Want unlimited access to top ideas and insights?

Synovus Financial in Columbus, Ga., has agreed to buy FCB Financial Holdings in Weston, Fla.

The $31 billion-asset Synovus said in a press release Tuesday that it will pay $2.9 billion in stock for the $11 billion-asset FCB. The deal, which is expected to close in the first quarter, priced FCB at 230% of its tangible book value.

The deal is the first traditional whole-bank acquisition for Synovus since it bought Banking Corp. of Florida in April 2006. It bought World’s Foremost Bank from Cabela’s last fall, though the acquisition was part of a complicated transaction to facilitate Capital One Financial’s plan to obtain the retailer’s credit card portfolio.

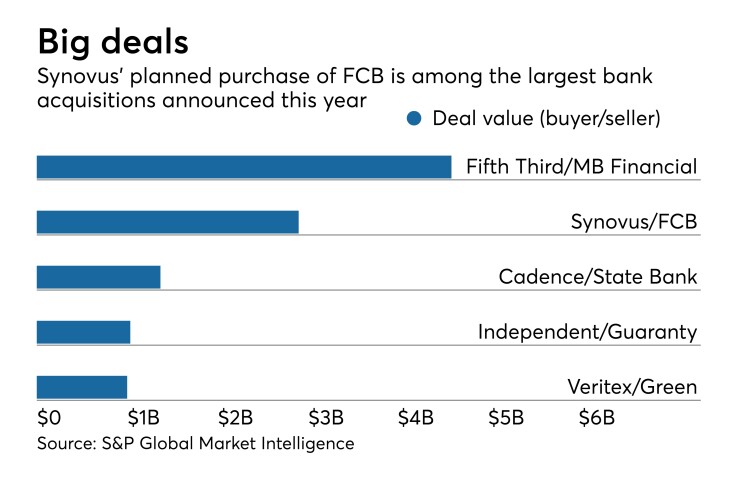

The FCB purchase is the second-biggest bank deal announced this year, based on value. The year’s largest deal is Fifth Third Bancorp’s $4.6 billion deal for MB Financial.

“This acquisition will expand our presence in the high-growth south Florida marketplace while leveraging FCB’s market leading reputation, culture, and successful organic growth platform,” Kessel Stelling, Synovus’ chairman and CEO, said in the release.

Synovus will gain $9.9 billion in deposits and 50 branches in Florida.

Kent Ellert, FCB’s president and CEO, will become Florida market president for Synovus.

Synovus said it expects to cut about $40 million in noninterest expenses as part of the integration.

The deal should be 6.5% accretive to Synovus’ 2020 earnings per share, excluding merger-related expenses. It should take less than two years to earn back the expected 3.3% dilution to Synovus’ tangible book value.

Bank of America Merrill Lynch; J.P. Morgan Securities; Simpson Thacher & Bartlett; and Alston & Bird advised Synovus. Sandler O’Neill; Guggenheim Securities; Evercore Group; and Wachtell, Lipton, Rosen & Katz advised FCB.

Synovus, in a separate release, said its quarterly earnings rose 48% from a year earlier, to $109 million. Earnings per share of 91 cents topped the mean estimate of analysts polled by FactSet Research Systems by 3 cents.

Rising interest rates, fee income and modest loan growth helped Synovus’ second-quarter results.

Total loans increased by 3% to $25.1 billion, with growth in consumer and commercial-and-industrial loans offsetting a decline in commercial real estate. The net interest margin expanded by 35 basis points to 3.86%.

Noninterest income rose by 7%, to $73.4 million, featuring improved income from fiduciary and asset management fees, brokerage services and card fees.

Laura Alix contributed to this report.