -

Roughly 28% of Swift's correspondent bank users have signed up for the cooperative's KYC Registry, defying early skepticism about financial institutions' willingness to share information.

January 14 -

A lack of access to financial services, particularly the inability to transfer funds overseas, can prevent lifesaving work from being carried out and has touched the refugee crisis in Europe, where many aid groups are delivering assistance.

November 4

To deal with the increased expectations around both areas, banks are beginning to increase spending on innovative technologies for compliance functions, said Amy Matsuo, national leader for regulatory risk with KPMG.

"Banks are looking to utilize advances in technology and data analytics to be able to do things a bit differently in past," when it comes to compliance, she said.

This could include things like utilizing machine learning technology to analyze documents and other compliance data more efficiently, or deep analytics to aid with trading compliance. As regulators are asking for more data quicker than ever before, new technology investment becomes vital for banks to keep up, Matsuo said.

However, as the compliance function takes on a bigger role, those in charge of it are feeling pressured to reconsider the way they approach their jobs. Essentially, they are being asked to do more, but not necessarily given more resources to do more. Relying on technology might be the hack they need to fill their enlarged role.

The ability of financial institutions' compliance function to manage risk is being challenged by rising expectations for the function to play a stronger role in front-office processes, increased volume and complexity of regulations, and a lagging data and technology architecture, according to Samantha Regan, a managing director in Accenture's finance and risk service.

"The role of compliance has substantially changed and it has gained a tremendous amount of stature inside bank organizations," she said. "But with that expectations have also risen. We now see compliance at a crossroads; it has the power to be a disruptive force in the organization or there is the potential for momentum to be lost."

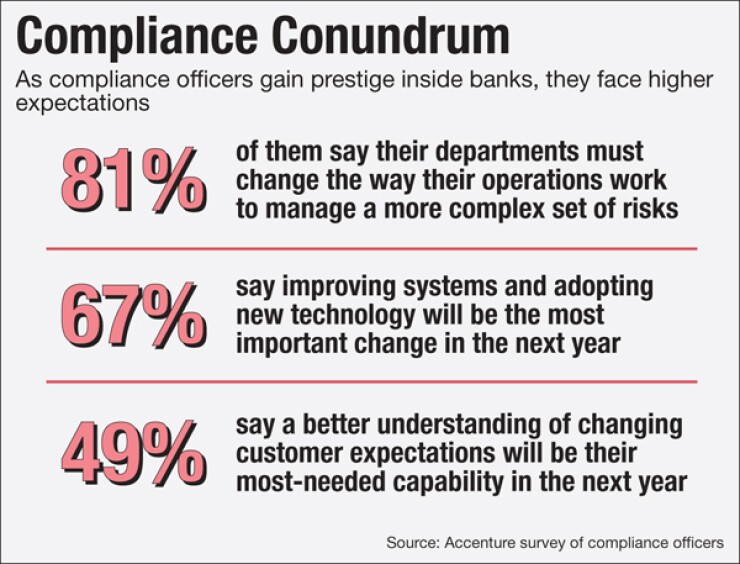

In an Accenture poll of 151 compliance officers in financial services in December, 81% indicated that managing a more complex set of risks with fewer resources will require the compliance function to optimize or reimagine its operations.

In the same survey, 67% of the compliance officers said that improving systems and adopting new technology will be the most important change in the next year.

Indeed, Hardy says, technology has helped State Street's compliance team serve multiple roles. In 2014, State Street was one of six founder banks to invest in Clarient Entity Hub, which is designed to provide increased controls, standardization and transparency during the client onboarding process and throughout the lifecycle of the relationship. The hub was formed with the intention of helping its participant banks to better cope with evolving internal risk management requirements, KYC rules, the Foreign Account Tax Compliance Act and other client data and documentation challenges. It is operated by the Depository Trust & Clearing Corp.

"So something that could constitute simply compliance with a regulation has been a technology hub to help understand our business better," Hardy said of the Clarient relationship. "It helps us understand our whole relationship with the customer."

As a custodian bank, State Street also sees many of its bank clients putting this increased focus on compliance technology, said Lou Maiuri, head of state Street's Global Exchange.

"Prior to the financial crisis, I think compliance was more of a check-the-box function," he said. "Now we see [financial institutions] making deep investment in tools around data analysis around compliance functions. Not just technology, but services around that, too. They don't just want information, but insights on that as well. There's more time, energy and money being spent on it now than in the past."