SunTrust Banks in Atlanta is teaming up with another fintech upstart to expand its reach in consumer lending.

The $202 billion-asset company said Wednesday that it has struck a partnership with the online lender Microf to offer point-of-sale loans to homeowners looking to replace aging residential heating, ventilation and air conditioning systems.

SunTrust will hold the loans on its books and a pay a fee to Microf for the referrals. Microf, based in Albany, Ga., offers the loans through its nationwide network of HVAC contractors.

“This program combines the strength of SunTrust’s lending experience with Microf’s strong industry presence to allow us to help more clients quickly and easily meet their HVAC needs,” Ellen Koebler, SunTrust’s head of consumer solutions, said in a news release.

SunTrust has aggressively expanded its consumer lending in recent years through partnerships with online lenders. Its Lightstream subsidiary, which it acquired in 2012, offers financing for a wide range of goods and services, including cars, boats, medical procedures, weddings and adoptions. It is also one of roughly 15 banks that offers home-improvement and other personal loans through a partnership with the fintech GreenSky.

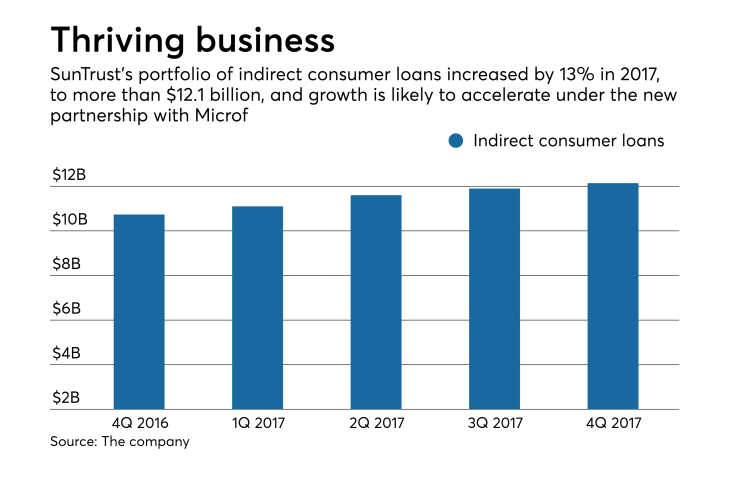

SunTrust’s portfolio of indirect consumer loans climbed 13% in 2017, to $12.1 billion, when compared to a year earlier. Direct consumer loans increased 12% year over year to $8.3 billion.

Microf, founded in 2010, has largely targeted borrowers with slightly blemished credit. Mitch Masters, its CEO, said in an intrview that the SunTrust relationship will now allow its contractor partners to offer point-of-sale loans to prime and super-prime consumers. Microf will continue to issue and service loans to subprime customers and refer the customers with better credit to SunTrust.

“Prime and super-prime borrowers are not our business model,” Masters said.

Microf, which is backed by the Bethesda, Md., private equity fund Rotunda Capital, has loan-referral arrangements with thousands of large HVAC dealers across the country, including Ace Home Services in Phoenix and Estes Services in Atlanta.

Masters said he founded the firm as a way to help HVAC contractors provide financing options to customers. “Most contractors will take cash or credit cards, but they don’t have financing partners,” he said. “They know the HVAC business, but they never learned financing.”

He added that Microf plans to seek more bank partnerships and could form alliances with as many as three outside banks.