China is one of the toughest markets for U.S. payment companies to crack, leaving the UnionPay network the main gatekeeper for payment firms looking to enter the world's

Stripe last week launched an integration with China's UnionPay International covering merchants in more than 30 markets including the U.S., Canada, the U.K., Australia, Singapore, the European Union and Hong Kong. The partnership will allow retailers to accept payments from UnionPay cardholders globally and access Stripe's dashboard, which includes services for online acceptance, security and other needs.

The collaboration demonstrates the importance and power of the government-backed UnionPay as a way to access the lucrative Chinese market. While the major U.S. card networks remain stuck in regulatory purgatory, rivals such as PayPal and Splitit have instead formed partnerships with Chinese companies to get a foothold in the country.

"In UnionPay, Stripe has arguably the strongest available partner to expand in China following eBay's localization into China using the

The partnership will allow Stripe to offer U.S. and European merchants access to Chinese consumers globally, pursuing a business model similar to Alipay and WeChat Pay, which provide "own currency" payments for consumers in or from China.

"People mostly think about the export market with China, but there's a massive opportunity for businesses in the U.S. to sell in China," said Noah Pepper, business lead in Asia Pacific for Stripe. "Chinese consumers give an enormous opportunity for businesses in the U.S."

Imports and exports for China's cross-border e-commerce totaled more than $260 billion in 2020, up 31% from 2019, according to the country's General Administration of Customs. Chinese consumers spent nearly $100 billion on e-commerce involving foreign merchants during that time.

China's size makes it attractive to U.S. payment companies, but China's government stands in the way.

The

China over the years has promised to clarify its terms for U.S. card brands, but has often

Among U.S. digital payment companies, PayPal offers payment services in China through a local partner called

Stripe has existing partnerships with WeChat Pay and Alipay, but the partnership between Stripe and UnionPay is still a danger to the large Chinese mobile apps, Chu said. Since UnionPay is a state-owned enterprise, even WeChat Pay and Alipay rely on UnionPay, he said.

"Hence, any local business innovations in China by Stripe would be implemented faster and easier than its competitors, and Stripe can also be a potential threat to WeChat Pay and Alipay in China," Chu said.

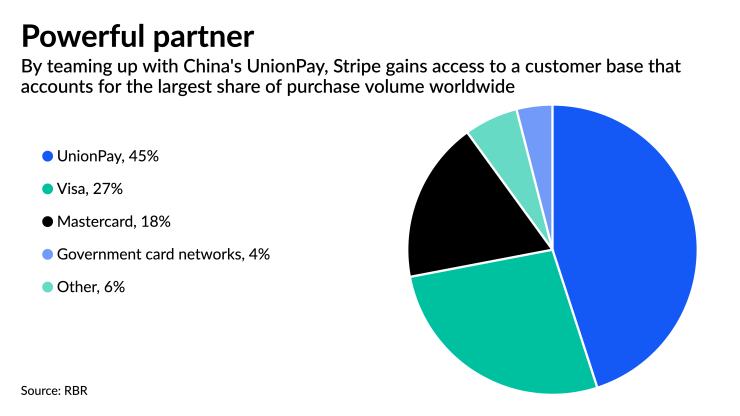

UnionPay controls about 45% of card spending worldwide according to

But UnionPay can benefit from cooperating with Western financial technology companies, according to Chu.

By partnering with Stripe, UnionPay can accelerate its internationalization using Stripe's merchant network, Chu said, adding there's an opportunity for UnionPay to enhance its own payment technology through Stripe's merchant services.

"The partnership with Stripe will remedy UnionPay's weakness in software and applications for the international payment business," Chu said. Square will also likely make a move to provide merchant payment technology in China, he said. Square and UnionPay did not return requests for comment.

Stripe, which will charge a fee on top of the UnionPay fee for payments, did not position the partnership as a competitive play against other fintechs or card networks. "It's best to have many ways to pay, to meet customers where they are," Pepper said.

The 11-year-old Stripe has its roots in offering application programming interfaces that allow businesses to accept online payments. That technology has attracted multiple investment rounds that have made it one of the

"Today we can move data and bits around the planet easily from one place to another," Pepper said. "But moving money from one place to another through different countries is complicated. There are a few point solutions, but nobody has really built a comprehensive, end-to-end money movement [system] enabling complex fund flows with products on top of it."