-

A new federal rule issued by the Department of Housing and Urban Development on housing discrimination will likely make it harder for banks to prevail in fair-lending disputes.

February 11 -

The CFPB released its long-awaited final rule laying out how lenders must ensure borrowers have the ability to repay a loan, including creating a carve-out for qualified mortgages.

January 10 -

Though regulators gave community banks an exemption for balloon mortgages, they carved out such a narrow definition that some banks would be forced to stop making them.

February 25

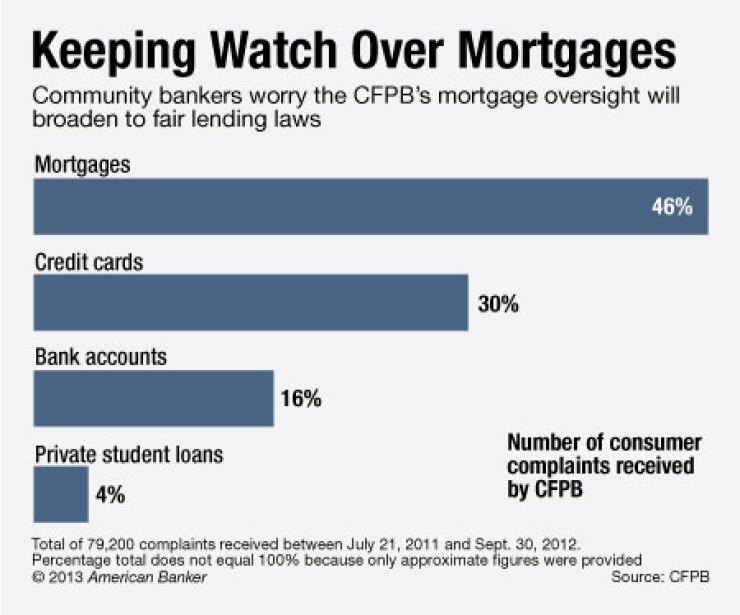

Community bankers have long harbored concerns about fair lending laws, but the Consumer Financial Protection Bureau's enforcement potential has executives flat-out spooked.

In areas such as mortgages, credit cards and auto loans, the CFPB has fostered an "almost adversarial relationship" when dealing with banks' lending practices, especially when it involves potential discrimination, says Scott Nininger, director of risk management at Union First Market Bankshares in Richmond, Va.

"They're the neighborhood cop on the beat and they're making [small banks] out to be the bad guy," says Nininger, who is also a senior vice president at the $4 billion-asset company.

The CFPB's clout is especially worrisome to residential real estate lenders, says Rod Alba, vice president of mortgage finance at the American Bankers Association. The bureau has released

"We're receiving absolutely no guidance that is specific to the new regulations that will allow us to comply with the fair lending … standards that regulators are placing before us," Alba says.

The CFPB has also given no insight into its views on how community banks should comply with "disparate impact" standards, Alba says. The Department of Housing and Urban Development issued an

The CFPB has no direct jurisdiction over the Fair Housing Act, but bankers believe the bureau is watching for violations tied to mortgages, says Jeff Plagge, president and CEO of the $1.5 billion-asset Northwest Financial in Arnolds Park, Iowa.

"The CFPB indirectly has a wide breadth of impact, which is the source of our angst," Plagge says. "Everyone thought that the CFPB would be about the big banks but, at the end of the day, it really has an impact across the industry."

Under the Dodd-Frank Act, HUD is responsible for rule making for the Fair Housing Act. But Dodd-Frank gave the CFPB supervisory, enforcement and rule making authority for the Equal Credit Opportunity Act.

The CFPB's

"They're setting the tone," Nininger says. "Consumer protection is so broad and can cover so many things."

During a recent exam, the Federal Reserve Board asked Union First numerous questions about its mortgage practices, including inquiries that the bank had not expected, Nininger says. It seemed clear to Union First's management that the Fed was taking cues from the CFPB, he says.

"It's almost like there was a fishing expedition," Nininger says. "They told us they knew these things weren't required, but they had to ask because of the push coming from Washington."

A CFPB spokeswoman declined to comment. Representatives at the Fed could not be reached for comment.

Fed examiners did not issue any threats or warnings when they made their information request, but it was clear to Union First that the inquiry was part of the CFPB's goal to collect more "data points," Nininger says.

"Whatever core [IT] system you have, it's important that your system be adjusted to …collect these data points," Nininger says. "The last thing you want is for regulators to ask you to provide information and you have no clue on the types of lending you're making."

Even without coercion, banks should respond to the new requests, Nininger says. "If you [say] that you don't have the data or that you're not collecting the data, it may send up a red flag" to regulators, he says.

The new CFPB rules, coupled with a lack of guidance on how the bureau will enforce them, could cause more banks to stop making mortgages, Plagge says.

"The fear built around fair lending …almost ends up constricting credit," Plagge says. "I thought the whole objective was to make credit available to more people on an equitable basis."