Lower interest rates are giving banks an opportunity to bring in cheaper capital.

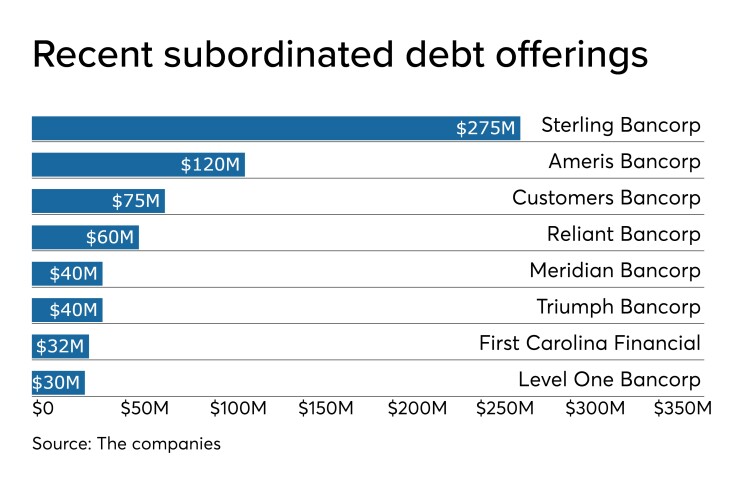

Several banks have issued subordinated debt in the past month, including Sterling Bancorp in Montebello, N.Y., Ameris Bancorp in Atlanta and Customers Bancorp in Wyomissing, Pa.

Debt is typically a cheaper form of capital than equity, and lower rates are making it even more appealing. Recent offerings are allowing issuers to pay off more costly debt and stockpile capital for organic growth and potential acquisitions.

Meridian Bancorp in Malvern, Pa., recently issued $40 million in subordinated debt at an initial rate of 5.37%. The $1.1 billion-asset company will use about $7 million of the funds to repay debt issued five years ago at 7.25%, saving it about $131,000 a year in interest.

The savings are "pretty significant," said Christopher Annas, Meridian's chairman and CEO. He said the company also wanted more capital to take advantage of recent disruption around Philadelphia stemming from bank consolidation.

Many of the subordinated debt deals disclosed have been priced between 4% and 5.88%. Those rates typically apply to the first five years, after which point the debt resets based on an industry benchmark. Subordinated debt counts toward a bank's Tier 2 capital for regulatory purposes.

More banks will likely issue subordinated debt in coming months as they reach prepayment windows tied to debt issued five years ago, said Stephen Scouten, an analyst at Sandler O’Neill.

A number of the recent issuances are augmenting capital following acquisitions, said Andrew Gibbs, who leads the financial institutions group at Mercer Capital. Several of the banks that recently issued debt —

Subordinated debt may also offset some of the capital hit banks will absorb when they implement the Current Expected Credit Loss standard, or CECL, said David Chiaverini, an analyst at Wedbush Securities. Subordinated debt can reduce an issuer’s weighted average cost of capital.

Chiaverini pointed to Wintrust Financial. The Rosemont, Ill., company lowered its weighted average cost of capital and total capital ratio after issuing $300 million in subordinated debt earlier this year.

Under the Fed’s Small Bank Holding Company Policy Statement, banks with assets of less than $1 billion can use debt to finance up to three-fourths of the purchase price of an acquisition.

Bigger banks, however, will need to bring in more Tier 1 capital to fund M&A, Gibbs said.

Other factors could discourage some banks from issuing subordinated debt, industry experts said.

"Unless there is a clear use for the capital ... not many banks like to carry it around for no reason," said Damon DelMonte, an analyst at Keefe, Bruyette & Woods.

There is significant investor appetite for subordinated debt, allowing banks to quickly raise capital, industry experts said.

"Bankers are herd animals, one does it and they all follow," said Lee Bradley, senior managing director at Community Capital Advisors.

One concern for Tom Thiel, president of the broker-dealer JWTT, is that banks are often buyers in subordinated debt issues, amplifying their exposure to an economic downturn.

"Though credit across the industry is clean, it does remind us a bit of the trust-preferred market where many banks were buying each other's issuances" before the financial crisis, Thiel warned.