-

Several big banks have hired environmental professionals from far outside the world of banking to make sure banks' clients aren't doing things to threaten water quality, public health or worker safety. The executives' job is to protect their banks' credit books and reputations.

May 21 -

The mock-up office is letting PNC resolve issues that would have been costly and time-consuming to fix on the Pittsburgh tower site.

March 31 -

Citigroup will commit $100 billion to help reduce the effects of climate change over the next 10 years as part of a new sustainability initiative.

February 18 -

New York's state-funded Green Bank is helping to finance solar farms and other alternative energy projects that traditional lenders aren't quite ready or willing to fund on their own. Commercial banks can get not only enhanced credit support from the Green Bank, but also help developing the expertise needed to get into this new lending niche, which is growing fast. Other states also have green banks in the works.

December 29

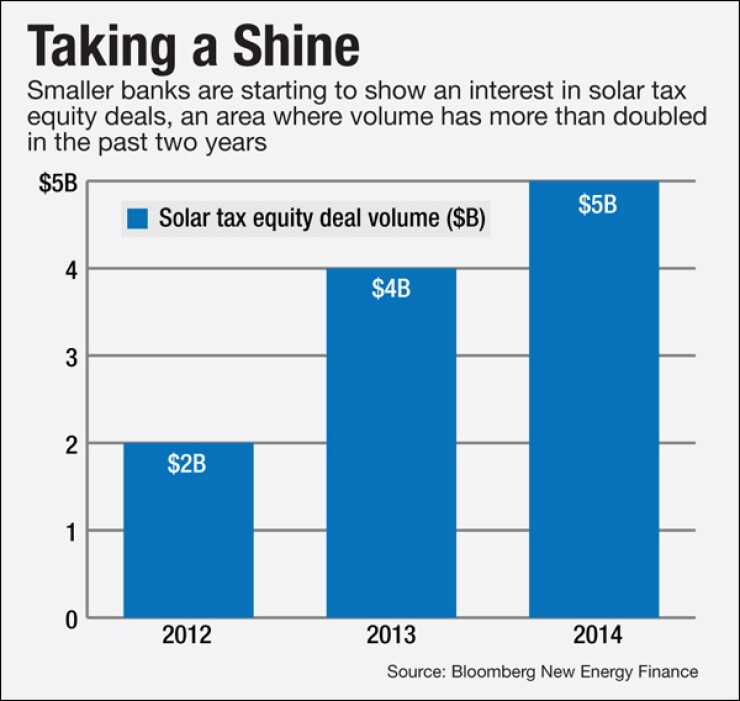

Small banks are starting to see the light when it involves taking advantage of solar energy tax breaks.

The industry's biggest banks for years have made big investments in renewable energy, taking advantage of tax credits while touting their conservation efforts. But steep legal fees have made those deals cost-prohibitive for smaller institutions.

That's starting to change. SolarCity, a solar developer in San Mateo, Calif.,

Cathay Bank in Los Angeles was the fund's first investor, Benjamin Cook, a vice president of structured finance at SolarCity, said. Given the strong returns associated with this type of investment, more community banks are expected to follow suit.

"The returns are very attractive," said David Burton, a lawyer at Akin Gump who specializes in tax equity financing for renewable energy. Also, "it's nice publicity it's nice to say in your annual report that you're green."

Heng Chen, Cathay's chief financial officer, declined to confirm that the $11.8 billion-asset company was working with SolarCity, though he said during a recent conference call to discuss first-quarter results that Cathay had invested an undisclosed sum in mid-April in an unnamed renewable energy tax credit fund.

The investment is expected to lower its effective tax rate from 37.3% in the first quarter, to between 28% and 30% for the full year, Chen said. (The company's lower tax rate will be slightly offset this year by a rise in pretax amortization expense tied to the investment.)

A lower tax rate reduces a company's taxes, allowing it to retain more of its earnings.

Cathay's participation in SolarCity's fund represents a shift in the way the banking industry invests in and profits from the fast-growing renewable energy sector. Tax-equity financing has been the domain of banking's biggest players, such as

About half of new power capacity added last year came from solar, said Todd Foley, chief strategy officer at the American Council on Renewable energy. Solar tax equity deal volume more than doubled last year compared to 2012, to $4.5 billion, according to Bloomberg data compiled by the trade group.

Most solar developers are too small to use large federal tax incentives designed to spur growth in their industry, so they strike deals with financial institutions, tech firms and other entities with high tax liabilities.

"Unless you're getting, let's say, just outlandish margins, there would be no way to self-shelter those tax benefits," Cook said. "Any solar development company in this business has a similar challenge."

Tax-equity deals involve complex legal arrangements, including sale-leasebacks, inverted leases and partnership flips, but they provide solar developers with much needed funding for equipment and installation. In turn, they provide banks with a federal tax credit equal to

Such deals typically provide banks with accelerated depreciation and monthly cash flows from customer payments.

After-tax gains on the investments typically range between 8% and 11%, Burton said. By comparison, banks would have to make a loan at 15% to get the same rate of return, he said.

"What is that going to be? Subprime car loans or something," Burton said, noting that default rates for residential solar systems are "very low."

Still, high legal and accounting costs have limited small banks' ability to enter the market.

"The challenge of these investments has been that they're very complicated to set up, and they typically require a lot of legal and consulting fees," said Josh Lutton, a managing partner at consulting firm Woodlawn Associates. "So it's been very difficult for smaller investors to get involved."

SolarCity's fund, launched last week, is designed to lower transaction costs by creating "one big pot of money to spread them across," Lutton said.

From SolarCity's perspective, the fund allows the rapidly growing company, chaired by tech entrepreneur Elon Musk, to expand its investor pool. "We want to bring the opportunity to smaller banks because there are many, many more available," Cook said.

SolarCity's customer base grew 97% in the first quarter compared to a year earlier, to 217,595 customers, according to the company's first quarter letter to shareholders.

A spokesman for Bank of America, which is administering the fund, declined to comment. A press release announcing the SolarCity fund said it is part of the Charlotte, N.C., company's "environmental business initiative to advance low-carbon economic solutions."

One of the elements that may be motivating SolarCity's push to add smaller investors is that the 30% investment tax credit for solar installations is set to drop to 10% in 2017.

"The implication is that there's going to be a desire for people who are considering getting into solar to do so before 2017, rather than after," Lutton said.

Getting more banks to join Cathay may not be easy. Renewable energy isn't in the typical wheelhouse of many small and regional banks, and it may prove difficult to find bankers who are willing to go to bat for green investments.

"My day-to-day business is mortgage lending and safe deposit boxes," Burton said, conveying a potential response a community banker might have. "Now I have to think about solar? I'm a small bank in Missouri, what do I know about solar?"

As the solar industry has grown, however, tax-equity financing has become increasingly mainstream. If other solar developers follow SolarCity in making the investment cost-efficient for smaller firms, more banks may take advantage.

"You can go to a bank and say 'Here's a model, let me explain,'" Burton said. "It's an educational process."