Marketplace lenders are slowly gaining traction with community banks eager to do more Small Business Administration lending.

Five Star Bancorp in Rocklin, Calif., is the latest small institution to follow the trend, agreeing earlier this year to try out SmartBiz Loans, which acts as a

For Five Star, an existing participant in the SBA’s 7(a) program, the partnership allows it to get more comfortable with fintech within the confines of a business line that it understands.

“We’re very intrigued by it,” said James Beckwith, Five Star’s president and CEO. The arrangement is allowing Five Star to add originations — more than 20 since February — and geographical diversity to its SBA loan portfolio. At March 31, total loans at Five Star rose 7.6% from a year earlier, to $691 million, based on call report data from the Federal Deposit Insurance Corp.

The goal is to average “upwards of 20” originations each month through SmartBiz, Beckwith said.

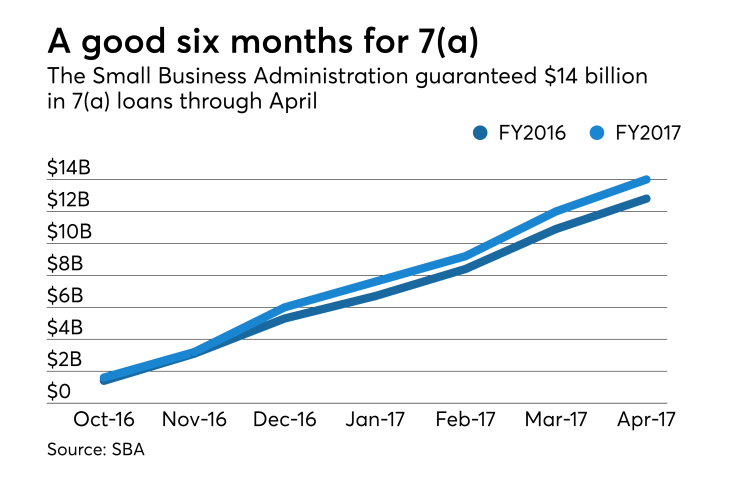

The emergence of firms like SmartBiz comes at a time of record use of SBA lending, so much so that some industry observers have suggested the agency may need more funds to make it through fiscal 2017. As things stand, volume in the 7(a) loan-guarantee program is up 9.4% in the current fiscal year from 2016, reaching nearly $14 billion at April 28.

The 7(a) program, which provides guarantees on loans up to $5 million, is the SBA’s most popular. Volume in the agency’s 504 program totaled $3 billion through April 28.

Several banks, including Berkshire Hills Bancorp in Pittsfield, Mass., and Gulf Coast Bank & Trust in New Orleans, have expanded their SBA lending by making acquisitions. Others are aggressively hiring lending teams to make more loans.

To be sure, there are inherent risks to any type of expansion, and regulators have frequently warned about the

Banks have also gotten in trouble in the past by making loans to

Banks, as a result, are generally more careful about dealing with outside firms, said Rob Morgan, vice president of emerging payments at the American Bankers Association.

“As a heavily regulated industry, banks are particularly careful and perform the appropriate due diligence to ensure the companies they’re partnering with are adhering to financial regulations,” Morgan said.

Five Star, for its part, researched SmartBiz to better understand the business, which matches small businesses with SBA-preferred lenders. The platform automates the application, underwriting and data collection for loan processing, using each bank’s documentation and underwriting criteria.

“We got very comfortable and thought this would be a great way to partner with a company that essentially does all the front-end work,” Beckwith said. “Once they’re done going through their process, their due diligence, their qualification process, they present us with very good packages that we can immediately act upon.”

SmartBiz, which is close to announcing its fifth bank partner, is handling a fair share of applications for SBA loans this year.

“We’ve certainly seen an uptick in the first quarter,” said SmartBiz CEO Evan Singer. “Businesses are looking to grow. I think they will continue to be bullish on the economy.”

SmartBiz did not immediately detail how many applications it has fielded this year.

Volume could increase more at lenders such as Five Star push beyond their home turf.

“We started out with a focus on the West Coast,” Beckwith said. “That has gone well. We’re going to be expanding our geographic footprint to include anything west of the Mississippi. If that goes we’ll become a national player. … We expect this relationship to be very profitable.”

Five Star, which has been an SBA preferred lender for about a decade, continues to originate 7(a) loans from its branches, but the SmartBiz loans have been easier to process, Beckwith said.

“We get to the funding a lot more quickly on the SmartBiz side than we would on our retail side,” Beckwith said, adding that Five Star has been able to fund some SmartBiz deals in as little as four days. “We’re able to cut out 90% of the work … so we’re much more efficient than our retail side.”

Technology is critical because SmartBiz focuses on loans that are typically $350,000 or less. Banks frequently bypass smaller deals, including 7(a) applications, because they are as costly to underwrite as bigger credits.

SmartBiz, which introduced its 7(a) platform in 2013, has been steadily growing. The company recently added

For the SBA’s 2016 fiscal year that ended Sept. 30, SmartBiz ranked as one of the leading providers of 7(a) loans under $350,000, generating $200 million of funded deals.

Adding more lenders improves the odds of loan approval, Singer said, adding that a larger volume of approvals inevitably spurs more applications.

“Banks say yes to different types of credits,” so adding more institutions to the platform increases the overall approval rates, Singer said. “We’re able to get to yes more often by partnering with additional banks.”